The Fed Becomes the U.S. Government’s Biggest Creditor

Do you remember life before the coronavirus epidemic? Like back in September 2019, when the Social Security Trust Fund was the largest creditor to the U.S. government?

The venerable trust fund’s long reign as the biggest single lender of money to the U.S. government has come to an end, because Uncle Sam has a new sugar daddy: the U.S. Federal Reserve! Political Calculations provides the analysis for how that has happened:

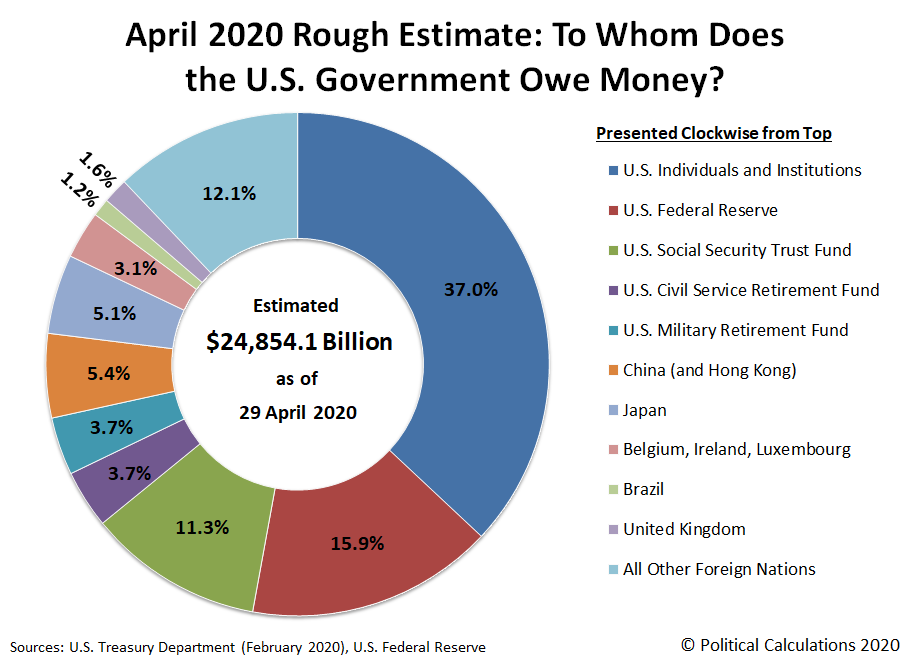

The U.S. government has gone on a borrowing binge since the global coronavirus pandemic reached the nation’s shores and the number of known cases began increasing relentlessly at the end of February 2020, just over two months ago. From 26 February 2020 through 29 April 2020, the U.S. government’s total public debt outstanding has increased by $1.427 trillion, from $23.427 trillion to $24.854 trillion.

That’s a lot of money to borrow, and for all practical purposes, all of it was loaned to the U.S. government by its new Number One creditor, the U.S. Federal Reserve, to whom the U.S. government now owes more money than it does to its previous largest single creditor, Social Security. According to the Federal Reserve’s H.4.1 statistical release for 29 April 2020, the Fed holds $3.945 trillion worth of U.S. Treasury securities, up from $2.465 trillion back on 26 February 2020, shortly before the number of known coronavirus cases in the U.S. began their rapid rise, which triggered the government actions that crashed the economy.

Our sharp eyed readers who do the math will catch that the Federal Reserve’s holdings of U.S. government-issued debt securities increased by $1.480 trillion, more than the amount by which the federal government’s total public debt outstanding increased over the same period of time.

How is that possible? Under current law, the Federal Reserve is prohibited from directly loaning money to the U.S. government, so it is actually acquiring debt securities that were originally issued by the U.S. Treasury when it borrowed money from banks and other financial institutions. The Federal Reserve can then pay them for their holdings of U.S. treasuries through its open market operations, much like how the lender you might have originally gotten your mortgage through might sell it to another financial institution. The money that was borrowed is still owed under the same terms as before, but now it’s paid back to a different entity.

Doing that gives the original creditor more money to be able to go out and loan even more money to the U.S. government, which in the current environment, the Fed will then pay to acquire it from them. That process will repeat until the Fed decides it has had enough and tries to stop. Like it has before, which didn’t really work out all that well for it.

In any case, that’s how the Fed went from holding less than one in ten of all the dollars the U.S. government has borrowed to about one in six, making it the new single largest creditor to Uncle Sam.

So to answer the question of how the Fed’s holdings of U.S. treasuries is increasing faster than the rate at which the U.S. government is borrowing money, it’s because the Fed’s holdings are being tapped out of the larger pool of treasuries held by U.S. individuals and institutions, which is then quickly replenished.

To summarize, all the Federal Reserve had to do to bump the Social Security Trust Fund from being the U.S. government’s top creditor was to practically loan it every single dollar it borrowed during the last two months, and then some. At some point, you have to wonder if the Fed will start lending directly to the U.S. government, dropping the pretense of going through the inefficient process they are using now to supply the government with funds it can spend.

At the end of their analysis, Political Calculations asked “How do you suppose the Fed will want to be paid back? And where do you suppose the U.S. government will get the cash to do that?”

Anthony Harries and James R. Harrigan’s 2017 analysis of the U.S. government’s borrowing situation seems especially prescient now for answering those two questions:

If federal borrowing is growing steadily at an average pace of 6 percent per year, yet foreign and American investors are slowing their lending, and the trust funds have no surpluses left to lend, where is the government getting the money it’s borrowing? And where will it get more in the future?

The answer is the Federal Reserve. Prior to the Great Recession, the Fed was increasing its annual lending to the US government by almost 6 percent per year. The Fed then dramatically increased its lending during the recession – that’s what all the “quantitative easing” talk was about. On average, since 2001, the Fed has increased its lending to the federal government by over 11 percent annually.

The U.S. government has borrowed more money than any government in human history. Politicians have convinced voters that government debt doesn’t matter or that, by the time it does, some magical solution will present itself. The ugly truth, though, is that there simply aren’t enough investors left on the planet willing to loan the U.S. government enough to maintain its spending habits. So the Federal Reserve takes up the slack. And this is where things go from bad to worse, because the Federal Reserve prints the money it loans.

When the Fed prints more money, every one of the dollars already in circulation, from those in people’s savings accounts to those in their pockets, loses some value. Prices go up in response. That’s inflation….

For nearly a century, politicians have treated deficit spending as a magic wand. In a recession? Government must spend more money! In an expansion? There’s more tax revenue, so government can spend more money! Always and everywhere, politicians argued only about how much to increase spending, never whether to increase spending. Past politicians left massive deficits, and the debt they created, for future generations to fix. The future has now arrived. There is simply no one left from whom to borrow.

To summarize, everyone will be paying more than they otherwise would for everything. Whether it’s through taxes or through inflation, they’ll be paying for years and years to come.