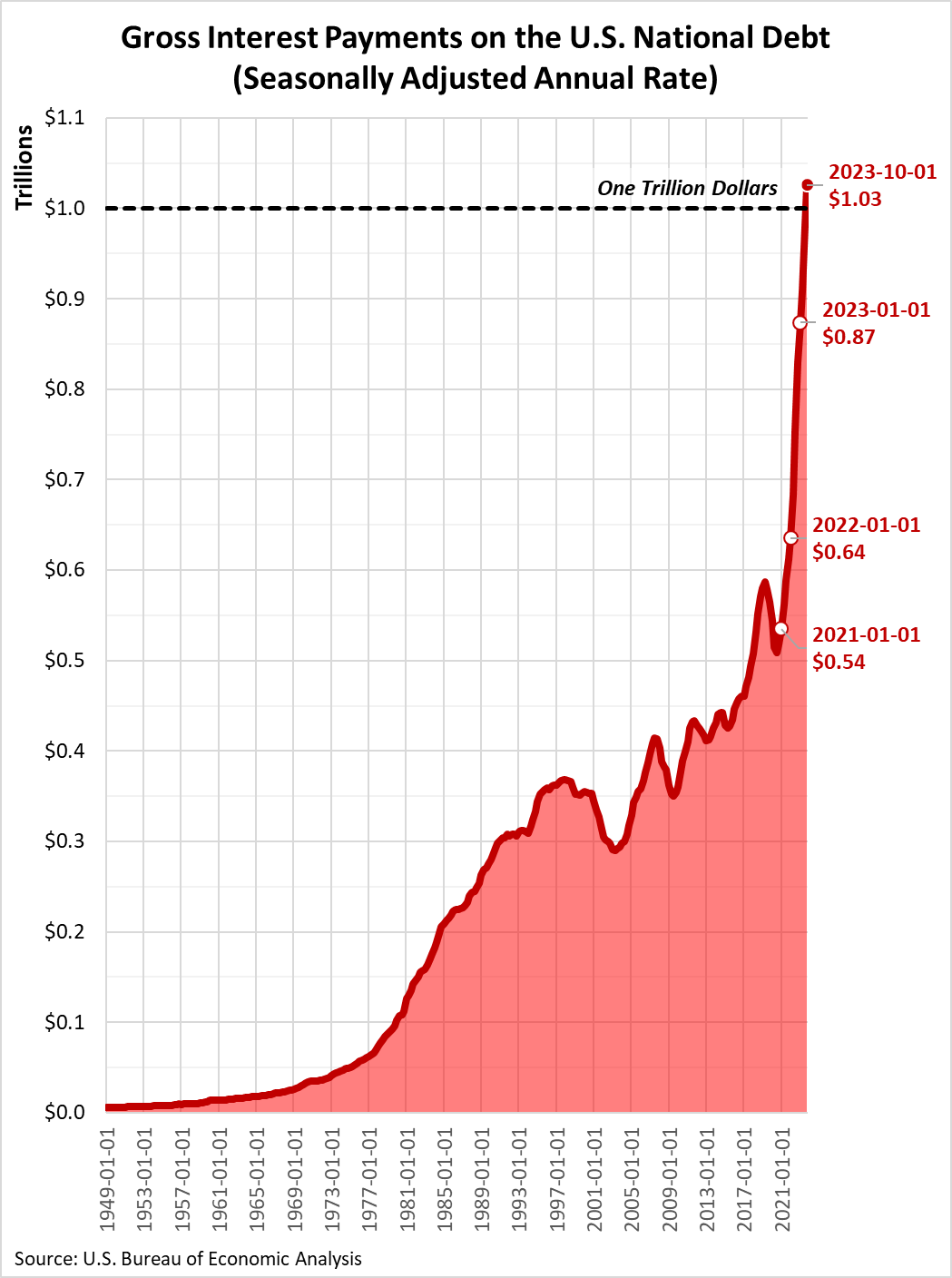

Total Interest on U.S. National Debt Now Exceeds $1 Trillion a Year

Sustaining the U.S. national debt has become very expensive thanks to rising interest rates. The annual cost of paying the gross interest on the national debt now exceeds one trillion dollars. That cost has almost doubled during the last three years.

This cost was confirmed in the Bureau of Economic Analysis’s (BEA) initial GDP estimate for the fourth quarter of 2023. The chart below illustrates how the amount of interest the U.S. government pays on its total public debt outstanding has grown in each quarter since the first quarter of 1949.

Paying interest on the national debt is mandatory for the U.S. government. As such, money that goes to pay interest owed to the U.S. government’s creditors is money that cannot be spent on things the elected officials and bureaucrats who run the U.S. government would rather spend it on. During 2023, having to pay the U.S. government’s rapidly rising cost of borrowing accounted for about 16% of the federal government’s total spending.

That means the cost of paying the gross interest on the national debt claimed almost one out of every six dollars the U.S. government spent during the calendar year of 2023. In the first quarter of 2021, it was one out of every fifteen dollars.

How did this happen?

None of this has happened by accident. As I wrote back in November, the two main culprits behind the rapid rise in the U.S. government’s interest expenses are the growth of the U.S. national debt and rising interest rates. Had the U.S. national debt not grown so large because of decades of excessive spending, the U.S. government’s fiscal situation would be much easier to manage. However, the problems caused by a large national debt and rising interest rates have been made worse by poor fiscal management in Washington.

There are two sides to that problem. First, because the U.S. Congress’s budget process rewards political game players at the expense of U.S. taxpayers, they have done nothing to fix what is clearly a broken budget process. Second, during the last several years, no help or fiscal discipline has come from the other end of Pennsylvania Avenue. The White House has utterly failed to propose any budget that restrains spending growth to sustainable levels.

If that was not enough, the U.S. Treasury Department blew its chance to restructure and refinance the national debt at historically low-interest rates before those rates started rising. Because of that bungle, with every month that passes, billions of dollars in short-term notes that cannot be fully paid off get rolled over and refinanced at higher rates than those at which they were originally borrowed. The Treasury Department’s choices of financing the national debt are making the existing national debt much more costly.

A fiscal time bomb

All these political games and bungling all but ensured the national debt would grow into a fiscal time bomb. When interest rates began rising to combat inflation, the fiscal time bomb started to detonate. The consequence is the exploding growth of the U.S. government’s cost of interest on the national debt.