Total Interest on National Debt Approaching $1 Trillion

The total amount of interest the U.S. government pays on its public debt outstanding over the past year may have just crossed the one trillion-dollar mark.

That’s the word from BNN Bloomberg‘s Ruth Carson and Mark Cudmore, who have been crunching numbers to arrive at that gross estimate:

Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month, Bloomberg analysis shows. That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.

The estimated interest expense is calculated using US Treasury data which state the government’s monthly outstanding debt balances and the average interest it pays.

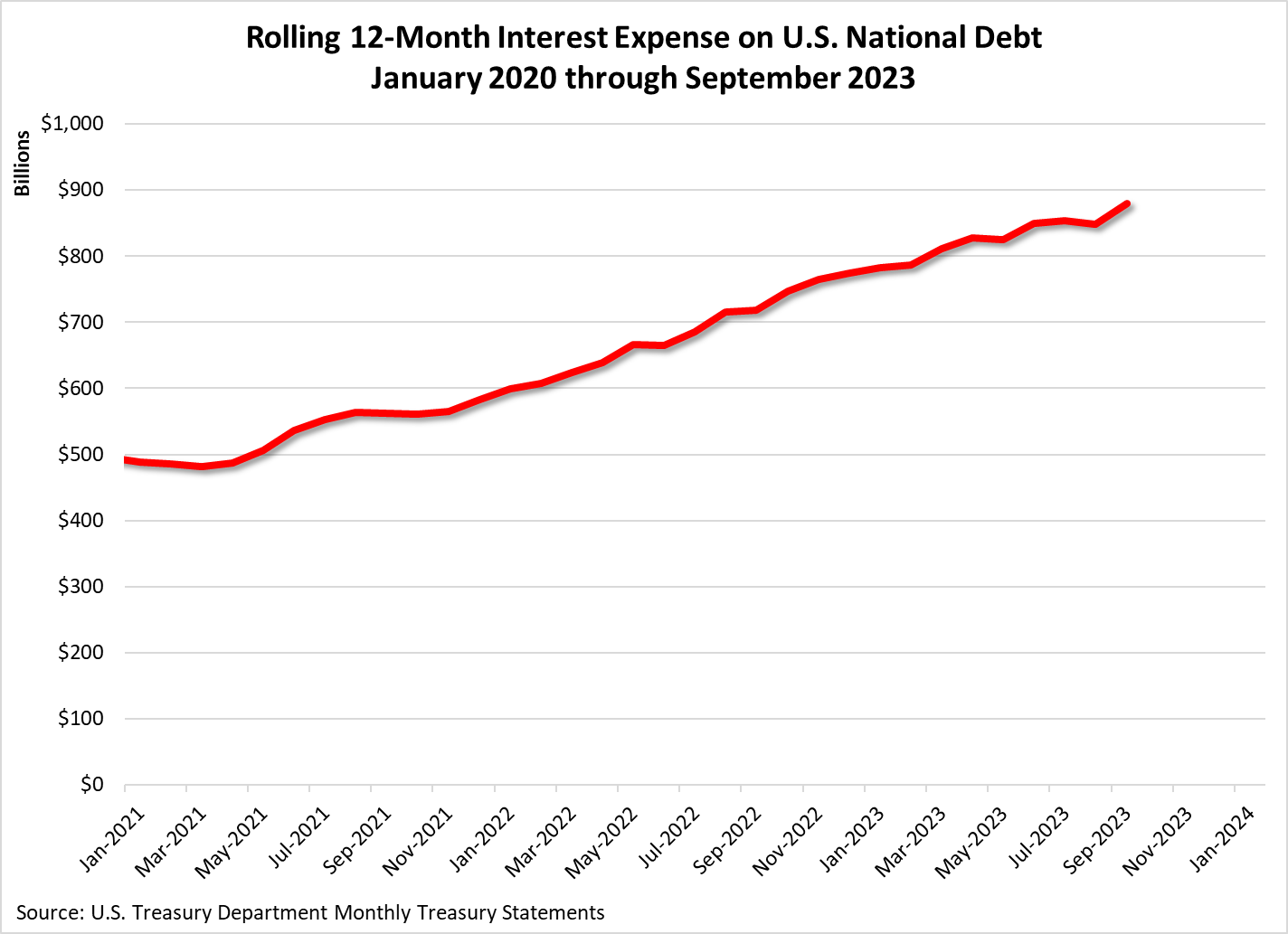

Of course, the gauge of estimated interest costs is different than what the Treasury actually paid. Interest costs in the fiscal year that ended Sept. 30 ultimately totaled $879.3 billion, up from $717.6 billion the previous year and about 14% of total outlays.

But, looking forward, the rise in yields on long-term Treasuries in recent months suggests the government will continue to face an escalating interest bill.

The worsening metrics may reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threatened the return of the so-called bond vigilantes and led Fitch Ratings to downgrade US government debt in August.

The chart below shows the official total for the U.S. government’s gross interest expense on the national debt from January 2021 through September 2023. The data comes from the U.S. Treasury Department’s monthly treasury statements.

Through the end of its 2023 fiscal year in September, the U.S. government paid out $879.3 billion just on the interest it owes on the national debt.

To put that number in perspective, it is more than what the federal government spent on national defense ($821 billion) or Medicare ($848 billion) in FY 2023. It is also about $10 billion shy of how much the government spent on health-related programs like Medicaid, the Child Health Insurance Program (CHIP), and Affordable Care Act subsidies during the year.

Because the U.S. government collects interest on federal student loans, its net interest expense in FY 2023 was $659 billion. That number could have been worse and would have been, had the Supreme Court not struck down President Biden’s unlawful student loan relief scheme.

Two Big Culprits

Two main culprits behind the rapid rise in the U.S. government’s interest expenses are the growth of the U.S. national debt and rising interest rates. The growth of the U.S. national debt is primarily the result of excessive spending. Meanwhile, interest rates have been forced up to combat inflation partly caused by the federal government’s excessive spending.

Poor fiscal management enables both of these culprits. The U.S. Congress’ budget process is broken, with episodes of government shutdown theater becoming frequent events in recent years. At the same time, the White House has regularly failed to propose budgets that restrain spending growth to sustainable levels.

Meanwhile, the U.S. Treasury Department failed to restructure and refinance the national debt at historically low-interest rates before it started rising, perhaps among the worst of the government’s fiscal policy failures. It has undoubtedly become its biggest lost opportunity.