K. Lloyd Billingsley • Wednesday, October 17, 2018 •

A group of Asian-Americans is suing Harvard with backing from the U.S. Department of Justice, which filed papers stating: “The record evidence demonstrates that Harvard’s race-based admissions process significantly disadvantages Asian-American applicants compared to applicants of other racial groups — including both white applicants and applicants from other racial minority groups.” This is a rare case where California policy could provide positive guidance.

The back story here is the dogma that all institutions must precisely reflect the racial or ethnic diversity of the wider population. If they do not, the reason must be deliberate discrimination and the only remedy is government action, namely, racial and ethnic preferences. This dogma ignores personal differences, effort, and choice and proclaims some groups “overrepresented.” On this basis, the University of California discriminated against Asians, a group that had suffered decades of official discrimination in California.

David Beito • Tuesday, October 16, 2018 •

“As the supper [in May 1939] progressed, I found myself revising my previous concept of [Franklin D. Roosevelt]… I had long admired him for his sagacious statesmanship. Hearing him in this informal atmosphere, I realized how much I had idealized him. He was as neither wise nor as proud as I had supposed him to be. His glibness, his propensity for generalizations jarred me; so did his lack of prudence especially when he spoke of Boake Carter, a popular radio commentator who was an outspoken enemy of the New Deal. The President made no bones of the fact that he was having Carter ‘thoroughly investigated,’ apparently by the FBI. He was quite certain that Carter—‘or whatever his real name is’—had a nefarious background which, when brought to light, would put an end to his career. That Roosevelt, the statesman I had admired, should admit to such vindictiveness came as the greatest jolt of all.”

—Jerry Mangione, An Ethnic at Large: A Memoir of America in the Thirties and Forties (New York: G.P. Putnam’s Sons, 1978), 248.

Craig Eyermann • Tuesday, October 16, 2018 •

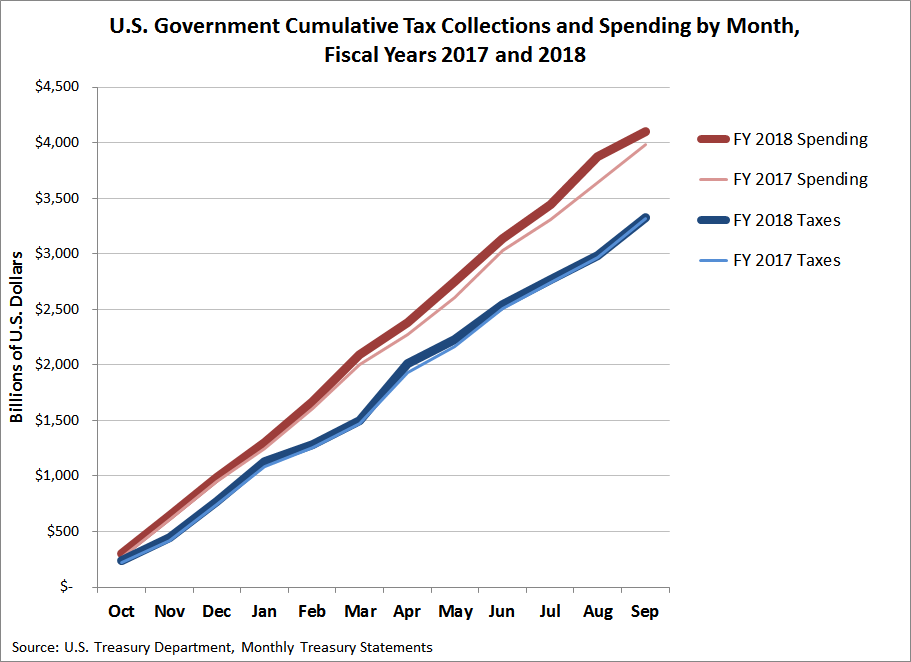

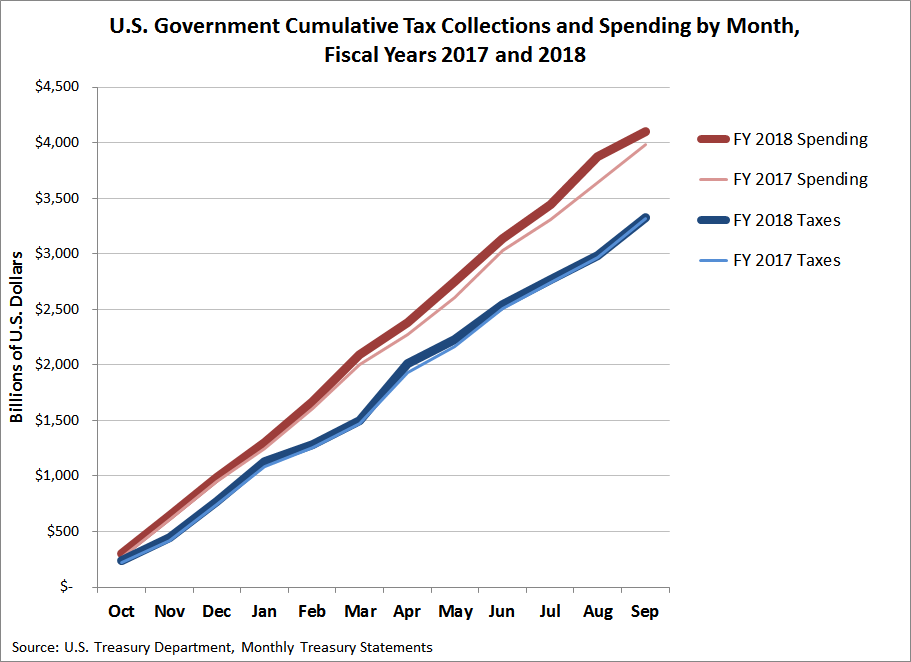

All year long, many Americans have been dreading what the U.S. government’s fiscal state would be at the conclusion of its 2018 fiscal year, which just ended on September 30, 2018. The combination of tax cuts passed into law in December 2017 that slashed corporate income tax rates and a budget deal in February 2018 that boosted federal spending at the same time seemed to be a sure recipe for creating a massive fiscal headache for American taxpayers.

But, only one of these measures appears to have negatively impacted the U.S. government’s fiscal situation since President Trump signed both measures into law. After a four-day delay, the U.S. Treasury Department issued its final monthly treasury statement for the U.S. government’s 2018 fiscal year, where the following chart shows one expected result and one surprising result.

The expected result is what happened with federal spending, which increased from $3.981 trillion in FY 2017 to $4.107 trillion in FY 2018. The unexpected result can be seen in the cumulative total for the U.S. government’s tax collections, which in a year of tax cuts, surprisingly rose from $3.315 trillion to $3.329 trillion. Overall, the U.S. government ran a $779 billion deficit in its 2018 fiscal year, up $113.2 billion from the $665.8 billion deficit in 2017.

According to CNS News, the national debt increased by $1.271 trillion during FY 2018, a $492 billion difference from the $779 billion deficit that the federal government reported for the year.

Craig Eyermann • Monday, October 15, 2018 •

Taxes are the price that regular people pay for government spending. Whether that spending goes to things and services that people want, like road repairs, schools, fire and police protection, trash pickup, public parks, or to things that people don’t really want, like sports stadiums or excessively lavish pension benefits for bureaucrats, the bill for all these things is ultimately paid through taxes.

For most states in the United States, the primary means by which state governments take money from their residents is through income taxes. As part of its 2019 State Business Tax Climate Index, the 81-year-old nonpartisan Tax Foundation has ranked U.S. states according to their individual income tax burden, which is the heaviest-weighted component of their state business tax climate index. The following map shows where each state has ranked according to state income taxes going into 2019.

Raymond J. March • Saturday, October 13, 2018 •

The healthcare sector of the U.S. economy is extraordinarily dynamic and complex, providing constant challenges for policymakers and regulators working to improve healthcare markets. However, recent research and policies suggest the greatest challenges for policymakers might be their misunderstanding of economic fundamentals.

Earlier this year, the Annals of Internal Medicine journal published a paper which found the prices increased for nearly 100 drugs while they were in a shortage between 2015 and 2016. The paper also notes these “price hikes” (price increases) were less severe in markets with comparatively more competitors (defined as more than three drug providers).

Although the authors consider these findings “mysterious,” they confidently offered policy recommendations to correct “the imbalance between supply and demand.” As they stated in their conclusion, “If manufacturers are observed using shortages to increase prices, public payers could set payment caps for drugs under storage and limit price increases.”

The situation described above, and the folly of its policy prescription, are no mysteries for anyone who understands basic economics.

K. Lloyd Billingsley • Friday, October 12, 2018 •

Customers at the Apple store in Sacramento’s Arden Fair Mall last weekend noticed an armed police officer standing at the door. This was a response to a wave of Apple store robberies in northern California, including four at the Apple store in nearby Roseville in 30 days. In July, in similar style, four thieves stole $27,000 of Apple products from the Apple store in Fresno’s Fashion Fair Mall.

This recent crime wave may have been inspired by Prop 47, which lowered sentences for drug possession, theft, shoplifting, identity theft, receiving stolen property, writing bad checks and check forgery. The 2014 ballot measure changed these offenses from felonies that can bring prison terms to misdemeanors that often bring minimal jail sentences, if thieves are charged at all.

K. Lloyd Billingsley • Thursday, October 11, 2018 •

“The Summer of 82” was quite the show in Washington, with Trump Supreme Court nominee Brett Kavanaugh cast as a drunken sexual predator and accuser Christine Blasey Ford playing a Ph.D. who doesn’t know the meaning of “exculpatory evidence.” In the thrilling denouement, Kavanaugh gets confirmed but Ford fans warn that millions will die and the nation will become The Handmaid’s Tale. As he performs with the Supremes, Justice Kavanaugh might have something else in mind.

As we noted, John Yoo and Robert Delahunty found no major Kavanaugh opinions on abortion, gay marriage and such. Instead, Kavanaugh’s record “creates a deeper challenge to liberalism: rolling back the administrative state,” which the authors describe as “the great threat to individual liberty today.” As Yoo and Delahunty explain, “progressives have evaded the Constitution’s checks and balances on the federal government by unceasingly expanding its regulatory reach, transferring the actual authority to make the rules from Congress to unelected bureaucrats, and then demanding that judges defer to the results virtually without question.”

William F. Shughart II • Wednesday, October 10, 2018 •

[This post was co-authored by Arthur R. Wardle; revised October 12.]

When Washington began subsidizing production of ethanol in the midst of 1970s’ fuel shortages, the aim was to reduce U.S. dependence on imported oil, especially from OPEC countries. But the United States no longer relies heavily on OPEC. In fact, America is now on track to become a net oil exporter. Thanks to the shale revolution and more drilling offshore, U.S. oil production has grown significantly, while imported oil as a share of total domestic oil consumption has plummeted.

Yet, instead of terminating the Renewable Fuel Standard (RFS) — which mandates a sharp increase in renewable fuel consumption by 2022 — the Trump administration has doubled-down on biofuels. President Trump has said that he supports ramping up ethanol production even further by allowing gasoline containing 15 percent ethanol to be sold year-round. Doing so would expand ethanol use and encourage the EPA to ratchet that percentage up in subsequent years. Not surprisingly, the president made his announcement in Iowa, a major corn-belt state.

K. Lloyd Billingsley • Tuesday, October 9, 2018 •

As his final term winds down, recurring California governor Jerry Brown has been busy touting his tax hikes, the delta tunnels, and the bullet train, among other projects. He also found time to speak out on Supreme Court nominee Brett Kavanaugh. “There’s no doubt that he was a heavy drinker and he told the exact opposite statement,” Brown told reporters. “So his lies, I think, are relatively well-proved and I hope the FBI can figure that out.” This marks a change of sorts for Brown.

In 2011, police busted state finance director Ana Matosantos for drunk driving. Matosantos took full responsibility for her “reckless and irresponsible” actions and offered to resign. Governor Brown declined the offer and kept Matosantos on the job.

Raymond J. March • Monday, October 8, 2018 •

Back in April, the Food and Drug Administration announced plans to reduce nicotine levels in cigarettes to help current smokers quit and prevent future generations from starting. In an op-ed I wrote for Inside Sources, I argued such efforts are unlikely to help and will likely cause considerable harm.

At the time, lawmakers also pressured the FDA to regulate e-cigarettes, worried they were steering younger generations into nicotine addiction. In the same op-ed, I warned that regulating e-cigarettes, like regular cigarettes, “will also lead to serious harm guided by good intentions.”

Unfortunately, more “good intentions” have followed.

In early September, the FDA began an anti-vaping campaign to deter teens from vaping and issued information requests to e-cigarette companies to determine how popular these products were among younger demographics. Two weeks later, the agency gave five e-cigarette producers 60 days to present it, “with robust plans on how they’ll [the producers] convincingly address the widespread use of their products by minors.”