The Fastest Growing Category of Government Spending

Let’s play a game. What do you think the fastest growing category of spending for the U.S. government will be over the next 30 years?

Here are your choices:

- Social Security

- Medicare

- Medicaid, Children’s Health Insurance Program (CHIP), Obamacare Subsidies

- Net Interest on the National Debt

- Everything Else

While most of these categories are self-explanatory, the Everything Else category includes all the budget items the U.S. Congress sets annually. It includes things like national defense, emergency pandemic spending, welfare, et cetera.

Are you ready for the answer? Here it is:

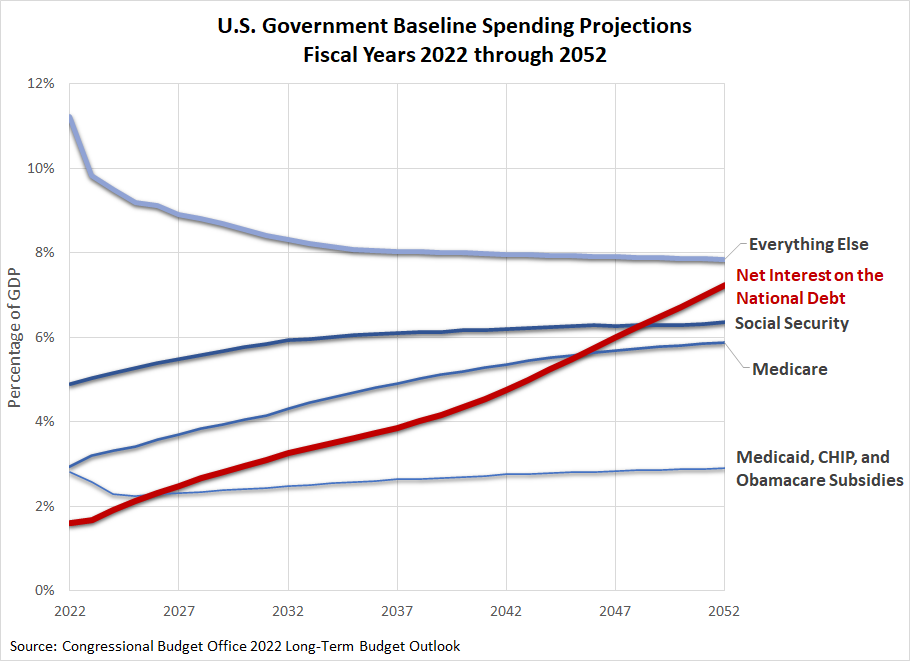

This data comes from the Congressional Budget Office’s 2022 Long Term Budget Outlook. The CBO identifies net interest on the national debt as what will be the fastest growing category of government spending for the next 30 years.

As you can see, Net Interest on the National Debt will grow larger than Medicaid, Child Health Insurance Program (CHIP), Obamacare Subsidies in 2026, Medicare in 2046, and Social Security in 2048. Assuming it continues growing as fast as the CBO shows, it will grow larger than all other government spending in 2054.

Net Interest on the National Debt

The CBO explains what will make net interest on the national debt grow so much faster than every other category:

Over the past 50 years, the government’s net interest costs have ranged from 1.2 percent to 3.2 percent of GDP, averaging 2.0 percent of GDP. In CBO’s projections, net interest costs are 1.6 percent of GDP in 2022. By 2032, those costs double, reaching 3.3 percent of GDP, as federal debt grows and interest rates rise. Net interest costs continue to rise thereafter, reaching 7.2 percent of GDP in 2052. They would be higher in that year than spending on Social Security, discretionary spending, or all mandatory spending other than that for the major health care programs and Social Security—and higher than at any time since at least 1940 (the first year for which the Office of Management and Budget reports such data).

The increase in interest payments is the result of escalating interest rates and the rising level of debt. CBO estimates that the increase in interest rates accounts for about one-half of the projected growth in net outlays for interest over the 2022–2052 period.

The CBO projects that the average interest rate the U.S. government pays its creditors will rise because of inflation. Here’s how they see those interest rates changing from 2022 through 2052:

The average interest rate on federal debt in CBO’s projections increases from 1.8 percent in 2022 to 3.1 percent in 2032 and to 4.2 percent in 2052.

Inflation does a lot more than affect the amount of net interest the government must pay on the national debt. It also affects the revenue side of the U.S. government’s fiscal situation. I’ll have more to say about that soon!