Coronavirus Is Quickly Draining Social Security

The 2020 Social Security Trustees’ Report is out, and it is not good news.

According to Social Security’s trustees, the Old Age and Survivors’ Insurance Trust Fund will run out of money in 14 years, meaning that beginning in 2035, all of Social Security’s beneficiaries will have their monthly income checks slashed by 21 percent.

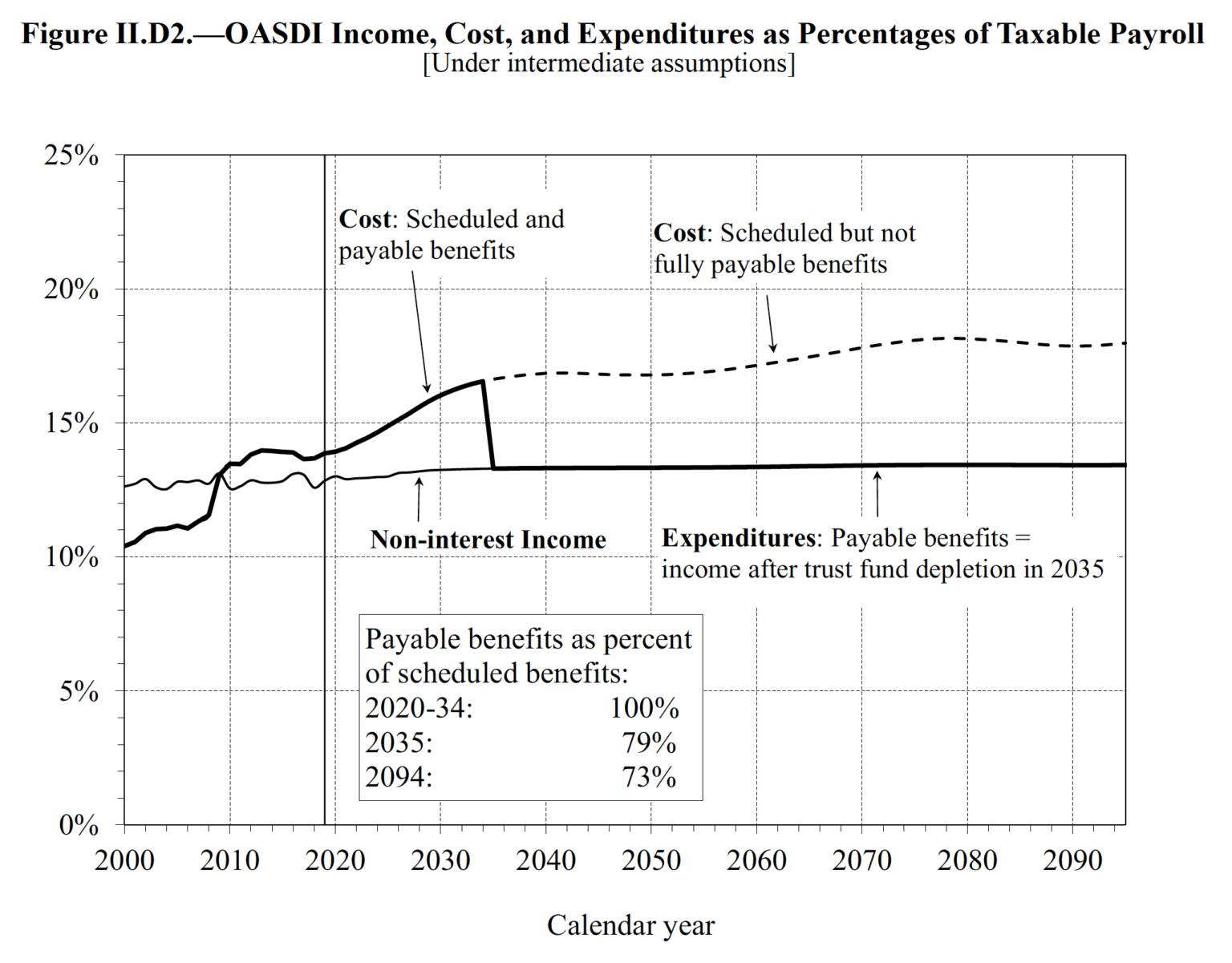

Here’s the chart from the Trustee’s report that shows that happening under the Trustees’ intermediate (“most likely”) assumptions:

Social Security Trustees’ Report: Figure II.D2 – OASDI Income, Cost, and Expenditures as Percentages of Taxable Payroll

But it’s going to be much worse than that.

As the Social Security’s Trustees are communicating in a special message to the public on the report’s web site, they make clear their assumptions did not include any aspect of the coronavirus pandemic that has thrown nearly 39 million Americans out of work as of May 22nd.

With U.S. unemployment now estimated to be “north of 20 percent,” Social Security is experiencing something much closer to its worst-case scenario, where its trust fund that provides money to boost the retirement income of millions of Americans will run out of money years sooner.

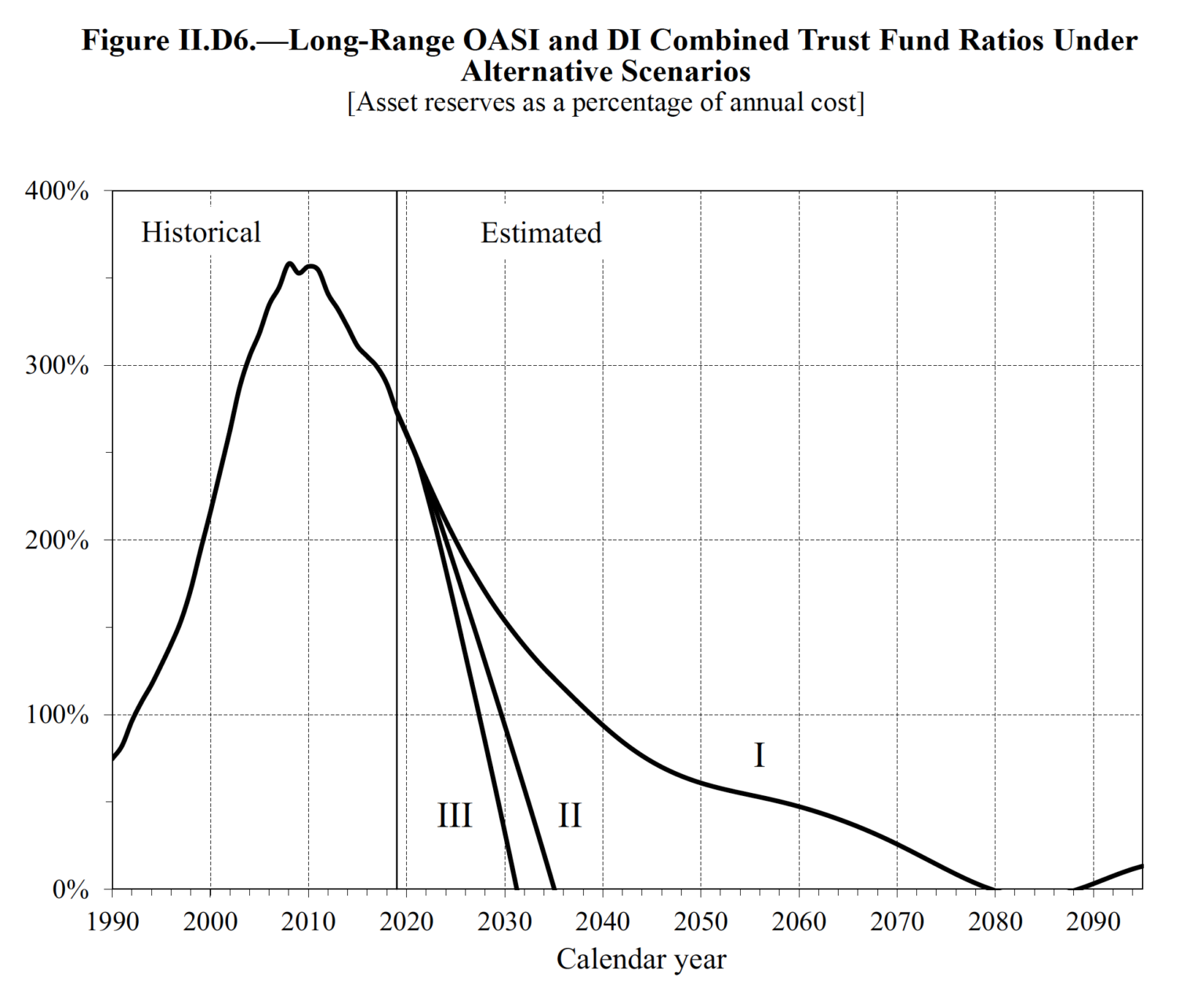

The chart below shows what Social Security’s Trustees thought would be a worst-case scenario to consider, labeled as Alternative Scenario III in the chart, which shows benefits being slashed during 2031:

2020 Social Security Trustees Report Figure II.D6 – Long Range OASI and DI Combined Trust Fund Ratios Under Alternative Scenarios

But it’s going to be much worse than that. Social Security’s Trustees never considered the possibility of a global coronavirus pandemic that would prompt state and local government officials to close businesses and to order residents to stay at home, effectively shutting down a massive portion of the U.S. economy for weeks on end, with some attempting to do so indefinitely.

Factoring in the negative impact of the coronavirus recession, analysts at the Bipartisan Policy Center estimate that Social Security‚Äôs retirement trust fund will now run out of money in less than 8 years, well ahead of the schedule anticipated by Social Security’s Trustees‚Äô worst case scenario:

Our preliminary analysis finds that the Disability Insurance (DI) trust fund’s reserves may be depleted during the next presidential term, and the Old-Age and Survivors Insurance (OASI) trust fund’s reserves may be depleted right around the time of the 2028 presidential election. These projections reflect a substantial further deterioration in the finances of a program that was already facing a large mismatch between income and outlays, making the need for action by policymakers even more urgent.

According to their analysis, the Social Security’s OASDI trust fund will be depleted much sooner for two main reasons:

- Fewer Americans are working to provide the revenue needed to sustain the trust fund longer through their payroll taxes at the current payroll tax rates.

- Because of job losses, more older Americans will be tapping Social Security benefits sooner, particularly those at or near the ages where they can draw early retirement benefits, which will accelerate the rate at which the OASDI trust fund will be depleted.

There are two main ways policymakers can address these problems.

- They can increase that payroll tax rates on working Americans incomes.

- They can cut promised benefits to some or all recipients of Social Security.

The bottom line is that Americans who rely on Social Security can now expect to both pay more for and get back less from the retirement income welfare program much sooner than they may have been expecting.

The coronavirus pandemic has moved up Social Security’s day of reckoning.