Craig Eyermann • Monday, April 8, 2019 •

Last December, the Congressional Budget Office generated a list of ideas for how the U.S. government could save trillions of dollars over the next 10 years.

The CBO altogether identified $5.8 trillion of potential savings, which in a world where they are already forecasting no less than $11.6 trillion in annual budget deficits in the 10 years from 2020 through 2029, would cut that accumulation of red ink in half.

Veronique de Rugy and Justin Leventhal of the Mercatus Center visualized the federal spending categories where the CBO identified potential savings that could be realized.

K. Lloyd Billingsley • Saturday, April 6, 2019 •

In 2016, California voters rejected Proposition 62, which would have eliminated the death penalty, and approved Proposition 66, which speeded up the process for executions. As Lt. Governor, Gavin Newsom said he would be “accountable to the will of the voters” and not put “my personal opinions in the way of the public’s right to make a determination of where they want to take us, as relates to the death penalty.” As governor, Newsom did the opposite.

On March 13, the governor issued a reprieve for all 737 convicted murderers on death row. Newsom said he believed some of the reprieved murderers might be innocent, which gave Californians good cause for bewilderment. Governor Newsom is not an attorney and not a judge. He did not attend the trials and produced no new exculpatory evidence in any of the cases. After the reprieve, other mysteries surfaced.

K. Lloyd Billingsley • Friday, April 5, 2019 •

“Volatility is not our friend, it’s our enemy.” That was California Governor-elect Gavin Newsom last November, referring to state tax reality: The top one percent of earners provide about half the state’s income tax revenue, the largest source of funding for state government. This makes for high volatility during any economic downturn. Gov. Newsom knows this is a problem, but so far he has done nothing to address it.

The governor has made no move to lower California’s income and sales taxes, highest in the nation, and he has made no effort to compress the number of tax brackets. On the other hand, he has been a vocal supporter of new taxes, including a tax on drinking water. Governor Newsom is also targeting voter-approved Proposition 13, Californians’ only meaningful measure for tax limitation.

K. Lloyd Billingsley • Thursday, April 4, 2019 •

Last week U.S. District Court Judge Roger Benitez struck down a California law that banned high-capacity rifle magazines. Judge Benitez ruled unconstitutional the 2016 ballot measure Proposition 63, which outlawed magazines of more than 10 rounds capacity. The measure also mandated background checks for purchases of ammunition and the confiscation of guns from those prohibited from owning them.

The Cuban-born Benitez, an appointee of President George W. Bush, wrote that “Individual liberty and freedom are not outmoded concepts.” California’s law, according to the judge, “turns millions of responsible, law-abiding people trying to protect themselves into criminals,” and Benitez cited examples of citizens who ran out of ammunition defending themselves against home invasions by violent criminals. Benitez also characterized the Second Amendment as a “check on tyranny,” first implemented by those who “cherished individual freedom more than the subservient security of a British ruler.” In other cases, the disarming of the people has preceded tyranny.

Craig Eyermann • Thursday, April 4, 2019 •

How often is your day interrupted by robocalls?

According to call-blocking mobile app-maker Hiya, last year Americans received 26.3 billion robocalls, or rather, automated telemarketing solicitations, on their mobile phones, which they estimate is up 46 percent from 2017. The Federal Communications Commission (FCC) estimates that, in 2018, Americans received nearly 48 billion robocalls on their mobile phones and landlines. With an estimated U.S. population of 327 million, that’s an average of 147 robocalls received by every person in the country last year.

The problem has gotten so bad that the Washington Post reports that many retirees, who are often targeted by fraudsters using robocalling technologies, have become too afraid even to answer their phones. Which is really sad, because after the U.S. government established its Do Not Call Registry, back in 2003, such problems were supposed to have been solved. Any telemarketer found to have solicited phone numbers identified in the registry was supposed to be subject to substantial fines.

Samuel R. Staley • Thursday, April 4, 2019 •

Hotel Mumbai was a particularly difficult movie for me to watch, let alone review, in part because I have direct experience with the historic Taj Mahal Hotel and Palace (aka Hotel Mumbai). I walked through the lobbies and in the halls of the hotel where unsuspecting innocents were gunned down brutally and indiscriminately in 2008. I walked the streets that Pakistan-based terrorists plied to get to their targets.

When I visited Mumbai in 2005, I marveled at the peaceful, if impoverished, bustle of a vibrant street life in this vast metropolis of nearly 21 million people. I dipped into the world of the slums with World Bank economists to see with my own eyes how this place peacefully housed as much as 40 percent of the city’s population and many of the service workers that staffed luxury hotels like the Taj Hotel. The experience was so profound, thanks in no small part to my hosts, that my visits inspired the development of several teaching units in my classes at Florida State University on land use, urban development, social entrepreneurship, and urban planning.

Craig Eyermann • Wednesday, April 3, 2019 •

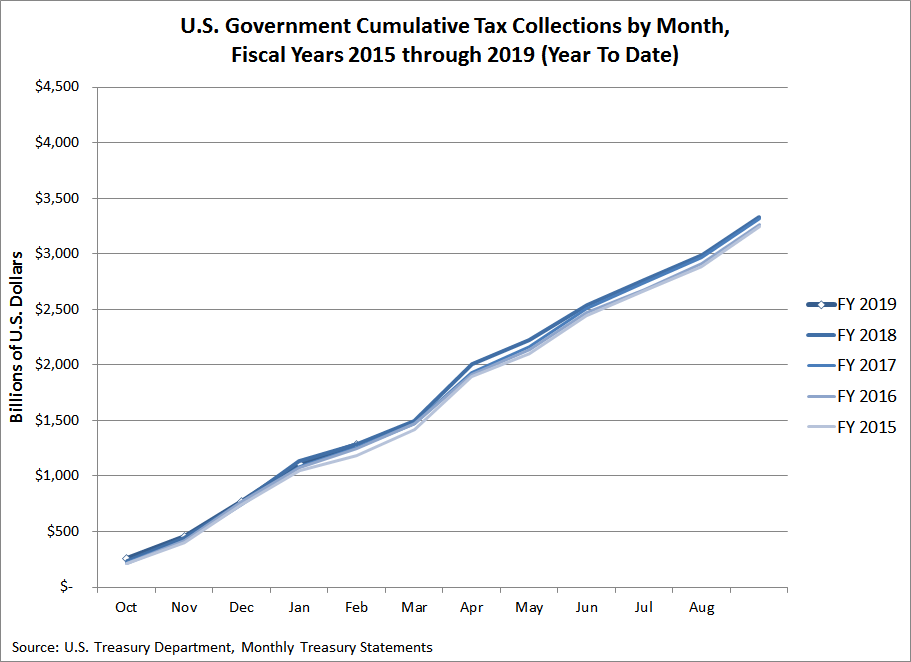

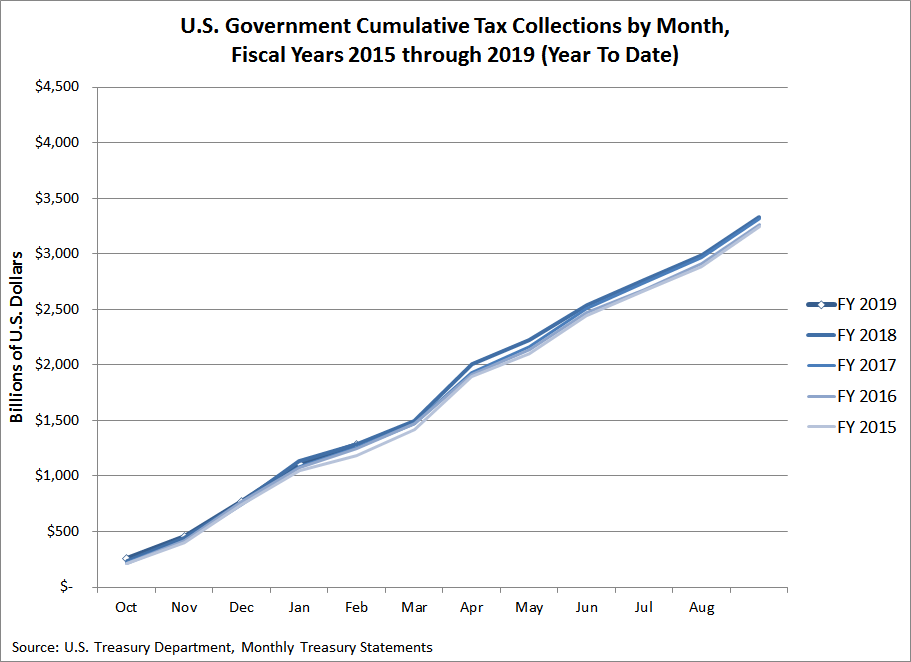

Have you ever gotten stuck in a rut at your job? Where every month is a lot like the exact same month in previous years, and your paychecks and cumulative take-home income has barely changed over time?

Sounds depressing, right? Now, what if your income never changed, but you decided to try to make yourself happy by spending more every month than you did in the same months of previous years? And you kept doing that, year after year.

Robert Higgs • Wednesday, April 3, 2019 •

The Internal Revenue Code is a massive part of the laws of the United States of America. It is complex. I daresay no single human being, even the most expert tax lawyer, understands all of it, and most people understand none of it. Many provisions are almost incomprehensible except perhaps to that most expert tax lawyer, and even he is probably uncertain about many details. Highly paid tax accountants and tax lawyers constitute a large industry, spending their time trying to tease out the meaning of the tax code and to divine how the IRS will interpret its legislative power.

Yet one thing is certain: virtually nothing in the code is there by accident. Every incomprehensible provision is there to serve the interest of someone who made it worthwhile for a politician to direct his staffers to put it there at an opportune point in the legislative process.

K. Lloyd Billingsley • Thursday, March 28, 2019 •

California’s 2016 Proposition 57 barred the direct filing of juvenile cases in adult court, whatever the gravity of the offense. The 2018 California Senate Bill 1391 barred the prosecution of 14- and 15-year-olds in adult court, even if they commit multiple murders. As the case of Larry Ray Richey shows, judges are also going easy on adults who commit deadly acts of violence.

“This is a tragic case. Both families have suffered a loss. One family has suffered the death of their patriarch. Another family has lost a son for a stupid act in which he lost control.” That was Sacramento Superior Court Judge Shelleyanne Chang, a former deputy attorney general and legal affairs secretary for California Gov. Gray Davis, who appointed her a superior court judge in 2002. Given the facts of the case, both families present for the March 22 court date might have wondered about Chang’s pronouncement.

Raymond J. March • Thursday, March 28, 2019 •

Ketamine, often referred to as “Special K”, is a powerful hallucinogenic drug which, when abused, can help users detach from reality. Long-term ketamine use can have harmful psychiatric effects such as memory loss, decreased sociability, and even permanent psychosis. However, Ketamine is also classified by the Drug Enforcement Agency (DEA) as a Schedule III substance, one with beneficial medicinal properties in addition to its risk of being abused.

Despite its reputation as a party drug, Ketamine is now hailed as a “game-changing” treatment for types of depression that do not respond to typical treatment methods.

Last year, a special panel assembled by the Food and Drug Administration overwhelmingly endorsed a ketamine-based drug named esketamine for treatment of depression. A few weeks later, the FDA approved the drug under the name Spravato (a nasal spray version of esketamine).