How Big Is the U.S. National Debt?

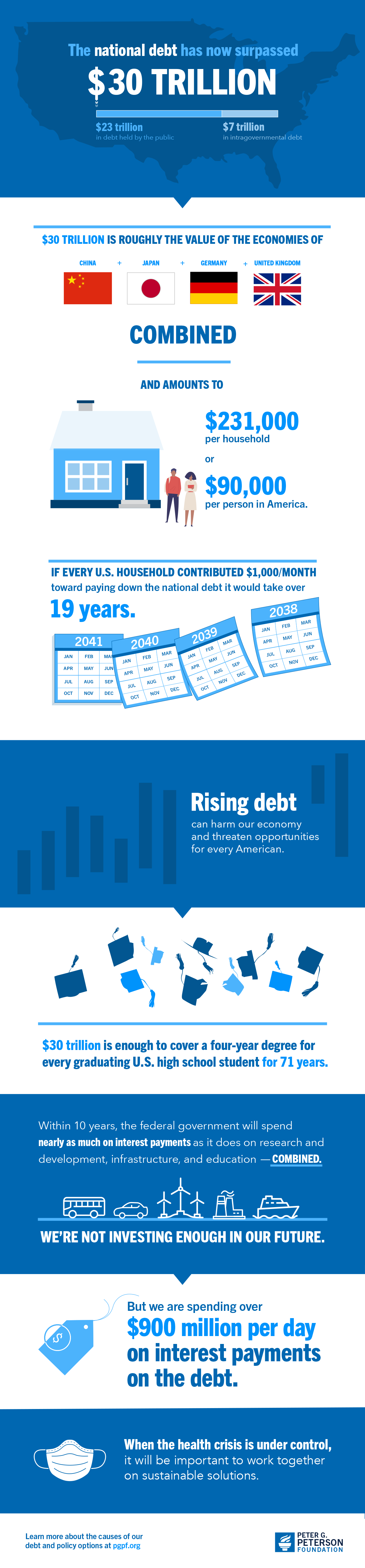

On February 1, 2022, the U.S. government’s total public debt outstanding surpassed $30 trillion. The Peter G. Peterson Foundation created an infographic to memorialize the grim debt milestone.

The National Debt Is Now More than $30 Trillion. What Does That Mean?, courtesy of Peter G. Peterson Foundation

The occasion of having racked up over $231,000 in debt per American household, or $90,000 per American, has also raised a question. The Manhattan Institute’s Brian Riedl tweeted the true national debt is just over $6.5 trillion less than $30 trillion.

As one of Twitter's few debt-hawks, I should be noting the debt passing $30 trillion…but I cannot bring myself to count the trust fund debt. Its an accounting fiction and was never borrowed out of economy.

So instead I'll highlight the true debt reaching $23,487,180,861,724.36

— Brian Riedl 🧀 🇺🇦 (@Brian_Riedl) February 2, 2022

That lower figure represents the public portion of the U.S. government’s total public debt outstanding. The $6.5+ trillion difference is called the intragovernmental portion of the national debt. It is often described as money the U.S. government owes itself.

Most of that is money that Social Security “loaned” the government to build up its Old Age and Survivors’ Insurance Trust Fund to pay benefits to baby boomers when they retire. Trust funds set up to pay retirement benefits to military and civilian government employees make up the next largest chunk of this category.

Why It Should Be Counted as Part of the National Debt

Historically, Riedl has a fair case for treating the intragovernmental portion of the national debt as a separate concern. But that doesn’t mean we should not include it when we tally up the U.S. national debt. That’s because of what the U.S. government must do to pay back what it owes itself when its debts come due in the future.

The U.S. government chronically runs in the red. It spends much more than it collects in taxes by a very wide margin. Because it does, paying off the debt it owes itself means having to borrow more money. Money that it will have to get by increasing the publicly held portion of the U.S. national debt. Given that situation, paying the intragovernmental portion of the national debt really means rolling it over to the publicly held side of the federal government’s debt ledger.

That’s nothing new. That particular shell game has been going on since 2009, when the cost of paying out Social Security benefits began exceeding Social Security’s payroll taxes. Under current law, it will continue indefinitely.

It doesn’t make sense to exclude the portion of the national debt the U.S. government owes itself from counting as part of the national debt. If anyone asks how big the national debt is, it’s the bigger number.