President Biden’s Fiscal Train Wreck

On 2023’s Labor Day, President Biden boasted of cutting the U.S. government’s budget deficit at a speech in Philadelphia.

“Unlike the last president, in my first two years—all this stuff, guess what?—I cut the deficit $1.7 trillion, cut the debt $1.7 trillion.”

There’s just one problem. President Biden’s fiscal policies are exploding the U.S. government’s budget deficit during his third year in office. Here’s the Washington Post‘s Jeff Stein’s introduction to that hard truth:

The federal deficit is projected to roughly double this year, as bigger interest payments and lower tax receipts widen the nation’s spending imbalance despite robust overall economic growth.

After the government’s record spending in 2020 and 2021 to combat the impact of covid-19, the deficit dropped by the greatest amount ever in 2022, falling from close to $3 trillion to roughly $1 trillion. But rather than continue to fall to its pre-pandemic levels, the deficit then shot upward. Budget experts now project that it will probably rise to about $2 trillion for the fiscal year that ends Sept. 30, according to the Committee for a Responsible Federal Budget, a nonpartisan group that advocates for lower deficits.

Here’s another hard truth. With the end of the coronavirus pandemic’s emergency spending, the budget deficit would have shrunk more without President Biden’s fiscal policies during his first two years in office.

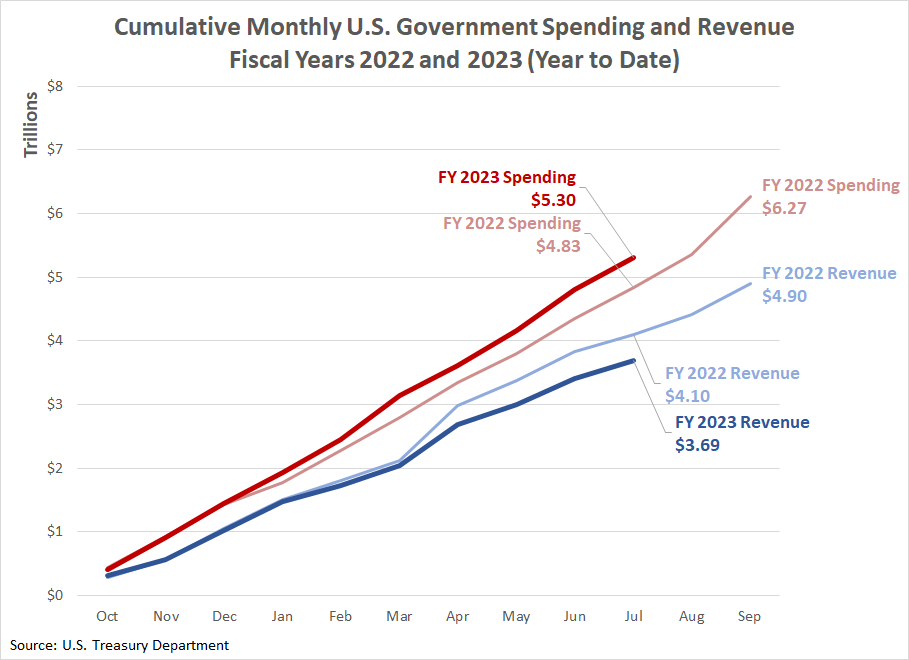

Now, in his third year, those policies look more and more like a fiscal train wreck. I threw together the chart below to show how the federal government’s cumulative spending and tax collections during the current 2023 fiscal year compares with the year before.

There are two big takeaways from this chart. First, federal government spending increased a lot in 2023. Second, tax collections are far below what they were in 2022, even though President Biden signed tax increases into law with the Inflation Reduction Act on August 16, 2022.

Rising spending paired with falling tax collections is why the Committee for a Responsible Federal Budget predicts FY 2023’s deficit will reach $2 trillion when the fiscal year ends on September 30, 2023.

Here’s a third hard truth. While the U.S. government has nearly 100% control over what it spends, it cannot guarantee how much it collects in taxes. Anytime tax revenues come in much lower than expected, whether because of recession or because the delayed effects of high inflation caused by other fiscal policies come home to roost, a fiscal train wreck can result.

A fiscal train wreck only becomes unavoidable because government spending is allowed to continue as if nothing were going wrong. Things are going very wrong in 2023.