Social Security To Run Out of Money Sooner

The trust fund that sustains a large portion of the Social Security benefits American seniors rely upon will run out of money in 2033. The trust fund will be depleted a year earlier than forecast a year ago.

That’s the verdict of Social Security’s trustees, who point to the “precipitous” effect of the coronavirus pandemic as the cause. Here’s the money quote describing the negative impact from their 2021 report:

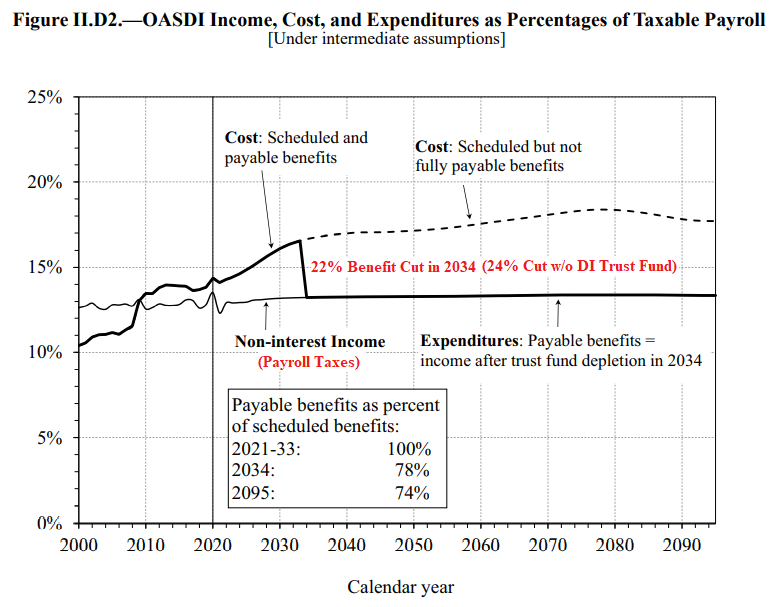

The OASI Trust Fund and the DI Trust Fund are projected to have sufficient reserves to pay full benefits on time until 2033 and 2057, respectively. Legislative action will be needed to prevent reserve depletion in those years. In the absence of such legislation, continuing income to the trust funds at the time of reserve depletion would be sufficient to pay 76 percent of OASI benefits and 91 percent of DI benefits.

The Old Age and Survivors’ Insurance (OASI) Trust Fund is the one that provides funds to pay Social Security’s retirement benefits. When it runs out of money in 2033, everyone who receives Social Security benefits will see their monthly payments slashed by 24%.

The Trustees could divert the Disability Insurance (DI) trust fund to keep paying Social Security benefits. If they do, the benefit cuts can be held off for another year and be smaller. But that means both trust funds would be completely out of cash.

How Did We Get Here?

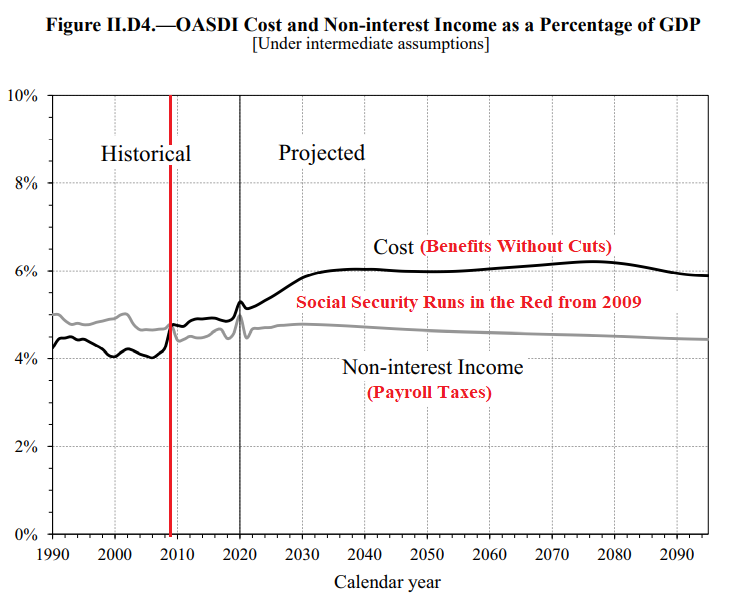

The 2021 Trustees’ report includes several charts that help explain why Social Security benefit cuts are coming. I’ve marked up the charts with additional comments to describe what they’re trying to say in pictures. This first chart shows the Social Security program’s money in and money out for the combined trust funds as percentages of GDP:

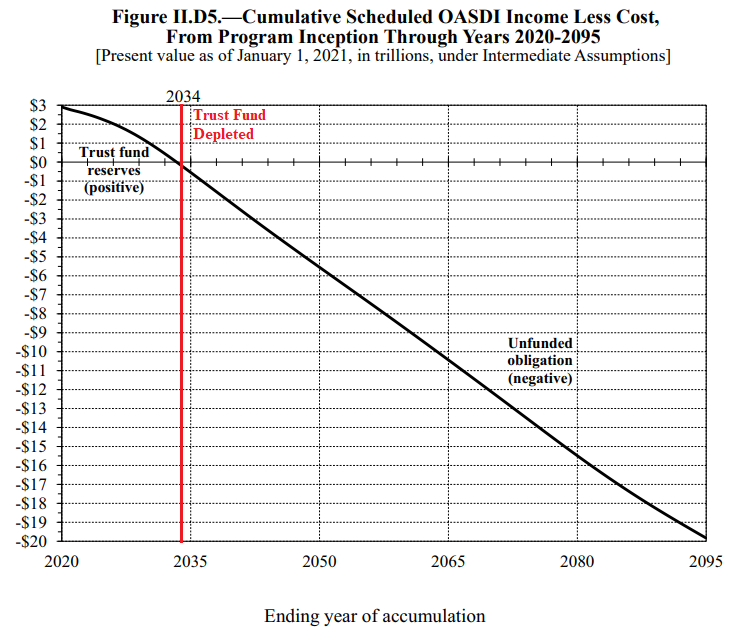

Social Security has been running in the red since 2009, and will by a wide margin for the foreseeable future. That’s why the Trustees have tapped Social Security’s trust funds to keep paying benefits at promised levels. The next chart looks at how long the combined trust funds will last until they run out of money.

In the next 12-13 years, Social Security will burn through nearly $3 trillion of the combined OASI and DI trust funds. After that, to pay its “unfunded obligation”, lawmakers would have to:

- Raise Social Security’s combined employer and employee payroll tax from 12.40% to 15.76% of the employee’s pay.

- Permanently cut promised benefits by 21-22% for all Social Security recipients in 2034. This action is what politicians have promised to Americans under current law.

- Permanently cut benefits by 25% for those who starting to collect Social Security in 2021 or after.

- Some combination of these approaches.

The final chart shows how benefits will change in the future for the combined trust funds under Options 1 and 2 with respect to how much taxable income employees earn:

A fifth option involves borrowing money to keep paying out benefits at elevated levels. A glance at the second chart above should convince lawmakers that’s not a sustainable fiscal path. But do today’s politicians even know what a sustainable fiscal path looks like?