“The Path We’re on Is Unsustainable”

When speaking to the New York Economics Club last week, Jerome Powell, the Chair of the Federal Reserve, did not mince words about the U.S. government’s fiscal situation. Barron’s Megan Cassella reported on his comments:

The overall level of the U.S.’s debt isn’t a problem in itself, the Federal Reserve’s Jerome Powell said Thursday. But when asked about the level of government borrowing relative to the past, the chairman suggested that rapidly rising debt levels could become a problem moving forward.

“The path we’re on is unsustainable, and we’ll have to get off that path sooner rather than later,” Powell said.

The next day, the Treasury Department released its final monthly treasury statement for the U.S. government’s 2023 fiscal year, which ended on September 30, 2023. The news, as reported by Reuters, was not good:

The U.S. government on Friday posted a $1.695 trillion budget deficit in fiscal 2023, a 23% jump from the prior year as revenues fell and outlays for Social Security, Medicare and record-high interest costs on the federal debt rose.

The Treasury Department said the deficit was the largest since a COVID-fueled $2.78 trillion gap in 2021. It marks a major return to ballooning deficits after back-to-back declines during President Joe Biden’s first two years in office.

The deficit comes as Biden is asking Congress for $100 billion in new foreign aid and security spending, including $60 billion for Ukraine and $14 billion for Israel, along with funding for U.S. border security and the Indo-Pacific region.

The big deficit, which exceeded all pre-COVID deficits, including those brought about by Republican tax cuts passed under Donald Trump and from the financial crisis years, is likely to enflame Biden’s fiscal battles with Republicans in the House of Representatives, whose demands for spending cuts pushed the U.S. to the brink of default in early June over the debt ceiling.

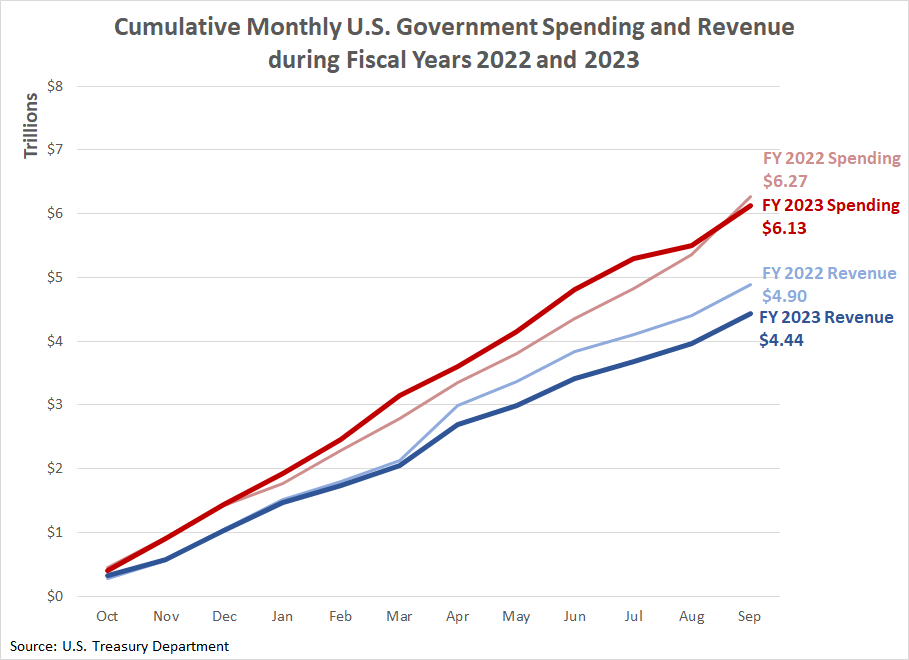

The chart below shows how the U.S. government’s spending and tax collections throughout its 2023 fiscal year compare with 2022:

Though U.S. government spending in FY 2023 ran ahead of FY 2022 in most of the year, spending significantly slowed in the final two months of the fiscal year. Total outlays for 2023 were $6.13 trillion, a slight reduction from 2022’s $6.27 trillion. Tax collections declined by a larger amount, falling from FY 2022’s record-high $4.90 trillion level to $4.44 trillion, the second-highest figure ever recorded.

An Unsustainable Fiscal Path

Spending might have fallen more if not for Social Security inflation adjustments and a much higher cost to service the U.S. national debt. Here’s Reuters again:

Social Security spending rose 10% to $1.416 trillion due to cost-of-living adjustments for inflation, and spending for the Medicare senior healthcare program rose 4% to $1.022 trillion.

Interest costs on the more than $33 trillion in federal debt also rose sharply, up 23% to $879 billion, a record. Net interest payments, excluding intragovernmental transfers to trust funds, rose 39% to $659 billion, also a record, according to a Treasury official….

Interest rates have soared over the last year and a half as the Federal Reserve jacked up borrowing costs to slow inflation. The average interest cost on the Treasury’s outstanding debt was 2.97% last fiscal year, up from 2.07% the year before.

Meanwhile, CBS MarketWatch reports on why the U.S. government’s revenues fell:

The Treasury said the sharp decrease in revenue was due to lower individual-income tax receipts as capital-gains realizations fell, and to rising interest rates that cut the amount of money the Federal Reserve deposited at the Treasury.

Both these problems result from the high inflation that characterizes President Biden’s tenure in office. Corporate profits fell in 2022 because inflation increased the cost of doing business, including the cost of borrowing from rising interest rates intended to fight inflation. These factors then led to reduced capital gains tax collections in 2023. You can see that consequence in the chart above as 2023’s tax collections deviate from 2022’s levels starting in April 2023. That month, capital gains taxes came due as Americans filed their 2022 income taxes.

All this is what an unsustainable fiscal path looks like. Powell is right in recognizing that “we’ll have to get off that path sooner rather than later.”