What Happens After Social Security’s Trust Fund Runs Out?

Earlier this year, Social Security’s Trustees reported that the trust fund, which supports about one-fifth of today’s Social Security payments, will run out of money at the end of 2033. When that happens, they say that every American who receives retirement or disability benefits will see them reduced by 20%. The program will still be able to pay out 80% of its benefits using what it collects through its payroll taxes.

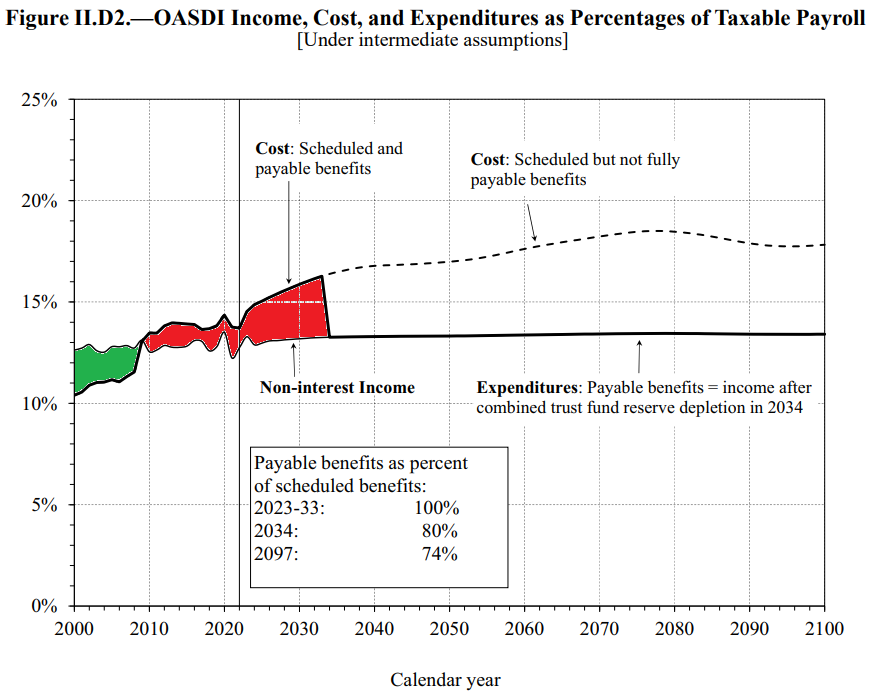

That will happen because the program has been running in the red. Since 2009, the program has paid out more benefits than it takes in through payroll taxes. It has taken money out of its Old Age and Survivors Insurance and Disability Insurance trust funds to make up the difference. But in 2034, that will come to an end because the trust funds will be depleted. Here’s the Trustee’s 2023 report chart that shows that happening. I’ve colored in when the program was either running a surplus (green) or a deficit (red):

The Congressional Budget Office wanted to determine how that event would impact the federal government’s fiscal outlook and the nation’s economy. They recently reported their findings. Some of what the CBO found is surprising:

The payable-benefits scenario would reduce budget deficits and debt significantly. Under that scenario, the abrupt and large reduction in benefits in 2034 would have both short-term effects and long-term effects on the economy. For instance, in the short term, the reduction in benefits would cause GDP to decline, though in the long term the effects of the reduction in benefits on people’s behavior and other aspects of the economy would cause GDP to rise. Those changes would affect different groups of people to varying degrees.

Here’s the effect they predict for the U.S. government’s annual budget deficits and the national debt:

In 2053, the primary deficit under the payable-benefits scenario would be smaller than it is in CBO’s extended baseline projections—0.9 percent of GDP instead of 3.3 percent of GDP. Adding interest costs raises the total deficit in 2053 to 5.4 percent of GDP under the payable-benefits scenario, compared with 10.0 percent of GDP in the extended baseline projections. For the payable-benefits scenario, debt held by the public would be 132 percent of GDP in 2053, CBO projects, rather than 181 percent.

The CBO sees the scenario of letting Social Security’s trust funds run out of money as promised under current law as a positive event for the federal government’s fiscal outlook.

For the economy, they have a more mixed outlook depending on whether you take a short- or long-term perspective:

In the short term, the significant and abrupt decline in Social Security payments would cause consumer spending to decrease, savings to increase by a corresponding amount, and overall demand for goods and services to decline. As a result, real GNP would be 1.2 percent lower in 2034 and 0.3 percent lower in 2035 than it is in the extended baseline projections, CBO estimates. In response, in CBO’s view, the Federal Reserve would lower interest rates to boost overall demand and prevent inflation from falling below its longer-term goal of 2 percent. In addition, the increase in the saving rate—and other factors—would further reduce interest rates. Taken together, those effects would cause the interest rate on 10-year Treasury notes to be 0.6 percentage points less in 2034 and 0.4 percentage points less in 2035 than it is in the extended baseline projections, in CBO’s estimation.

In the long run, though, output would be higher than it is in the extended baseline, mainly as a result of three factors. First, the supply of labor would expand. Second, private investment would increase following a rise in private savings as some workers chose to save more while working to offset the effect of smaller benefits on their income and spending in retirement. Third, the amount of funds available for private investment would grow, owing to smaller budget deficits and an associated reduction in borrowing by the federal government, which would reduce interest rates and boost output.

All this assumes politicians do nothing to try to restore Social Security’s benefits to their pre-2034 level. I think it’s fair to say that’s an unlikely scenario. It’s more likely politicians will try to plug the gap with new or higher taxes and more borrowing. To be sure, that’s what the CBO assumes in its baseline assumption that projects a more negative future for the U.S. government’s fiscal situation.