Lawrence J. McQuillan • Friday, January 15, 2016 •

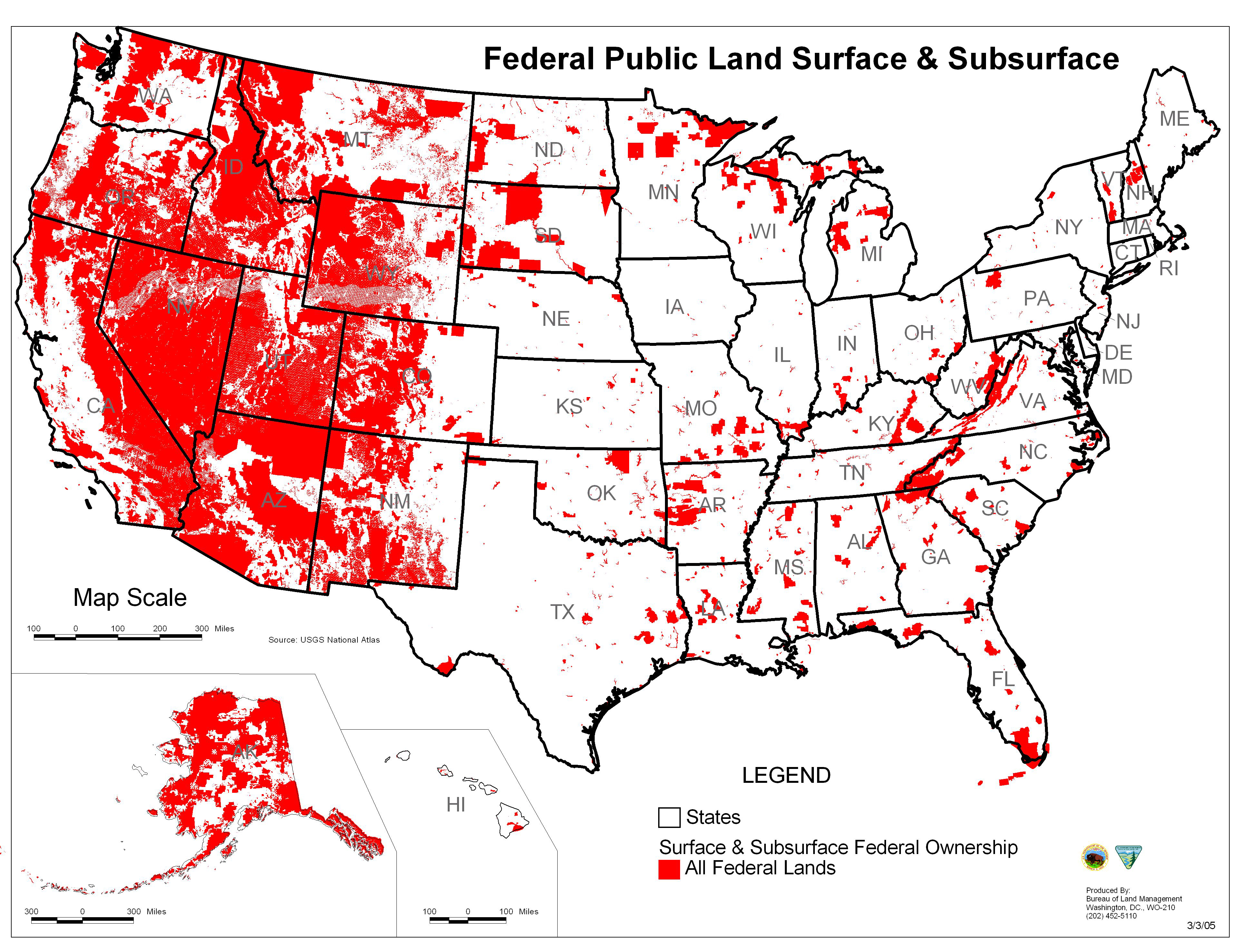

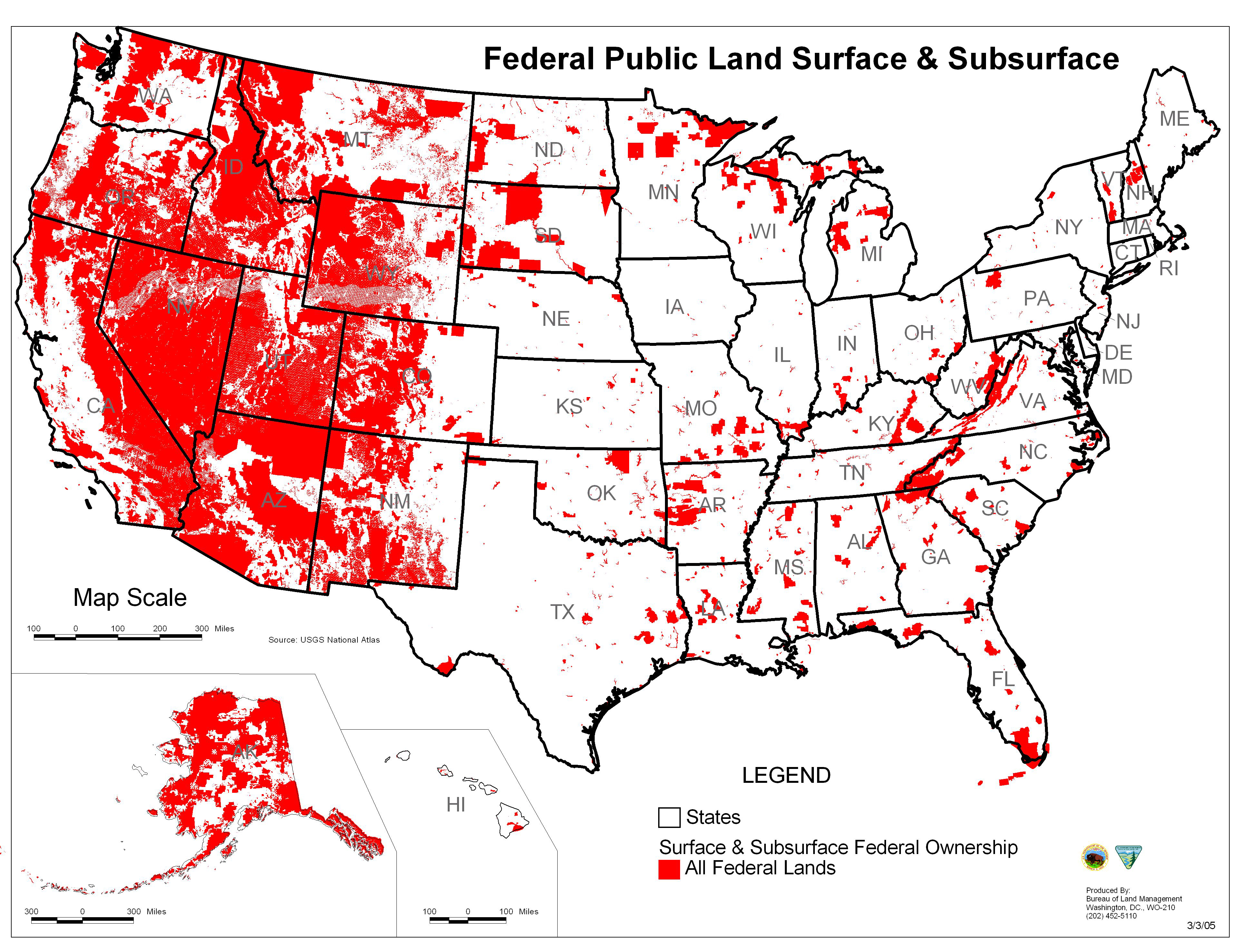

In a recent New York Times commentary titled “Give States Control Over Public Land Out West,” Robert H. Nelson wrote: “The federal government owns almost half the land in the American West—even California is some 46 percent federal land.” Here is what surface and subsurface federal ownership looks like on a map.

The theory behind federal land ownership, as Nelson noted, was that the feds would manage land “more efficiently” and by “the best experts.” But time has proven this to be untrue. Federal agencies that manage public lands such as the U.S. Forest Service and the Bureau of Land Management have been stuck in the quicksand of political gridlock and bureaucratic paralysis that prevent them from addressing quickly and effectively critical concerns of forest health such as wildfires and invasive species.

Randall G. Holcombe • Friday, January 15, 2016 •

The Obama administration announced that they were going to invest $4 billion in self-driving cars. Why? Private firms have already developed self-driving cars, and although none are available for purchase now, they are on their way with or without government involvement.

Is this really a good use of our tax dollars? What investments can the government make here for the benefit of American taxpayers?

Transportation Secretary Anthony Fox says, ” the government would remove hurdles to developing autonomous vehicles and set further guidelines for them within six months.” Getting government out of the way of self-driving cars seems like a good idea, but should this cost $4 billion? And as for setting further guidelines, imposing regulatory costs on the industry seems counterproductive.

Why not let the industry proceed, as it has been doing, without government interference?

This seems like a case of somebody in the Obama administration seeing what’s ahead and wanting to get in on the ground floor after most of the superstructure has already been built.

John R. Graham • Thursday, January 14, 2016 •

The “slacker mandate” is the provision in Obamacare requiring employer-based health plans to offer benefits to adult dependents of their workers, up to age 26. I have discussed research showing that the mandate reduced work among adults, aged 19 to 26, and increased the time they spend socializing, sleeping, and exercising.

What about the financial costs of the mandate? Speak to an insurance agent or benefits consultant and they will tell you the cost are fully borne by working parents.

In the old days, employer-based health insurance was offered to workers in three sizes: single, couple, or family. It did not matter how many kids you had. Today, each dependent adds to the premium. So, the “slacker mandate” is paid for by the working parents. That is not really a problem for society.

However, it invites the question: Why mandate slacker coverage? Parents were always free to help their adult children pay for health insurance, just like they can help with rent or car loans. The only government-imposed discrimination was the tax exemption of premiums paid for minor children on a parent’s employer-based health plans; if a parent wanted to buy health insurance for an older dependent, he had to use after-tax dollars.

Abigail R. Hall • Thursday, January 14, 2016 •

In college, I read a short story titled “Harrison Bergeron.” The piece was written by Kurt Vonnegut, Jr., in 1961, and published in The Magazine of Fantasy and Science Fiction. That piece was eye-opening for me, and pushed me to think about the world, particularly government policies, in a different way.

In college, I read a short story titled “Harrison Bergeron.” The piece was written by Kurt Vonnegut, Jr., in 1961, and published in The Magazine of Fantasy and Science Fiction. That piece was eye-opening for me, and pushed me to think about the world, particularly government policies, in a different way.

In the piece, Vonnegut takes readers to the year 2081. In the story, the U.S. Constitution has been amended so that citizens are “fully equal.” That is, no one is allowed to be more attractive, smarter, or able-bodied than anyone else. These laws, enforced by the “Handicapper General,” require citizens to endure a variety of impediments so as to level the playing field. Those who are above average intelligence have radios in their heads to distract them with loud noise. Heavy weights adorn those with strength. Those who are aesthetically pleasing wear bags over their heads.

Harrison Bergeron, the title character, was taken away from his parents by the government. Some time later, as his parents watch a ballet on tv (the dancers all weighed down, of course), a news report states their son has escaped from prison. Harrison enters the nationally televised ballet in an attempt to overthrow the government. He removes his impediments as well as those of the lead female dancer. (I won’t spoil the ending.)

Vonnegut’s work was one of obvious satire regarding authoritarianism and the dangers of egalitarianism. Vonnegut died in 2007, but it’s safe to say that his nearly 55-year-old satire is still painfully valid nearly a decade after his death.

Alvaro Vargas Llosa • Wednesday, January 13, 2016 •

Sean Penn’s meeting with Mexican drug lord Joaquín “El Chapo” Guzmán—conducted for an interview in Rolling Stone magazine—has triggered intense debate. Should Penn be prosecuted for being in secret contact with a fugitive from justice?

The discussion raises familiar questions: Is a journalist guilty of aiding and abetting a known criminal by not revealing his whereabouts to the authorities? Is a journalist who meets with a lawbreaker interfering with the course of justice?

Penn has a penchant for the so-called third world, sometimes of a noble kind and sometimes not, as when he uses his fame to legitimize dictators. His piece on Guzmán in Rolling Stone is less sexy than one would expect—it says more about Penn than about the drug lord himself. But Penn’s sometimes questionable politics, his debatable flair as an interviewer, and the fact that he is not a full-time journalist are no grounds for prosecuting him.

Otherwise hundreds of journalists would have been prosecuted for interviewing terrorists who were on the run. Osama Bin Laden spoke to Robert Fisk, Peter Arnett, John Miller, and Rahimullah Yusufzai while in hiding. None of them were sent to prison.

Mary L. G. Theroux • Tuesday, January 12, 2016 •

You know what happens when the government “requests” information from me as an employer, business or property owner, or taxpayer, and I don’t respond within their deadline?

My bank account is seized, my property is seized, and I am thrown into jail.

You know what happens when the State Department (or any other government employee or agency) fails to respond to a request for information as required by law?

It gets more personnel and a bigger budget.

From this recent, “Inspector General Faults State Department’s Handling of Hillary Clinton’s Records: Department Repeatedly Fell Short of its Obligations under the Freedom of Information Act, Internal Watchdog Finds:”

The State Department’s internal watchdog found that the department gave “inaccurate and incomplete” answers to groups seeking access to former Secretary of State Hillary Clinton’s records.

In a statement, the department acknowledged shortcoming in its information-management practices and vowed to accept the inspector general’s recommendations on improving the process. “We know we must continue to improve our FOIA responsiveness and are taking additional steps to do so,” State Department spokesman John Kirby said.

Mr. Kirby also pointed to Secretary of State John Kerry’s appointment of a transparency coordinator last year, as well as additional staff resources that are being added to the department to help manage its load of FOIA requests. [emphasis added]

John R. Graham • Tuesday, January 12, 2016 •

The Kaiser Family Foundation and the New York Times have published the results of a survey of Americans, aged 18 through 64, which questioned respondents about their troubles paying medical bills. What is most interesting about the survey, which was conducted in September 2015, is that it shows no change in the proportion of people with trouble paying medical bills versus a similar survey from 2005, which surveyed all adults.

That is, despite a large decrease in the proportion of working-age people categorized as “uninsured” (even though many have actually become dependent on Medicaid, a joint state-federal welfare program, instead of actual insurance) one-quarter of us still have trouble paying medical bills.

- In 2015, 15 percent spent “all or most” of their savings on medical bills. In 2005, it was 12 percent.

- In 2015, 10 percent “borrowed money from friends or family” and nine percent “increased credit card debt.” In 2005, eight percent reported “borrowing money or taking out another mortgage.”

- In 2015, 32 percent “put off/postponed getting health care you needed.” In 2005, 29 percent of adults report “they or someone in their household skipped medical treatment, cut pills, or did not fill a prescription in the past year because of the cost.”

- In 2015, three percent declared personal bankruptcy because of medical bills, the same as 2015.

Robert P. Murphy • Monday, January 11, 2016 •

As of this writing, the record-breaking Powerball official jackpot is some $1.3 billion, though this is misleading because a winner taking the lump-sum option would receive a check for “only” $806 million. With such a huge pot, many articles and blog posts are popping up, telling people that it actually makes financial sense to play the Powerball this particular time. However, many of these analyses completely overlook the role of other people playing, and even those that consider this factor tend to treat it as a fixed number. In reality, the best baseline result is to say that the bigger the jackpot grows, the more people who will play and hence the game once again takes on negative expected value. If you want to play for the psychic thrill, go ahead, but don’t let some quick arithmetic convince you that you’re making a savvy investment.

With the version of the Powerball game in place since October 2015, the probability of randomly picking the winning number is 1-in-292.2 million. If the cash lump-sum payout is $806 million, then one might calculate the expected value of a single ticket at about $2.75. If we factor in federal income taxes, the value of the ticket appears to be closer to $1.70. Since a Powerball ticket costs $2, we’re still in negative expected value territory.

However, these calculations overlook a crucial point about incentives: Even if the jackpot grew large enough to truly make such exercises yield a positive expected value, then that would induce people to buy more tickets. It would be quite foolish to rely merely on the results of a calculator, since there are presumably other people in the country capable of using a calculator as well.

Randall G. Holcombe • Monday, January 11, 2016 •

This article in USA Today is headlined, “El Salvador: World’s New Murder Capital.” El Salvador’s murder rate is 104 per 100,000 population, and as the article notes, this is a national average. “If you start looking at where the pockets of violence are, it’s shocking.”

Why are things so bad in El Salvador? The article says, “All countries south of the U.S. border face the same problem: cartels and gangs fighting to control smuggling of drugs and people to the United States and infiltrating government institutions to help them.”

It should be difficult for Americans to support domestic policies that have such pernicious effects overseas.

The effects spill over at home too. The article says, “The surge in violence explains why thousands of Salvadorans and other Central Americans have fled to the United States and why immigration officials are stepping up efforts to send them back home.”

The drug war clearly compromises individual liberty at home. Freedom has no meaning if people are only free to engage in activities that meet with government approval. I could list a host of other negative consequences stemming from the war on drugs, but I will save that for another time, to emphasize how our domestic policies have had such negative consequences for our neighbors.

John R. Graham • Monday, January 11, 2016 •

The health insurance industry is undergoing a crisis of consensus on how to respond to the failure of Obamacare. That is the only way to interpret the departure of another large, national carrier, Aetna, from America’s Health Insurance Plans (AHIP). This follows UnitedHealth Group’s departure from the industry’s trade group last June:

Those misgivings manifested most recently during the debate over ObamaCare when the so-called “big five” — UnitedHealthcare, Anthem, Aetna, Humana and Cigna — formed their own informal coalition.

Another healthcare executive, who asked for anonymity in order to speak freely, said that, for some, “there’s a sense that AHIP has become a one-trick pony for the Obama administration,” referring to the goal of advancing ObamaCare.

With the country’s first- and third-largest health insurers gone from its ranks, the insurance group could see problems arise from the divisions between large and small companies.

(Peter Sullivan & Megan R. Wilson, “Aetna departure a major blow for insurers group,” The Hill, January 5, 2016).

Insurers are losing money in Obamacare’s exchanges. The Republican-majority Congress has refused to bail them out of their Obamacare losses. On the other hand, they clearly have influence in the Congress, because last December a bipartisan majority gave the industry one-year relief from its Obamacare excise tax (which is passed on to consumers and employers anyway).

In college, I read a short story titled “

In college, I read a short story titled “