Where Did 2022’s Extra National Debt Growth Come From?

In its 2022 fiscal year, the U.S. national debt increased by $2.5 trillion. But the U.S. government’s budget deficit for the year was $1.375 trillion. How is that possible?

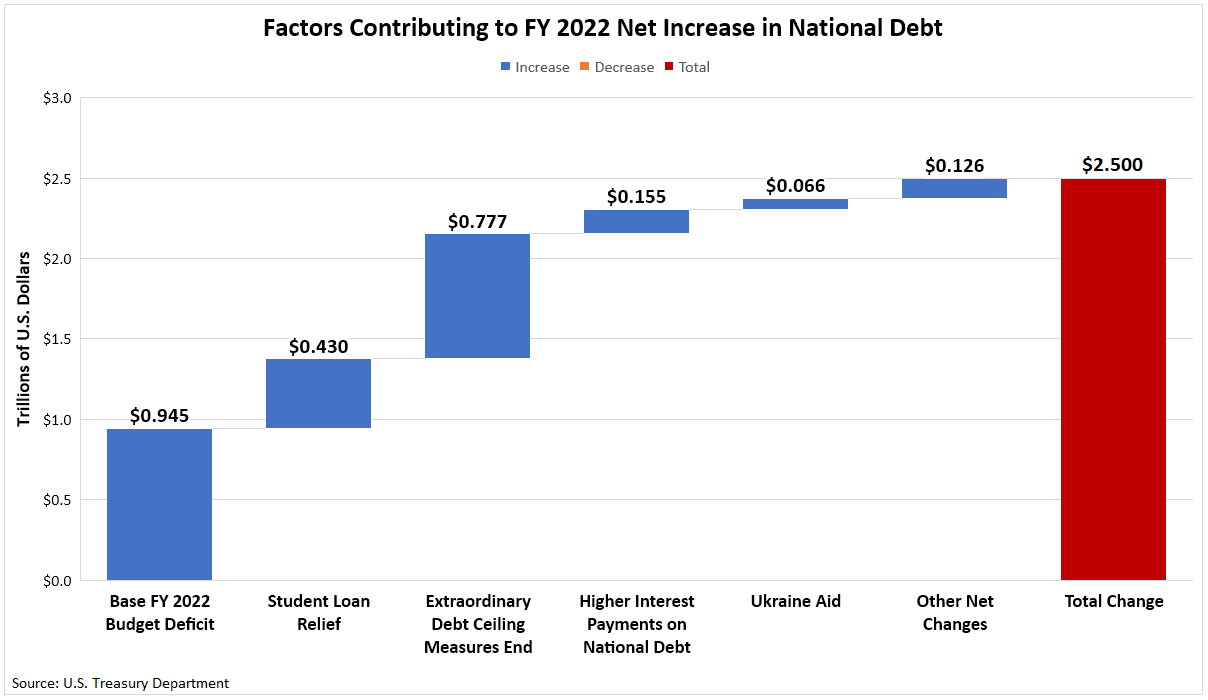

If there was more fiscal responsibility in Washington D.C., it wouldn’t have. But Washington D.C. is not known for fiscal responsibility, so now we have an accounting problem. To solve it, I looked at spending that either was not on the table when the federal government’s FY 2022 budget was proposed or that involved hangover spending from FY 2021. The chart below illustrates the various items that went above and beyond what the annual budget deficit could have been for FY 2022.

Now that we have a picture of everything else beyond the base budget deficit that added to the national debt in FY 2022, let’s break them down.

Base FY 2022 Budget Deficit

The U.S. government’s base budget deficit was $945 billion. President Biden’s original FY 2022 budget proposal had assumed a deficit of $1.8 trillion, but the failure of Biden’s Build Back Better spending bill and record high tax collections resulted in a much smaller net budget deficit. This smaller figure is what the U.S. Treasury Department would have reported for FY 2022’s actual budget deficit, if not for President Biden’s student loan debt relief scheme.

Biden’s Student Loan Debt Relief Scheme

Even though it is probably illegal and has been ruled unconstitutional, President Biden’s executive order forgiving the student loans owed by millions of Americans added $430 billion to the U.S. national debt. That change happened entirely because of President Biden’s action, as government-issued student loans were immediately transformed from assets into liabilities without any vote of Congress on the last day of the government’s 2022 fiscal year.

This new liability added to the U.S. government’s base budget deficit to produce the $1.375 trillion deficit figure reported by the U.S. Treasury Department for FY 2022.

Paying Off National Debt Ceiling IOUs

This is the hangover portion of the $2.5 trillion increase in the national debt during FY 2022. The U.S. government started FY 2022 in a deep hole because it had already smacked into the U.S. debt ceiling during FY 2021. Whenever the government’s total borrowing gets close to its legal credit limit, the U.S. Treasury Department deploys “extraordinary measures” to keep from defaulting on its national debt payments. It does that by taking money out of trust funds they control to pay the U.S. government’s creditors. The Treasury takes most of that money from military and civilian government employee retirement funds, among others, and leaves IOUs behind.

Those IOUs stack up until the debt ceiling is raised by an act of Congress. The Treasury’s latest extraordinary measures ran from August 2, 2021 through December 16, 2022, which overlaps the end of FY 2021 on September 30, 2021 and most of the first three months of FY 2022.

The figure of $777 billion represents the total amount the national debt increased from the end of FY 2021 on September 30, 2021 to December 16, 2021 when the debt ceiling was increased. About 62% of that amount, or $484 billion, was paid back to the military and civilian government employee retirement trust funds to repay IOUs accumulated since August 2, 2021.

Higher Interest Payments Because of Rising Interest Rates

During FY 2022, the amount of interest the U.S. government had to pay on the national debt rose $155 billion higher than what the government paid in FY 2021. This increase occurred because inflation from President Biden’s excessive spending forced the U.S. Federal Reserve to repeatedly hike interest rates during 2022.

What makes this contributor worse is that the U.S. Treasury Department borrows most money short term. Because President Biden’s excessive spending keeps it from fully paying it off as it comes due, the Treasury has to borrow more to roll over the debt it cannot pay back. In FY 2022, that meant frequently reborrowing money at higher interest rates as borrowing became much more expensive.

Ukraine Aid

At just over $66 billion, aid for the government of Ukraine is the smallest of the major contributors to the increase of the U.S. national debt above and beyond the FY 2022 annual budget deficit. That aid was approved in three installments by the U.S. Congress during FY 2022.

There were other net changes from FY 2021 that reduced the accumulated national debt by a net amount of roughly $10 billion. All in all, the additional borrowing driven by these factors would account for why FY 2022’s national debt increase was so much larger than the official annual budget deficit.