In his first State of the State address, California Governor Gavin Newsom announced that he is ending the state’s high-speed rail project, also known as the “bullet train,” because it “would cost too much and take too long” to build. Recent estimates peg the cost at $77 billion but the true figure would surely be much higher. Recall the new span of the Bay Bridge, ten years late, $5 billion over budget, and still riddled with safety issues. Even if built, the bullet train would be more expensive and slower than air travel, so it was all about spending and building up government. Taxpayers might note how High-Speed Rail boss Brian Kelly responded to the governor’s announcement: “The Governor has called for setting a priority on getting high-speed rail operating in the only region in which we have commenced construction—the Central Valley. We are eager to meet this challenge and expand the project’s economic impact in the Central Valley.”

As Fox News reports, New York Democrat Andrew Yang, eyeing a White House run in 2020, is touting a plan for “universal basic income.” In this deal, the government would give $12,000 a year to each American adult. Where will this money come from? Yang wants a “value-added tax, known as a VAT,” of 10 percent that he claims would raise $700-$800 billion. This scheme deserves a hard look.

Though touted as “value added,” the VAT fails to add any value to anything. All it does is jack up the price consumers pay at point of purchase. Under Yang’s plan, a California consumer buying a new Toyota would be looking at the state sales tax in the neighborhood of 8 percent, plus an additional 10 percent. So the VAT is higher than the sales tax, now highest in the nation. California’s sales tax was once much lower, so consumers could expect a rise in the VAT, perhaps to 15 percent, as it is in several Canadian provinces.

The Transportation Security Administration has been around for only 17 years, but it is something of a prodigy when it comes to bad behavior among bureaucrats. Government Exec magazine first described the problem of TSA managers becoming the “biggest bullies in government” over two and a half years ago:

A toxic culture and poor management are causing a mass exodus of Transportation Security Administration employees, lawmakers and agency whistleblowers said during a congressional hearing Wednesday.

Senior leadership at the agency has made a practice of hiring managers with no experience and few skills, three TSA employees told members of the House Oversight and Government Reform Committee. The employees cited repeated examples in which they were retaliated against for highlighting wrongdoing at the agency, which they said were emblematic of a widespread problem that has cultivated a fearful workforce.

Last month, freshman New York Rep. Alexandria Ocasio-Cortez, 29, pitched a proposal for a 70 percent marginal tax rate on incomes of $10 million and beyond. In similar style, Vermont socialist Bernie Sanders seeks to escalate the estate tax and Sen. Elizabeth Warren, a candidate for president, wants an “ultra-millionaire” surtax on wealthy families. Soaking the rich is not a new tactic but some of the nuances may have escaped notice.

Jacking up the marginal tax rate to 70 percent comes packaged as a “progressive” move but in reality, it’s punitive. Those who earn at high levels find themselves punished with higher taxes. Those who earn in the millions tend to draw their income from investments, businesses and such. Promoters claim that punitive marginal tax rates will exempt the working class but workers have problems of their own.

Two years ago, readers may recall, the concrete spillway of the Oroville Dam failed, launching fears of complete dam failure and forcing the evacuation of 188,000 people. Governor Jerry Brown told reporters he was unaware of warnings about the emergency spillway and added, “I’m glad we found out about it.” As Brown explained, “We live in a world of risk. Stuff happens and we respond.” One of the government’s first moves was to dam up the flow of information on safety issues.

Governor Brown and state water bureaucrats blocked access to the dam’s design specifications, federal inspection reports, technical documents, and other crucial information. Much of that emerged in Independent Forensic Team Report: Oroville Dam Spillway Incident, a 584-page report that chalks up the disaster to “a complex interaction of relatively common physical, human, organizational, and industry factors, starting with the design of the project and continuing until the incident.” In addition, the designer of the spillway “was hired directly from a university post-graduate program, with prior engineering employment experience limited to one or two summers.” And the designer had “no prior professional experience designing spillways” and “no instruction on spillway design” in college coursework. So little wonder that the spillway failed.

At this writing, the U.S. national debt has nearly reached $22 trillion, rising by nearly $500 billion since the U.S. government’s 2018 fiscal year ended on September 30, 2018.

But to whom does the U.S. government owe all that money? Here’s an answer to that question, as if it were asked before the U.S. government’s 2019 fiscal year began.

From the end of its 2017 fiscal year to the end of its 2018 fiscal year, the U.S. government’s total public debt outstanding increased by $1,271 billion, or $1.3 trillion, to reach a total of $21,516 billion, or $21.5 trillion. Put a little bit differently, the U.S. national debt grew at an average rate of nearly $3.5 billion per day on every day of the government’s 2018 fiscal year.

That’s a very large number, but 2018 was only the sixth largest annual increase for the U.S. national debt in terms of nominal U.S. dollars. Larger increases were recorded during President Obama’s tenure in office in 2012 ($1,276 billion), 2010 ($1,294 billion), 2011 ($1,300 billion), 2009 ($1,413 billion), and 2016 ($1,423 billion).

So it’s not an accident that the U.S. national debt has risen to $21.5 trillion, where these six years combined account for 37% of the official U.S. national debt. But to whom does the U.S. government owe all that money?

The following chart breaks down who the U.S. government’s major creditors were at the end of its 2018 fiscal year, which is based on preliminary data that will be revised in upcoming months.

As crisis conditions grow in Venezuela, Russia appears to be increasingly involved in propping up Nicolas Maduro. Maduro’s presidency is being challenged by Juan Guaido, who claims to be the legitimate interim president. Political leaders in the US have expressed solid support for Guaido, while Russia, Cuba, and, it appears, China are pouring resources (mostly, military resources) into Venezuela to help Maduro retain power.

Russia’s support of Maduro is draining resources from their country to support an authoritarian regime ruling over a failed economy. Russia bears the cost, but for little apparent benefit.

One benefit is that they get Venezuelan oil, but Russia already has a lot of oil. Putin also wants to appear to project power in the Americas, but realistically, there is little power in propping up an authoritarian ruler in a failed economy that will require an increasing resource commitment over time.

Those of you who regularly visit my Facebook page or see my posts at The Beacon blog may recall that I have posted from time to time about Lucio, my hero and savior.

His heroism pertains to his dedicated entrepreneurship in the service of the consumer (that’s where I come into the story, as a purchaser of the fruits, vegetables, and assorted other foodstuffs he brings to my gate three times each week from markets more than a hundred miles away).

His salvation has nothing to do with my immortal soul, but everything to do with my mortal body, which, thanks to him, I am able to nourish regularly with high-quality food.

A few days ago, in response to our special request, he brought something we had never bought from him before: a substantial portion of carnitas (a dish akin to pulled pork in the USA), along with some serious salsa picante and a bag of delicious pico de gallo. I used the tortillas I had on hand to make these ingredients into two outstanding tacos for my lunch that day, and I ate more of the meat with boiled eggs for dinner. I still had enough left for another two or three nice meals. And the price was certainly affordable.

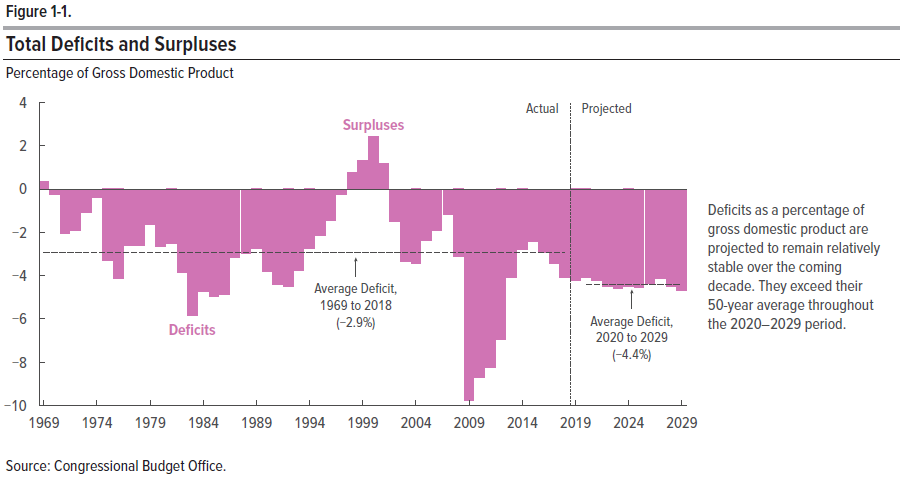

The Congressional Budget Office has issued its Budget and Economic Outlook for 2019 through 2029, where it projects that for the next 10 years, the U.S. government’s spending and tax collections will each grow at an average annual rate of 5 percent a year.

What’s the problem with that? To put it bluntly, it’s the spending, which starts out at a level 23 percent higher than the federal government’s revenues. That means Americans can expect the government’s budget to bleed red ink in deficits for the next decade, a point that’s brought home by the very first figure featured in the CBO’s report.

In 2018, the overall cost for Americans to comply with regulations issued by U.S. government agencies decreased for the first time since that burden began to be measured in 2005. But that achievement wasn’t an across-the-board success story, because one federal government department bucked the trend by greatly increasing the regulatory burden on American food producers, where the cost of complying with new regulations issued by the U.S. Department of Agriculture (USDA) will ultimately be paid by all Americans whenever and wherever they might shop for food.

The new regulation is the National Bioengineered Food Disclosure Standard (NBFDS), which was imposed by the USDA on December 20, 2018, just ahead of the partial federal government shutdown, which Henry Miller, the founding director of the Food and Drug Administration’s Office of Biotechnology, and Drew Kershen, a law professor at the University of Oklahoma, have described as the USDA’s “most bewildering, least cost-effective regulation ever” in a recent op-ed in the Wall Street Journal.