U.S. Government’s Fiscal Mid-Year: Record Tax Collections But Huge Deficit

We are halfway through the U.S. government’s 2023 fiscal year. The U.S. Treasury Department’s Monthly Treasury Statement documenting the federal government’s tax collections and spending has both good and bad news about the federal government’s fiscal situation.

First, the good fiscal news. After adjusting for inflation, the U.S. government has raked in the second-highest amount of revenue it has ever collected during the first six months of its fiscal year. CNSNews Terence P. Jeffrey reports the fiscal news:

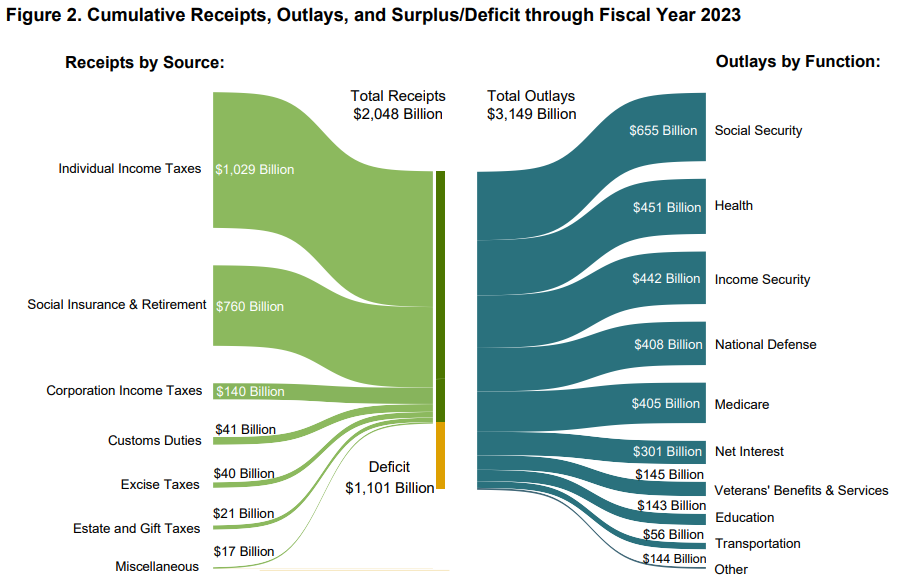

The $2,048,196,000,000 that the federal government collected in tax dollars in the first six months of this fiscal year was only exceeded by the $2,236,043,500,000 (in constant March 2023 dollars) that the federal government collected in taxes in the first six months of fiscal 2022.

That good news is impressive because 2022’s record-high tax collections resulted from unique factors related to the end of pandemic lockdowns. In 2023, many of those factors have gone away. However, the government is still succeeding in collecting a near-record level of cash from its taxes.

The bad fiscal news? The federal government is spending over $3.1 trillion, with the accumulated budget deficit through the first six months of 2023 already exceeding $1.1 trillion. After accounting for inflation, Jeffery reports this year’s budget deficit is the fourth-highest ever recorded at the halfway point of the government’s fiscal year.

When the historical budget numbers are adjusted for inflation into March 2023 dollars, it turns out that this year’s October-through-March federal deficit is the fourth largest in the nation’s history. In fiscal 2021, during the COVID pandemic, the October-through-March deficit was $1,944,334,490,000 in constant March 2023 dollars. That was the largest deficit the federal government has ever run in the first six months of a fiscal year.

The second-largest was in October-through-March of fiscal 2009, when the federal government ran a deficit that was $1,357,706,460,000 in constant March 2023 dollars. The third-largest was in October-through-March of fiscal 2011, when the federal government ran a deficit of $1,120,280,830,000 in constant March 2023 dollars.

Here is what the leviathan of federal tax collections and spending looks like halfway through the government’s fiscal year:

President Biden’s budget proposal from just a few weeks ago indicates the federal government’s budget deficit will rise to over $1.5 trillion before the end of the 2023 fiscal year. With his proposed spending and anticipated tax revenues for the next several years, the annual budget deficit will never drop below $1.5 trillion again.