The Economic Costs of the National Debt and How to Avoid Them

One week ago, noted Stanford University economist John Taylor testified at a hearing before the U.S. House of Representatives’ budget committee, whose members are reexamining the economic costs of the national debt.

After the hearing, Taylor summarized his remarks and reflected on previous testimony he provided on a related topic back in 2015:

At the earlier hearing I showed that basic economic theory grounded in real world data implies that high federal government debt has a cost: it reduces real GDP and real income per household compared to lower debt levels. At yesterday’s hearing I reported that a reexamination of the economic costs yields the same results. A fiscal consolidation plan which reduced debt to GDP would lead to an immediate and permanent increase in real GDP according to model calculations.

Recently the Congressional Budget Office (CBO) reported similar results. They compared their “extended baseline” in which the debt goes up to 144 percent of GDP by 2047 with an “extended alternative fiscal scenario” in which the federal debt goes to 219 percent of GDP. CBO found that real GNP is 3.6 percent lower when debt is higher. So, the higher level of debt has real economic costs.

The CBO also analyzed scenarios in which debt is lower as share of GDP: 42 percent and 78 percent. In the 42 percent scenario, real GNP would be 5.8 percent higher; in the 78 percent scenario, real GNP would be 3.7 percent higher.

Put simply, too much national debt makes it harder to advance up the path of higher economic growth.

There are two ways the growth of the national debt can be restrained to try to keep it from harming economic growth. The government can either impose higher taxes to try to close the gap between its spending and its tax revenue, or it can restrain the growth of its spending to better match how much it collects in taxes.

Taylor goes on to describe which of these approaches he advocates:

With the CBO currently projecting large increases in the federal debt relative to GDP in the United States, this reexamination implies the need for a credible fiscal consolidation strategy. Under such a strategy spending would still grow, but at a slower rate than GDP, thereby reducing debt as a share of GDP compared with current projections. Such a fiscal strategy would greatly benefit the American economy. It would also reduce the risk of the debt spiraling up much faster than projected by the CBO.

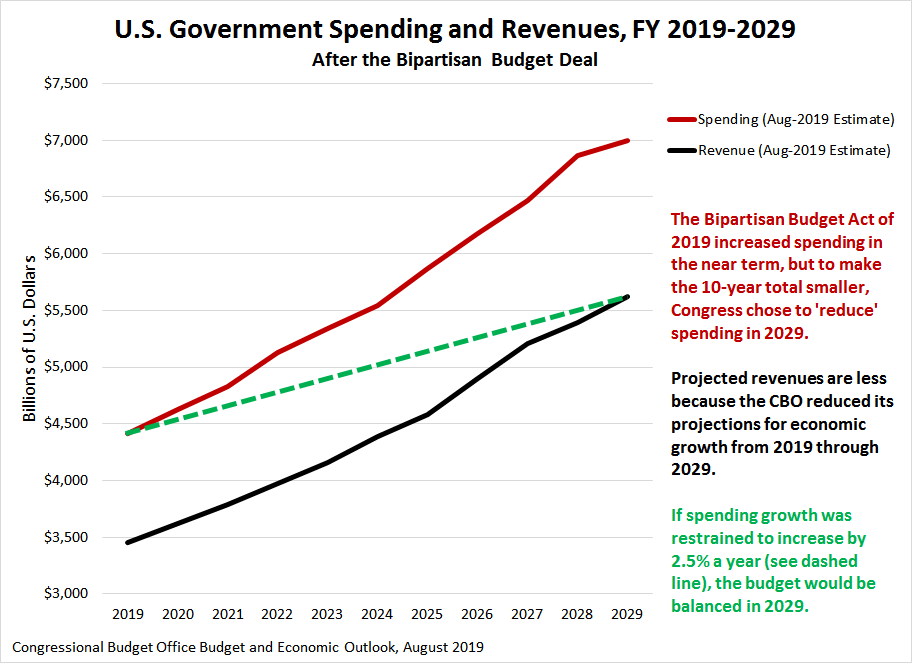

Taylor describes this result as a “robust” conclusion. Since the U.S. government’s tax revenues keep pace with the country’s GDP, this strategy works because spending is restrained to rise more slowly that tax revenues do, even without any new taxes or increases in tax rates, because tax revenues keep pace with GDP growth. The chart below, which many readers may recognize from a few months ago, illustrates how this concept works as the U.S. government’s budget might be brought into balance over the next 10 years:

The bonus is that both Taylor’s and the CBO’s models project higher GDP growth if the growth of government spending, and by extension, the growth of the national debt, is simply restrained to grow slower than Washington, D.C.’s politicians would like. The problem is that too many of them would rather see the government grow faster than the economy, because that’s what benefits them more.