Social Security Benefit Cuts Coming by 2035

Good news! Instead of going broke in 2033, Social Security’s Old Age and Survivors’ Insurance (OASI) trust fund will run out of money in 2034. If the program’s Disability Insurance (DI) trust fund is diverted to pay retirement benefits, it will last until 2035!

That’s the latest projection from Social Security’s trustees, who released their 2022 annual report last week. If you’re on track to be collecting Social Security benefits in 2034 or after, here’s what that will most likely mean:

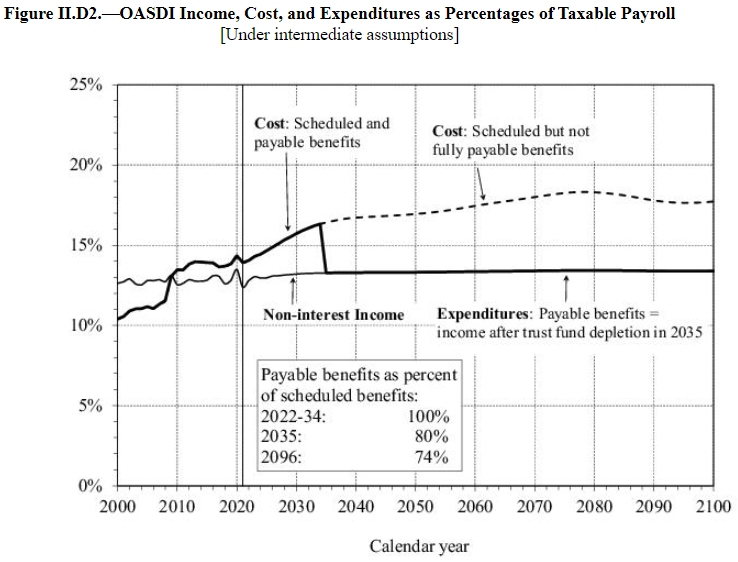

Under the intermediate assumptions, the projected hypothetical combined OASI and DI Trust Fund asset reserves become depleted and unable to pay scheduled benefits in full on a timely basis in 2035. At the time of depletion of these combined reserves, continuing income to the combined trust funds would be sufficient to pay 80 percent of scheduled benefits. The OASI Trust Fund reserves are projected to become depleted in 2034, at which time OASI income would be sufficient to pay 77 percent of OASI scheduled benefits. DI Trust Fund asset reserves are not projected to become depleted during the 75-year period ending in 2096.

Here’s the Trustees’ chart illustrating when benefits will be cut and by how much under current law:

Those benefit reductions are also good news. A year ago, the cuts were projected to be bigger. Now, retired Americans relying on Social Security benefits will only lose 20 cents of every dollar they might have been expecting. That’s a promise by the politicians who set Social Security’s funding and benefits on their current scheme.

The Costs of Saving Social Security’s Benefits

Social Security’s Trustees have also updated their estimates of what it would cost to keep the trust funds from depleting. Here’s a summary of their hypothetical solutions:

- Raise Social Security’s combined employer and employee payroll tax from 12.40% to 15.83% of the employee’s pay. This is a slight increase over last year’s estimate.

- Permanently cut promised benefits by 20.3% for all Social Security recipients by 2035. This action is what politicians have promised Americans under current law.

- Permanently cut benefits by 21.2% for everyone receiving Social Security benefits in 2022.

- Some combination of these approaches.

Each of these solutions would, by themselves, make it possible for Social Security to pay out benefits for nearly another 75 years without any other adjustments. At least, according to the Trustee’s intermediate assumptions, which fall between their best and worst case scenarios.

What should the real solution be? The Committee for a Responsible Federal Budget has an interactive tool where you can try out your own reform with a lot more options than the Trustees have listed. If you find a good one, share your solution in the comments.