Scary National Debt Numbers

Ready for a pre-Halloween scare?

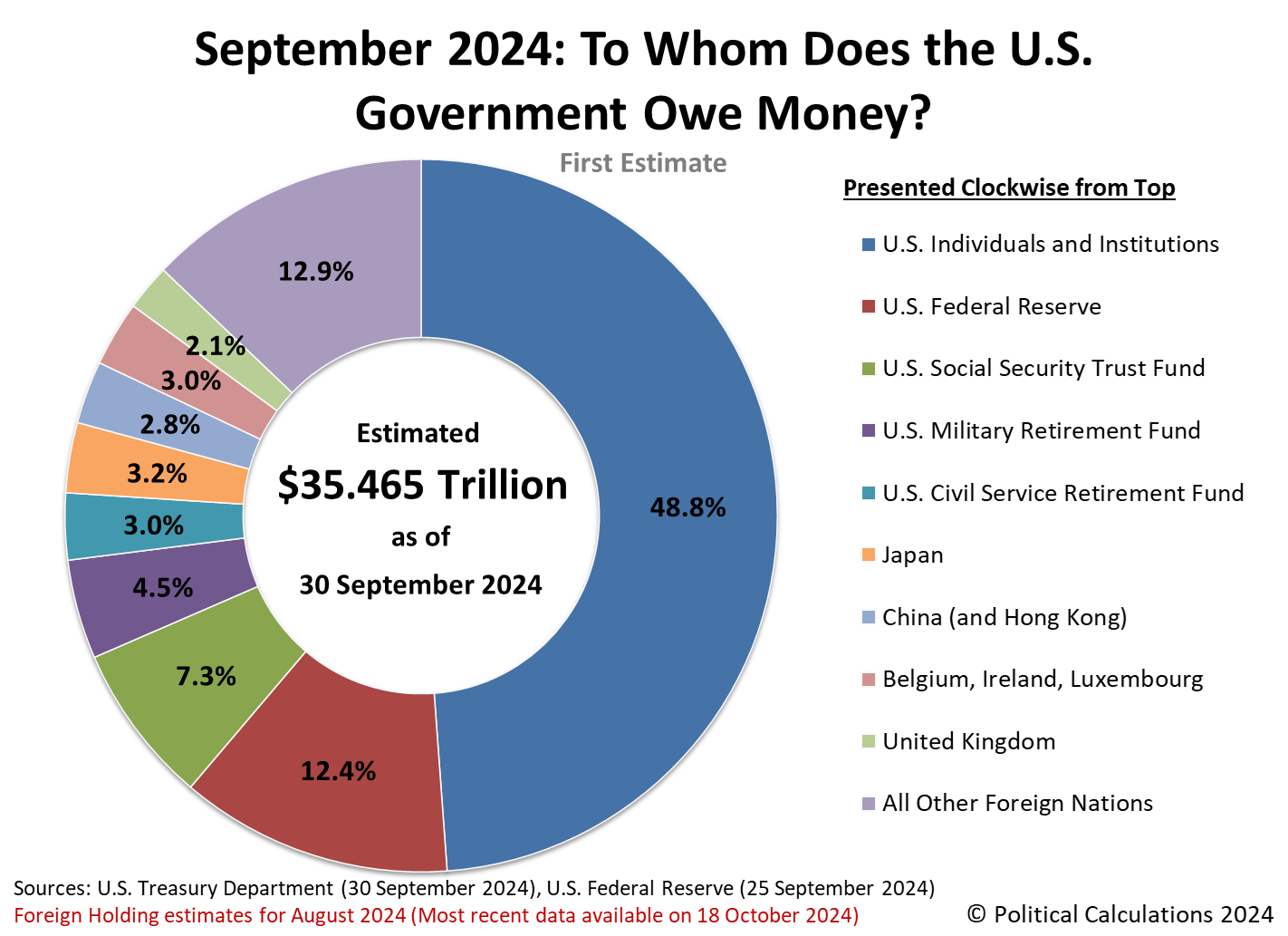

The U.S. government’s total public debt outstanding surpassed $35.465 trillion at the end of its 2024 fiscal year on September 30, 2024.

That massive number is the equivalent of $268,265 of national debt for each household in the United States. This figure is above and beyond the amount of debt each household has accumulated through their mortgages, car loans, and credit cards.

It’s also an underestimate because the national debt has kept growing. As of October 24, the national debt increased by another $334 billion, or by about $2,647 per household. Altogether, the national debt has grown by $54,862 per household during the Biden-Harris administration’s tenure. There is a good chance the Biden-Harris administration will beat the $57,989 per household figure run up during Donald Trump’s term in office before President Biden leaves the White House on January 20, 2025.

Who has the U.S. government borrowed so much from?

That’s a pretty reasonable question to ask. Political Calculations took a snapshot of the U.S. government’s major creditors as of September 30, 2024. The chart below reveals the major creditors to whom the U.S. government owes money and how much of that debt each is owed.

Here’s their overall picture of who owns the U.S. national debt:

The U.S. Federal Reserve is once again the U.S. government’s single largest creditor holding U.S. government-issued debt securities worth 12.4% of the U.S. government’s entire total public debt outstanding. However, its share of the national debt is down from the 18.3% it held in 2022 and the 15% recorded last year as the Federal Reserve has continued reducing its holdings. In doing so, the Fed is still following the monetary policy of shrinking its balance sheet that it initiated in March 2022 when it began hiking interest rates to combat inflation unleashed by President Biden’s policies.

Speaking of interest rates, on 19 September 2024, the Federal Reserve initiated a new series of interest rate reductions after holding them steady at an elevated level for over a year. Those higher rates have attracted U.S. individuals and institutions such as banks, insurance companies, investment funds, corporations, and individuals to collectively increase their share of the national debt from 47.1% in 2023 to 48.8% in 2024.

Social Security’s share of the national debt plunged from 8.1% in 2023 to 7.3% in 2024. This decline coincides with the ongoing depletion of its Old Age and Survivors Insurance trust fund, which has run in the red in every year since 2009.

The combined share of the U.S. national debt held by the government’s military (4.5%) and civilian (3.0%) employee retirement trust funds swelled from 7.2% to 7.5% from FY 2023 to FY 2024.

Altogether, the portion of the U.S. national debt held by U.S. entities in 2024 is 76.0%, a small dip from the 77.4% in 2023, but up slightly from 75.7% share in 2022….

The portion of the U.S. total public debt outstanding held by foreign individuals and institutions is 24.0%.

During the last few years, interest on the national debt has become the fastest-growing category of government spending. That money comes straight out of the U.S. government’s tax collections without ever doing anything U.S. taxpayers expect to be done with their tax dollars.

Ready for the real scare? Unless something dramatic changes things, these numbers will be bigger and scarier next year.