Closing the Government’s Books on 2024

The end of the calendar year traditionally represents a time when many people take stock of their personal finances. How much did your income change during the last year? How much did your spending change? What about your debt? Are you better off now than you were a year ago? What do you need to change in the next year to improve your financial situation?

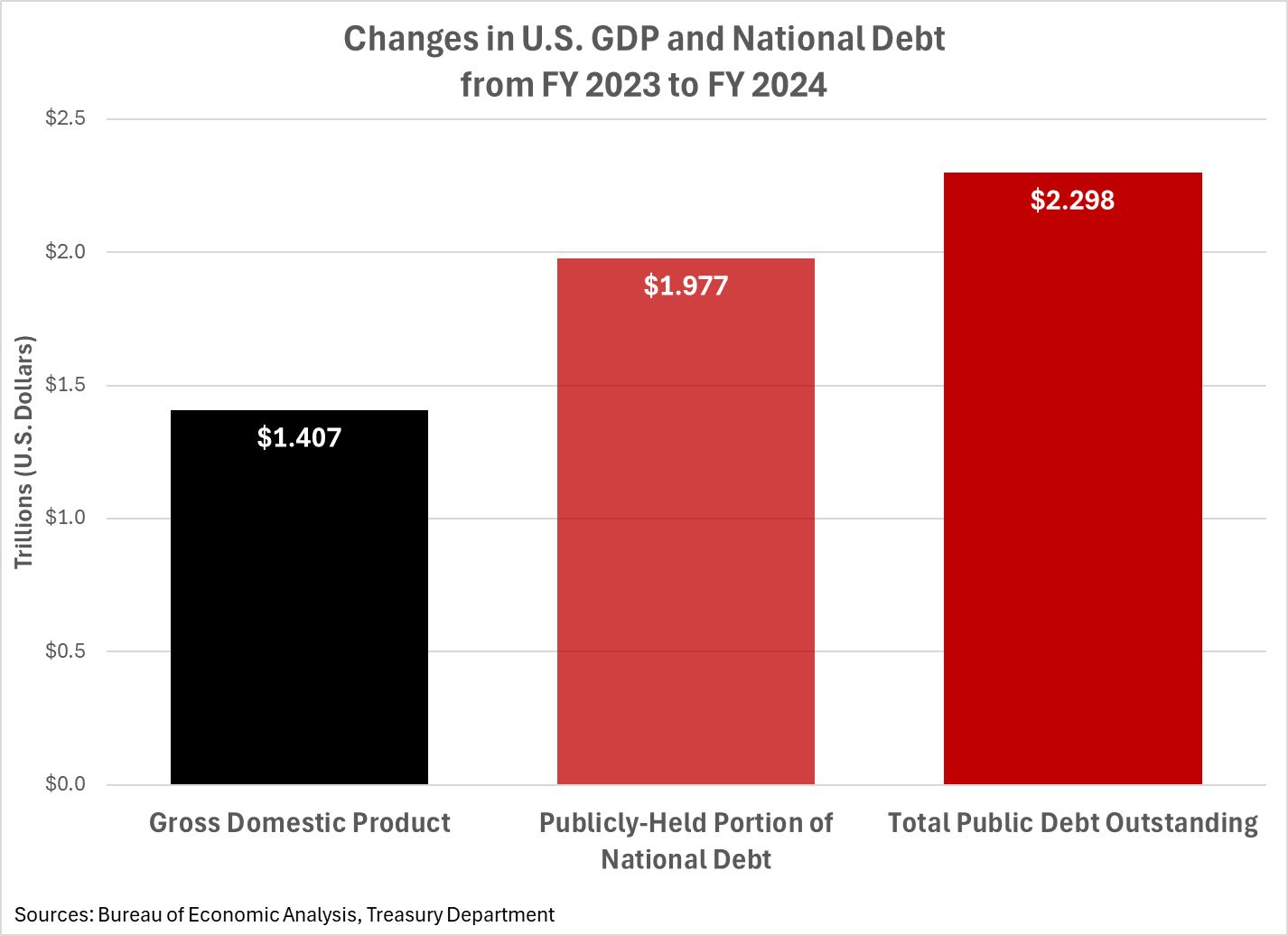

The same is true for the U.S. government. Even though its 2024 fiscal year ended on September 30, 2024, bureaucrats do not determine how much the economy changed during the year until late December. That information completes the federal government’s fiscal picture. The chart below shows how much GDP and the U.S. national debt changed during FY 2024.

This picture shows that the U.S. government is on an unsustainable fiscal path. Both the publicly held portion of the national debt and the nation’s total public debt outstanding increased far more than GDP did. That’s a raw indication that the U.S. government’s spending is outstripping the economy’s ability to pay for it.

How the Numbers Changed

GDP increased by $1.407 trillion from $27.968 trillion at the end of FY 2023 to $29.375 trillion at the end of FY 2024.

The publicly held portion of the national debt grew from $26.330 trillion (94% of GDP) at the end of FY 2023 to $28.307 trillion (96% of GDP) at the end of FY 2024.

Over that same time, the U.S. government’s total public debt outstanding rose $2.298 trillion. It increased from $33.167 trillion (119% of GDP) to $35.454 trillion (121% of GDP) during the federal government’s 2024 fiscal year.

That was the fiscal picture from about three months ago. How have things changed as the 2024 calendar year comes to an end?

Change for the Worse

The Center Square‘s Thérèse Boudreaux reports the U.S. government’s fiscal situation worsened during the first three months of the government’s 2025 fiscal year:

As 2025 approaches, America’s fiscal health is in serious trouble with a ballooning federal debt exceeding 100% of the GDP.

It’s projected to get even worse.

A year ago, the U.S. national debt amounted to more than $33.8 trillion, according to Senate Republican Joint Economic Committee data. As of Dec. 24, 2024, the debt has climbed to nearly $36.3 trillion, a $2.5 trillion increase within the past 12 months….

As the debt grows, so does the average interest rate the government is paying. That rate jumped from 2.378% five years ago to 3.155% now. Since one of the key drivers of U.S. debt growth is interest on the debt, a vicious spending cycle has been created, one that lawmakers in the U.S. House Committee on the Budget recently called “completely unsustainable.”

The next grim milestone for the U.S. government’s fiscal health will come when the publicly held portion of the national debt exceeds 100% of GDP. We won’t know for sure if that happened before the end of 2024 for another few months.

Regardless, we already know the current situation is unsustainable. What do the nation’s politicians and bureaucrats need to change in the next year to improve the federal government’s fiscal situation?

At the very least, it seems a fiscal reckoning is long overdue on their part.