Is the Presidential Election Winner Ready to Face a Mammoth Debt Crisis?

Writing in Foreign Policy, economist Dambisa Moyo paints a nightmare scenario of what is waiting for the next U.S. President:

The next U.S. administration will likely face a global debt crisis that could dwarf what the world experienced in 2008-2009. To prevent the worst, it will need to address the burdensome debt plaguing both the United States and the global economy.

Even before the COVID-19 pandemic paralyzed economies around the world, economists were warning about unsustainable debt in many countries. Take the United States: A surge in spending to mitigate the health and economic impacts of the pandemic has brought the total public debt in the United States to over 100 percent of GDP—its highest level since 1946 and a hurdle that will create a considerable drag on future economic growth. Other types of debt—household, auto, and student loans, as well as credit card debt—have seen similar surges. Almost 20 percent of U.S. corporations have become zombie companies that are unable to generate enough cash flow to service even the interest on their debt, and only survive thanks to continued loans and bailouts.

Multiply that across the globe. Total global debt stands at an unsustainable 320 percent of GDP. Perhaps more worrisome, China is now an important creditor, which adds a geopolitical dimension to the concerns over debt. China is the largest foreign lender not only to the United States, but to many emerging economies. This gives the Chinese political class enormous leverage. Naturally, the combination of strained U.S.-Chinese relations and the dependence of many advanced and developing countries on continued Chinese credit and investment limits the scope for negotiations on debt restructuring or moratoriums.

Worrying About the Debt

If too much debt didn’t concern you before 2020, now is a good time to start worrying. Moyo is absolutely correct in recognizing that having too much debt limits economic growth. She is also right to recognize that China’s debt trap diplomacy will negatively affect the nations whose leaders buy into it.

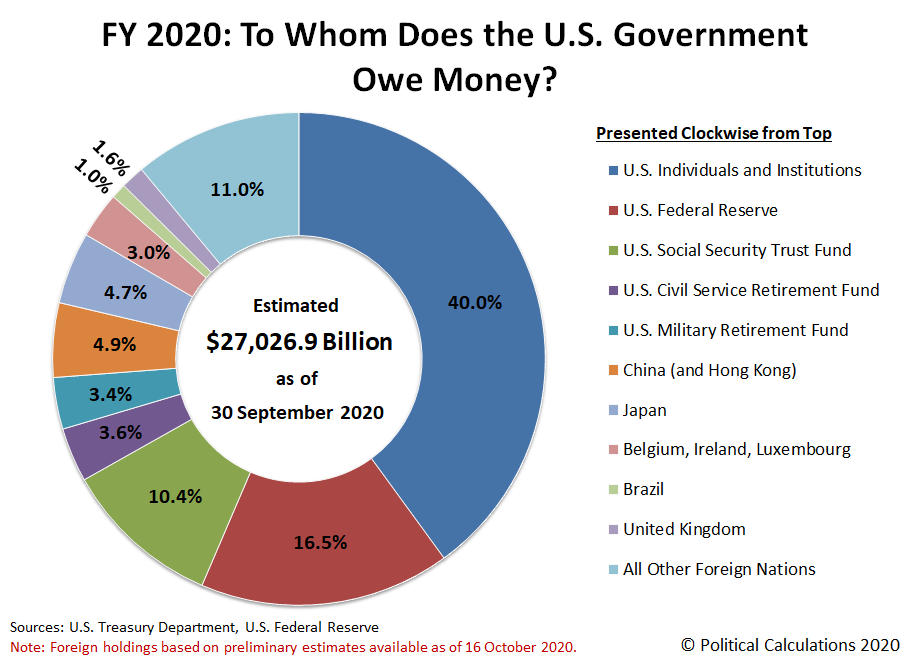

On the other hand, I think the U.S. government has less to fear from being dominated by China than do smaller nations. In the current fiscal crisis, we’ve seen the Federal Reserve become Uncle Sam’s new sugar daddy, making the U.S. government less dependent on borrowing money from the Chinese than it was in the past. Below is Political Calculations’ latest chart revealing to whom the U.S. government owes money. It shows both a shrinking share of I.O.U.s held by the Chinese and a growing share owned by the Fed:

China has threatened the United States with a “nuclear debt option” strategy of financial warfare. This option involves dumping all its U.S. debt holdings in a fire sale which, in normal times, would hurt the government’s ability to raise funds by borrowing money. But as we’ve learned from the coronavirus pandemic, the Fed could and would step in to fund the U.S. government with as much as it could ever want to borrow.

Knowing the politicians and bureaucrats who run the federal government, that possibility may be a much bigger danger.