The National Debt in the Biden Era

The U.S. government rang up another $669 billion in the national debt from January 20, 2021 through the end of its 2021 fiscal year. That’s how much extra money the federal government has had to borrow to support its excessive spending during President Joe Biden’s tenure in office.

Much of that additional debt is because of new spending President Biden approved. Political Calculations describes how the national debt has grown and who’s willing to loan money to the Biden-Harris administration:

When Joe Biden was sworn in as President of the United States on 20 January 2021, the U.S. national debt had reached $27.8 trillion. Through the end of the U.S. government’s fiscal year on 30 September 2021, the total public debt outstanding increased to $28.4 trillion.

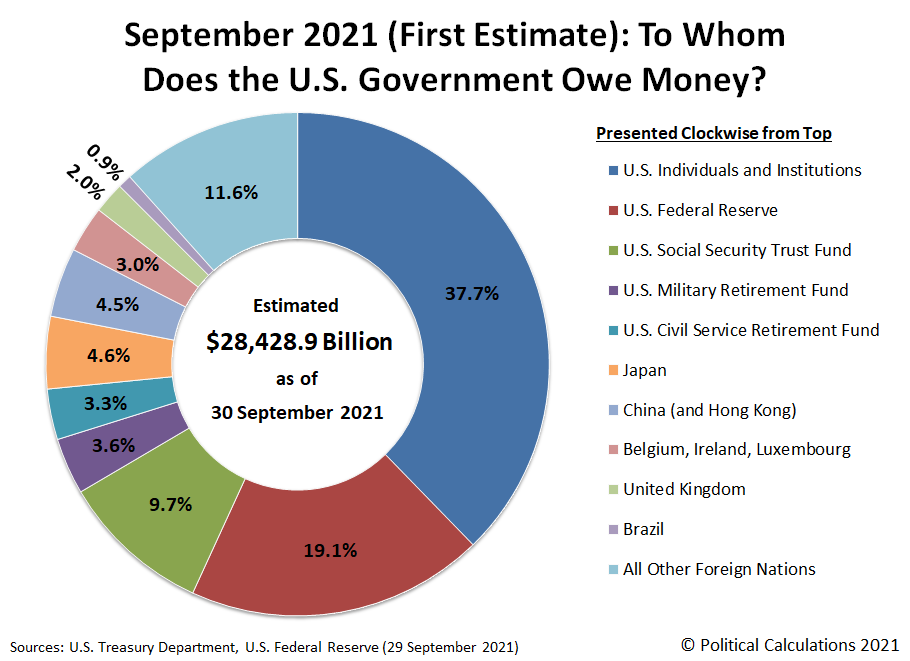

The chart below shows the national debt and indicates the share loaned to the U.S. government by its biggest creditors:

Who is loaning money to the U.S. government?

Here’s the description of who the U.S. government’s biggest creditors are and how much they’re loaning to it:

Once again, the U.S. Federal Reserve is Uncle Sam’s largest single entity creditor, outranking its former top creditor, Social Security’s Old Age and Survivors Insurance Trust Fund, by a widening margin. That margin is widening because Social Security is running in the red, which means it has to cash in its holdings of U.S. Treasuries to keep paying benefits to Social Security beneficiaries at promised levels.

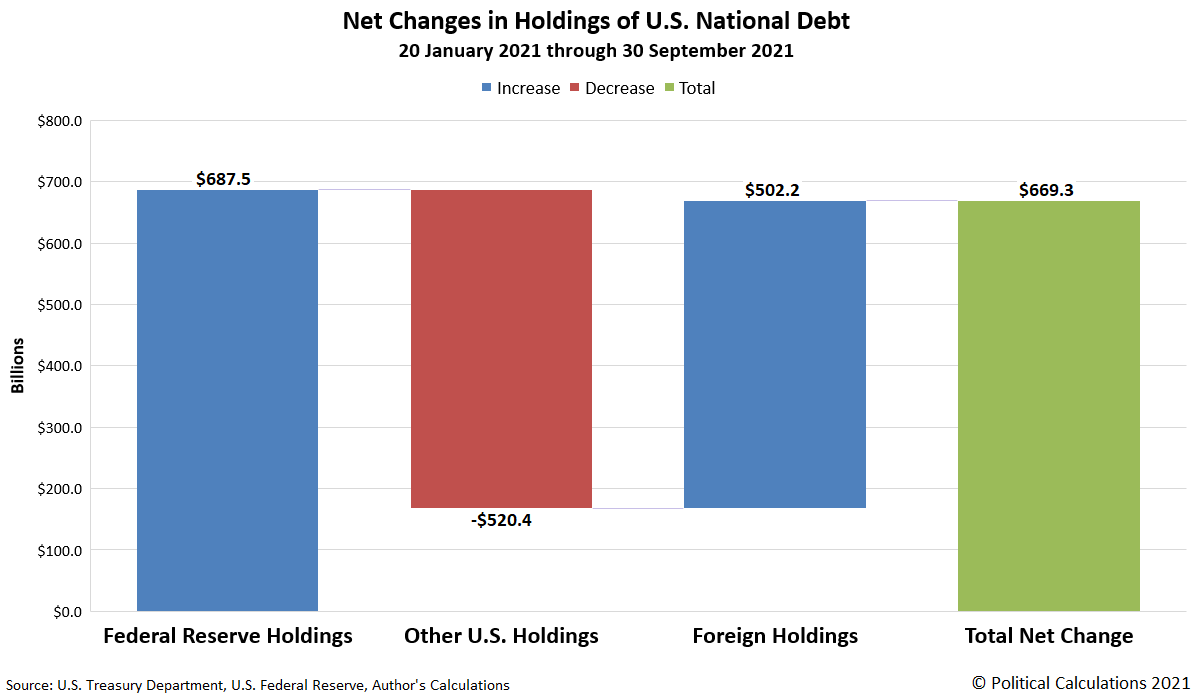

But what is really remarkable is the extent to which the U.S. Federal Reserve is funding the U.S. government’s spending above and beyond what it collects in taxes that has taken place during Joe Biden’s tenure in office. Since 20 January 2021, the U.S. national debt has increased by $669.3 billion, but the U.S. Federal Reserve’s holdings of U.S. government-issued debt securities has increased by $687.5 billion.

That’s possible because the U.S. Federal Reserve has more than offset a net reduction of $520.4 billion in the amount of money other U.S. entities have loaned to the U.S. government during this time. At the same time, foreign entities have boosted the amount of money they’ve loaned to the U.S. government by $502.2 billion, which when combined with the other figures, accounts for the overall net change since 20 January 2021.

Making the net changes add up

The next chart shows how these net changes fit together to account for the $669 billion increase in the national debt since January 20, 2021:

The next point drives home how the Federal Reserve has become the 800-pound gorilla financing the U.S. government.

As of the end of the U.S. government’s 2021 fiscal year, the Federal Reserve had loaned nearly one out of every five dollars the U.S. government owed through the end of September 2021.

At what point do you suppose whoever runs the Fed will start spelling out how much money the U.S. government may borrow and spend? If the Federal Reserve is genuinely independent of the U.S. government, that could happen.

How long do you suppose the independence of the Federal Reserve will last when whoever is in the White House decides they need to borrow even more? What’s to stop someone with President Biden’s spending ambitions from putting people willing to comply with his wishes in at the Fed to keep his money train going?

We’ve seen that show before, with President Nixon and Federal Reserve Chair Arthur Burns in the 1970s. We got a decade of high inflation and a stagflating economy to show for it. Are we seeing a repeat of those corrupt policies today in the Biden era?