Who Are the U.S. Government’s Biggest Creditors?

With almost $22.5 trillion in debt, the U.S. Treasury Department has a tough job in sorting out just who has loaned money to the federal government.

That’s because around 30 percent of all the money the government borrows comes from overseas, where the amount of U.S. government-issued debt reported to be held in a given country may partially represent money that was loaned to the U.S. government by another country altogether. For example, over the years, China has loaned money to the U.S. government through international banking centers in the United Kingdom, Belgium, and Ireland, to name just a few.

It takes time for the Treasury Department to determine how much of the U.S. national debt is actually held by interests in each country. Until that accounting is completed, it looks like the countries whose financial institutions are acting as intermediaries for others are holding much more of the U.S. government’s total public debt outstanding than they really do.

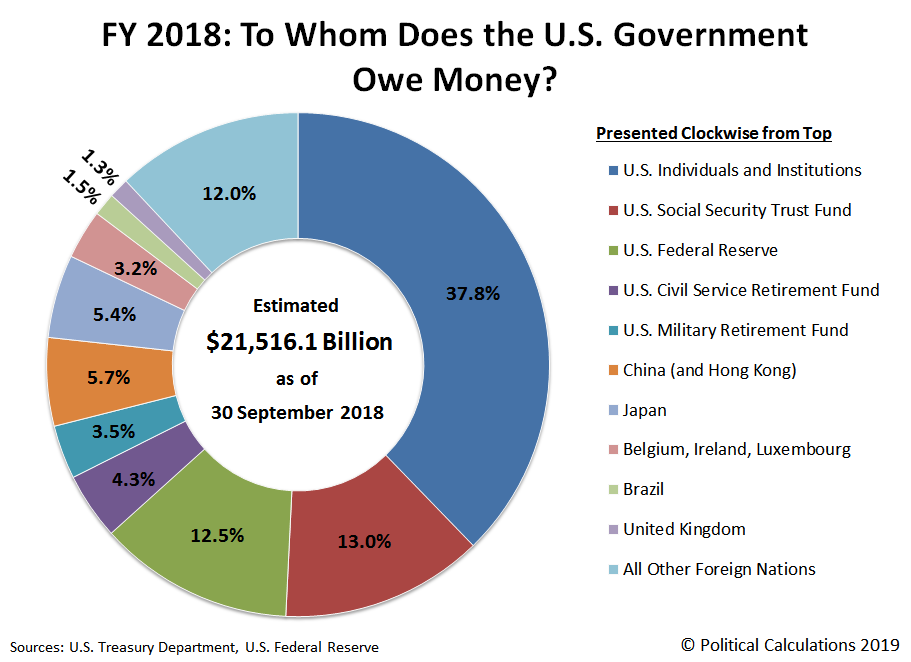

The Treasury Department has recently revised and updated its estimates of who the U.S. government has borrowed from for its 2018 fiscal year. The chart below shows the federal government’s largest creditors.

Here is Political Calculations’ analysis of whom the U.S. government owes money:

Overall, 70% of the U.S. government’s total public debt outstanding is held by U.S. individuals and institutions, while 30% is held by foreign entities. For FY2018, China has retained its position as the top foreign holder of U.S. government-issued debt, with directly accounting for 5.7% between institutions on the Chinese mainland and Hong Kong, even though the country has been reducing its holdings of U.S. government-issued debt.

Japan ranks as the second largest foreign holder of the retirement, with the U.S. owing Japanese institutions 5.4% of its total debt. After that, the European international banking centers of Belgium, Ireland, and Luxembourg combine to account for 3.2% of the U.S. national debt, followed by Brazil at 1.5% and the United Kingdom with 1.3%.

The largest single institution holding U.S. government-issued debt is Social Security’s Old Age and Survivors Insurance Trust Fund, which is considered to be an “Intragovernmental” holder of the U.S. national debt, and which holds 13.0% of the nation’s total public debt outstanding. The share of the national debt held by Social Security’s main trust fund has begun to decline as that government agency cashes out its holdings to pay promised levels of Social Security benefits, where its account is expected to be fully depleted in just 16 years. Under current law, after Social Security’s trust fund runs out of money in 2034, all Social Security benefits would be reduced by 23% according to the agency’s projections.

The largest single “private” institution that has loaned money to the U.S. government is the U.S. Federal Reserve which, like China, has been reducing its holdings of U.S. government-issued debt. At the end of September 2018, the Fed held 12.5% of the U.S. government’s total public debt outstanding. In FY2018, other U.S. institutions such as pension funds and insurance companies have significantly increased their holdings of U.S. government-issued debt as interest rates rose during that year.

The U.S. government’s 2019 fiscal year will come to an end on September 30, 2019. When it does, its total public debt outstanding is expected to be at least $960 billion higher than it was in its 2018 fiscal year.

As long as the U.S. government can keep finding people and institutions willing to loan it money at low interest rates, there’s very little that can stop it from continuing down its current fiscal path. If that changes, we can expect the U.S. government to engage in what financial analyst Wolf Richter described as “the giant sucking sound of financial repression.” This comes with huge costs to anyone trying to save for the future or who are counting on income from their pensions and investments in retirement.