How the Debt Ceiling Deal Will Affect the National Debt

On Saturday, June 3, 2023, President Biden signed the Fiscal Responsibility Act of 2023 (FRA) into law. The new budget law does two things. It suspends the U.S. government’s statutory debt ceiling until January 1, 2025. It also reduces a portion of the federal government’s planned spending over the next ten years.

But how will that affect the U.S. national debt? The Congressional Budget Office has released its estimate of how the debt ceiling deal will affect the growth of the U.S. national debt. Here’s the CBO’s main finding:

The smaller deficits projected under the FRA reduce CBO’s projections of federal debt. In CBO’s May 2023 baseline projections, debt held by the public in 2033 is $46.7 trillion, or 119 percent of GDP. Subtracting the $1.5 trillion reduction in projected deficits estimated to occur under the FRA from those baseline amounts results in debt held by the public in 2033 of $45.2 trillion, or 115 percent of GDP, a roughly 3 percent reduction.

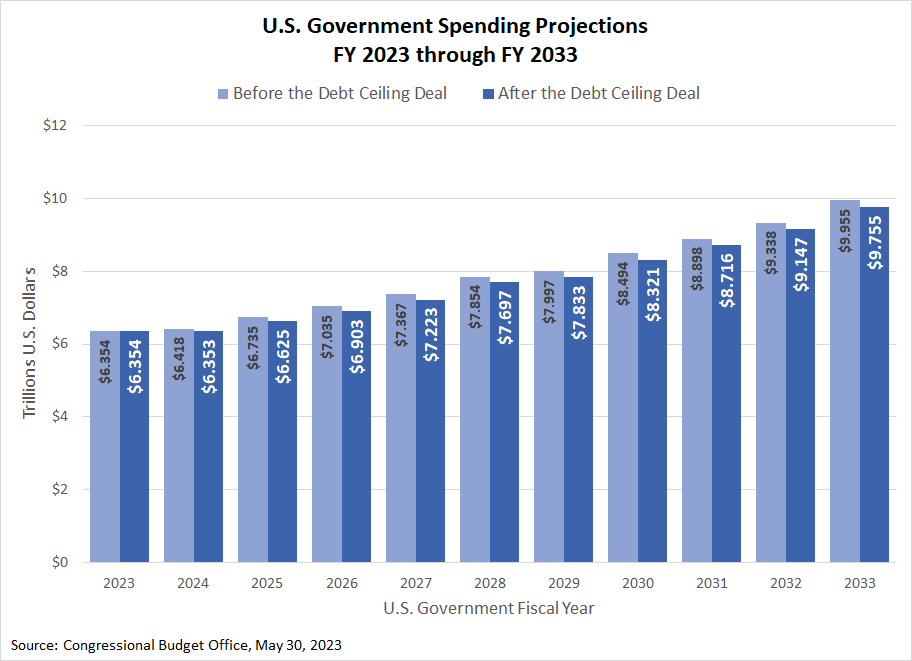

The chart below shows how the CBO estimates the FRA will change the U.S. government’s total annual planned spending from 2023 through 2033:

The annual spending reductions resulting from the debt ceiling deal are unimpressive. It’s very likely the vast majority of Americans won’t even notice.

Direct and Indirect Savings

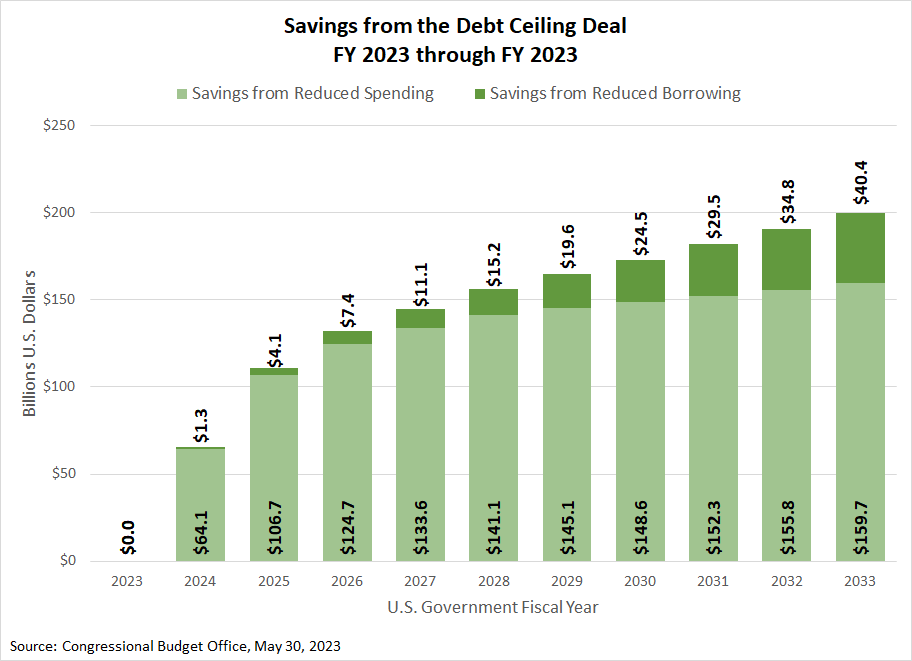

There is, however, something noteworthy to learn from these annual reductions. The CBO identifies two ways the U.S. government will achieve savings over time. The first is direct, coming from reduced spending on discretionary programs. The second is indirect, with savings from not borrowing to spend as much money as previously projected. I’ve charted how the CBO estimates those savings will be delivered over the next ten years.

Reducing spending means reducing borrowing, which reduces the interest the U.S. government must pay its creditors. As this second chart reveals, those savings compound over time, even though the direct spending reductions are unimpressive.

That’s of vital importance because the CBO expects the interest rates the U.S. government must pay to borrow will rise over the next ten years. They expect the average interest rate on the national debt will increase from 2.7% in 2023 to 3.2% in 2033. Higher interest rates mean bigger savings can be achieved by reducing the government’s planned spending, which is the one thing politicians have full control over.

Something to keep in mind for when the next debt ceiling “crisis” arrives in 2025.