Two Minimum Wage Fallacies

According to a recent report, Democrats plan to use a drive to increase federal and state minimum wages as a 2014 election strategy. (“Democrats Turn to Minimum Wage as 2014 Strategy”, NYT 12/30/13.)

Generally, a binding minimum wage law will reduce the employment of the lowest-skilled workers. However, two economic fallacies that cloud the issue are prevalent, one among opponents of the minimum wage, and one among proponents.

The first fallacy is that an increase in the minimum wage (MW) will invariably lead to layoffs of the lowest-skill workers. In fact, a moderate increase in the MW could easily lead to no perceptible layoffs at all, and a windfall gain for workers at the expense of employers who have invested in their training. But to the extent employers can foresee the increase in the MW, they would never have hired these workers in the first place.

The second fallacy is that a MW can permanently increase low-skill employment when labor markets are not perfectly competitive. While it is true that a MW could conceivably increase employment of some workers in the short run, this is again at the expense of employers who have invested in capacity in the expectation of the market wage. If they had anticipated the MW, they would have invested on a smaller scale, or perhaps not at all.

In either case, in the long run, a MW unambiguously reduces the employment of low-skilled workers, even when labor markets are imperfectly competitive.

The First Fallacy

MW opponents often claim that increasing the MW will invariably lead to layoffs of low-skilled workers. While this is close to the truth, it is important that MW opponents not overstate their case with this claim.

Firms incur considerable fixed costs when they hire new workers: They must interview the field of applicants, complete considerable payroll paperwork for those they do hire, and then train the new workers for their specific workplace. Firms hope to recoup these fixed costs by paying the new workers somewhat less than the value of their marginal product for some time after they are trained and actually become productive.

If firms know well in advance that a MW increase is scheduled to occur, they will have taken this into account in their hiring plans, and will simply have hired fewer workers in the first place, so that no layoffs will occur when the increase actually occurs. But even if the increase is unanticipated, firms will have no incentive to lay off workers until the MW actually exceeds the value of their marginal product.

The claim of MW advocates, that firms “can afford to pay more” is therefore often true, so long as the increase is moderate. However, the MW increase only works by partially expropriating the hiring investment that firms have made in their workers. Had firms known that this investment was going to be expropriated, they would never have made it in the first place.

The Second Fallacy

The second MW fallacy is based on the ingenious observation that in the presence of imperfect labor markets, an increase in the MW can actually result in a short-run increase the quantity of labor hired. It does not, however, follow that a permanent MW will result in more long-run employment than no MW.

“Imperfect” labor markets are the natural outcome of a world in which there are economies of scale and workers are spatially distributed. Workers are naturally concerned with their net wage per hour, taking commuting costs and travel time into account. This means that each firm will be able to offer a lower wage to workers who live nearest to their location, and therefore will face an upward sloping labor supply function.

Abstracting from the fixed hiring and training costs discussed above, firms hire workers until the value of the marginal product of labor* equals marginal labor cost. If the labor supply function facing each firm is horizontal as in a “perfect” labor market, marginal labor cost simply equals the market wage. But if the firm faces an upward sloping labor supply function, which is to say an upward sloping average labor cost function, marginal labor cost will lie above average labor cost, and the market wage the firm pays on its labor supply function will be less than the value of the marginal product of labor. If a MW is then imposed above the firm’s wage, its average labor cost function will become horizontal at the MW, until it reaches the original labor supply function at a labor quantity above the firm’s original employment. As long as the MW is only moderately above the market wage, employment will actually be higher with the MW than without it.

Ingenious though this argument may be, the flaw in it is that it takes the number and size of firms as given. If firms near workers can offer lower wages, it is relevant to ask why there aren’t hundreds of tiny firms within a few minutes of each worker’s residence. The answer, of course, must be that there are economies of scale that make such small firms uneconomical. In order for the firms that do enter to be free from competition from new entrants (i.e. in the absence of “contestable markets”), there must be some irreversibile sunk costs that serve as a barrier to exit. But firms only incur these sunk costs in the expectation that they will be able to recoup them, in part, with the profits generated by their monopsony power in the local labor market. If they knew there was going to be a MW, they would have chosen to enter on a smaller scale, if they chose to enter at all.

When firms’ investment decisions are taken into account, therefore, it remains true that with a MW, employment is less than it would be without the MW.

The Minimum Wage and Unemployment

The reduction in low-skilled employment caused by a MW is partly reflected in a higher unemployment rate for low-skilled workers, and partly in a lower labor force participation rate for these workers through the so-called “discouraged worker effect.” In theory, therefore, a MW might have no effect on measured unemployment at all.

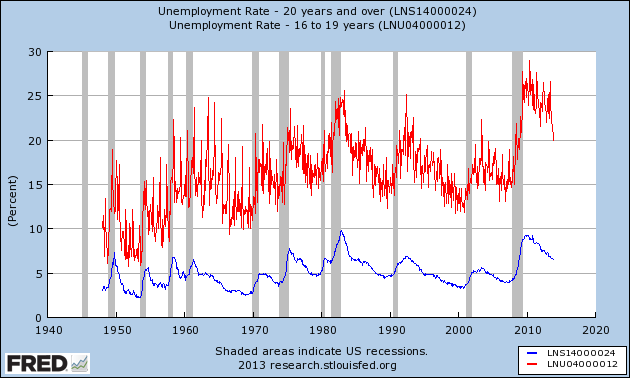

In practice, however, there does seem to be a tendency for the measured unemployment rate of low-skilled workers to vary even more strongly with labor market conditions than the overall unemployment rate, as shown in the following figure. The red line shows the unemployment rate for inexperienced teenage workers 16-19 years of age, while the blue line shows the unemployment rate for those 20 years and over. In each recession, the over-20 unemployment rate surges, but the teen unemployment rate has an even greater surge.

Figure 1

As pointed out in this blog by Mary Theroux (”Just Say No to Jobs for the Young and Unskilled,” Nov. 11, 2013), the MW is clearly blocking young workers from the opportunity to obtain job experience that will be valuable throughout their careers.

* In a competitive market, firms equate the value of the marginal product of labor, i.e. the price of the output times the marginal product of labor, to the wage. However, if the labor market is imperfect, the output market may be as well, in which case firms equate the marginal value product of labor (the derivative of the product of price times output with respect to labor) to the marginal cost of labor. For simplicity, the discussion assumes that the output market is competitive.

FRED® Graph ©Federal Reserve Bank of St. Louis. 2014. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis.