Are Greedy Corporations Really to Blame for Higher Prices?

Certain politicians have recently stated that Americans are paying more for what they buy because greedy corporations are hiking prices to fatten profits at their expense. Is this so? Legislation that governs the securities industry requires companies to disclose financial statements to ensure honesty and fair play. These financial statements should tell us whether companies are profiting at the expense of ordinary Joes.

Take the fast food sector. Nothing says “Americana” more than jumping in the car and heading to the drive-thru to grab some burgers to eat in the parking lot. Consumers are paying more for fast food. Prices at Burger King and Wendy’s have risen 55% over the last 10 years; McDonald’s prices have doubled, or risen more than 7% per year, much more than the 2.8% that the Bureau of Labor Statistics has reported in annual inflation over the same period. Do higher prices translate into fatter profits for burger joints?

Figure 1: Operating Margins Have Been Flat

(Revenue – Operating Expenses)/Revenue, %

Source: Company SEC Fillings

As shown in Figure 1, operating profitability at fast food chains has remained fairly constant over the past five years. In other words, the higher prices restaurants charge have not resulted in greater profitability. This, in turn, means that restaurants are simply passing higher input costs onto final consumers.

Figure 2 shows that the main burger inputs, beef (to the extent that patties actually contain beef) and bread, have risen 41.4% and 44.2%, respectively, over the past five years, or 7.2% and 7.6% annually, a level consistent with McDonald’s price increases and far more than Burger King or Wendy’s have hiked prices. Even electricity prices have risen 28.1% (5.1% per year), to say nothing of labor and other costs.

Figure 2: Input Costs Have Skyrocketed

US City Average Prices, Monthly, June 2019 = 1

Source: St. Louis Fed

Furthermore, in the absence of barriers to entry or government interference in the marketplace, if fast food joints were arbitrarily hiking prices to boost profits, someone would enter the market and sell burgers for less, taking away market share and forcing incumbent players to lower prices to stay in business. This is the essence of our capitalistic system. The lack of new entrants shows that existing burger joints are not earning above-average profits.

We must look elsewhere for the answer to why prices are rising.

Over the past several years, the federal government has been spending considerably more than it collects in tax revenue, running massive deficits. In the early years of this century, deficits were a few hundred billion dollars, which was not a good fiscal situation but manageable. As Figure 3 reveals, federal deficits have exploded recently and look to be permanently fixed above $1 trillion, or over 6% of U.S. GDP, a staggering amount.

Figure 3: Government Spending Is Out of Control

US Federal Deficit by Fiscal Year

Source: St. Louis Fed

Much of this spending is wasteful, on programs that certain politicians want but the public does not want and programs not demanded by the market. Furthermore, since there is a limited pool of funds to lend, government borrowing crowds out private borrowing, which could be used to finance more productive projects that are demanded by the market. Such projects would do more to expand the U.S. economy and increase Americans’ well-being.

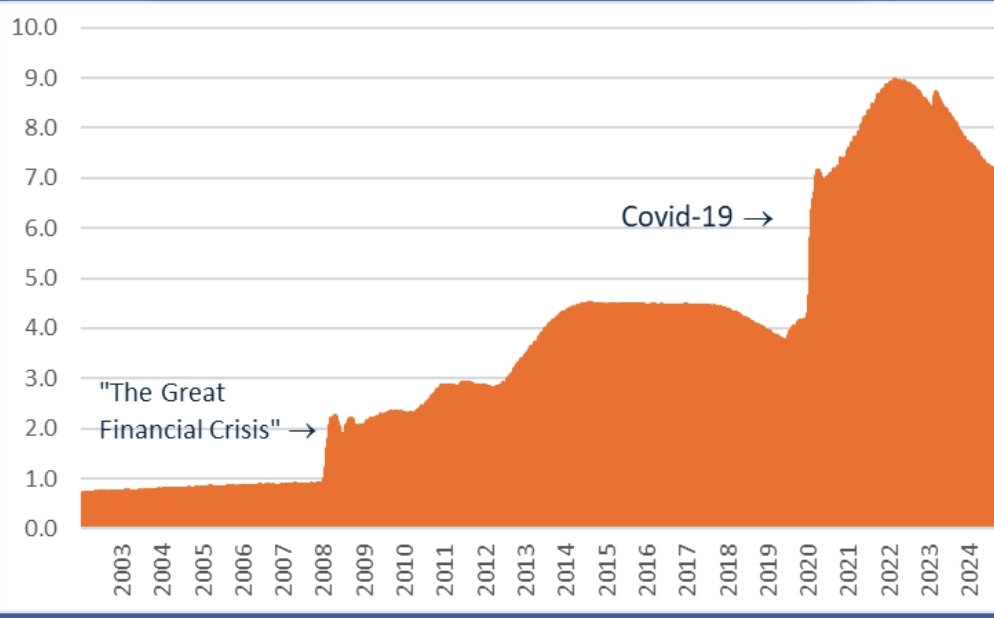

To accommodate the federal government’s irresponsible spending, the Federal Reserve has ballooned the money supply from $4.7 trillion at the start of this century to $21 trillion today, an increase of 347%! Over the same period, U.S. GDP has risen 108%. As money in circulation increases faster than the production of goods and services does, the price level must rise. In other words, the dollar’s value relative to goods and services it can buy continues to decrease.

To make matters worse, the Federal Reserve has been buying debt issued by the federal government, allowing the latter to continue its out-of-control spending habit. The Federal Reserve has expanded its balance sheet to over $7 trillion and is now by far the largest holder of U.S. federal debt.

Figure 4: The Federal Reserve’s Balance Sheet Has Ballooned

Total Assets, $ trillions, weekly

Source: The Federal Reserve

Thus, the massive spending of the federal government, far beyond the revenue it collects, is the root cause of inflation. The Federal Reserve aids and abets the government by purchasing securities, a process tantamount to printing money. As a result, the value of the dollar declines, or the nominal prices of goods and services purchased for dollars increase, aka, inflation. Corporations, facing higher input costs, have no choice but to hike final prices. As we have seen, corporate profit margins have not expanded during this period of reckless fiscal and monetary policy.

The solution is to reign in deficits, preferably by reducing the size of government by eliminating unnecessary, inefficient, non-market programs, rather than raising taxes. To the extent that price controls or other forms of government intervention in the free market will lower prices, they will be accompanied by shortages, rationing and a thriving black market where the true price, determined by supply and demand, will be revealed.

History is replete with examples of government intervention, including price controls, that had disastrous results. The recent experience of Cuba and Venezuela should be enough to convince policy makers not to head down this dark path.

The United States prevailed over the Soviet Union in the Cold War largely due to the latter’s command economy, where not only were prices fixed by the government, but also what to produce and in what quantities, ignoring the will of the people and market demand. US policy makers would do well not to repeat these mistakes, since the results are likely to be disastrous for the US economy and Americans’ well-being.