Exploding Interest on the National Debt

The final numbers for the U.S. government’s spending and revenues during its 2024 fiscal year have finally come in. From October 1, 2023, through September 30, 2024, the U.S. government’s spending exceeded its revenues by $1.833 trillion.

That is the third-largest budget deficit ever recorded, and it occurred despite the federal government collecting a record amount of tax revenue during the year. The U.S. government’s total receipts were nearly $4.919 trillion, and its total outlays exceeded $6.751 trillion, the second-highest amount spent in U.S. government history.

Reuters provides some additional comparisons for how excessive the U.S. government’s spending was during its 2024 fiscal year:

The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

The fiscal 2023 deficit had been reduced by the reversal of $330 billion of costs associated with President Joe Biden’s student loan program after it was struck down by the U.S. Supreme Court. It would have topped $2 trillion without this anomaly.

Interest Owed on the National Debt

It’s almost impossible to understate how fast the amount of interest the U.S. government pays on its accumulated national debt is growing. That liability, through the end of the 2024 fiscal year, has grown to $35.465 trillion.

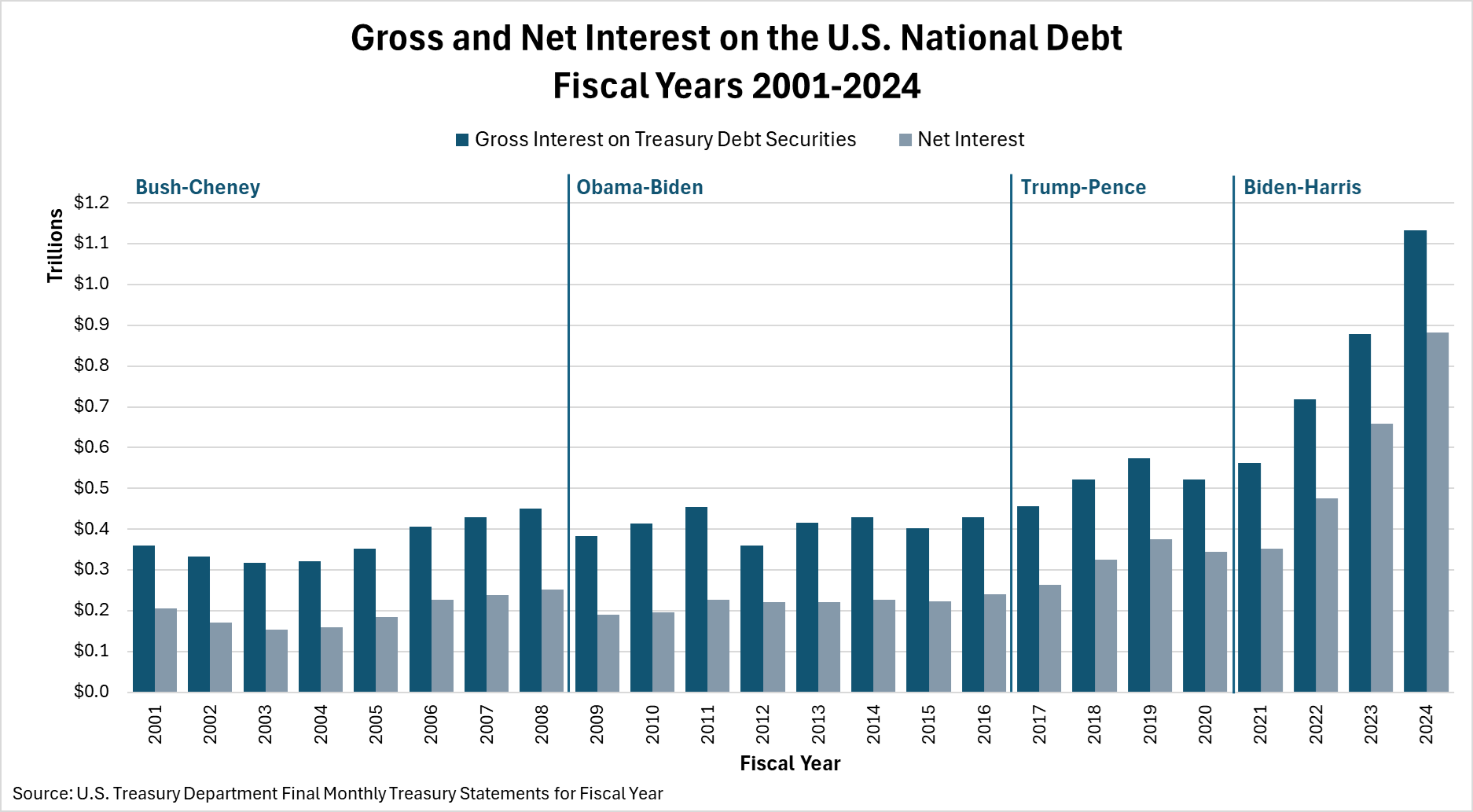

During FY 2024, the U.S. Treasury Department paid over $1.133 trillion in gross interest on its outstanding debt securities to the nation’s creditors. The federal government pays less net interest because it is offset by interest income it collects through the trust funds it operates and other sources. Even so, the federal government paid out nearly $882 billion in net interest.

Both these figures represent record-high numbers. The chart below shows how they compare with previous fiscal years from 2001 onward.

Reuters explains how big 2024’s gross interest number is:

The biggest driver of the year’s deficit was a 29% increase in interest costs for Treasury debt to $1.133 trillion due to a combination of higher interest rates and more debt to finance. The total exceeded outlays for the Medicare healthcare program for seniors and for defense spending.

Interest paid on the national debt isn’t an ordinary outlay. Unlike other expenditures, it must be paid out of the U.S. government’s revenues. The nation’s creditors will not accept an IOU when the debt they are owed comes due. When such a thing happens, it’s called a default. Lenders respond to that situation by making it even more costly for governments to borrow.

Paying the Interest It Owes

The Treasury Department circumvents that risk by using the cash it collects from taxes first to pay off debts it owes as it matures. Then, it borrows more to sustain the government’s excessive spending because it doesn’t have enough cash left to cover that cost. Because of this practice, the U.S. government’s creditworthiness is not determined by the national debt size but by its ability to service or pay back the money it owes.

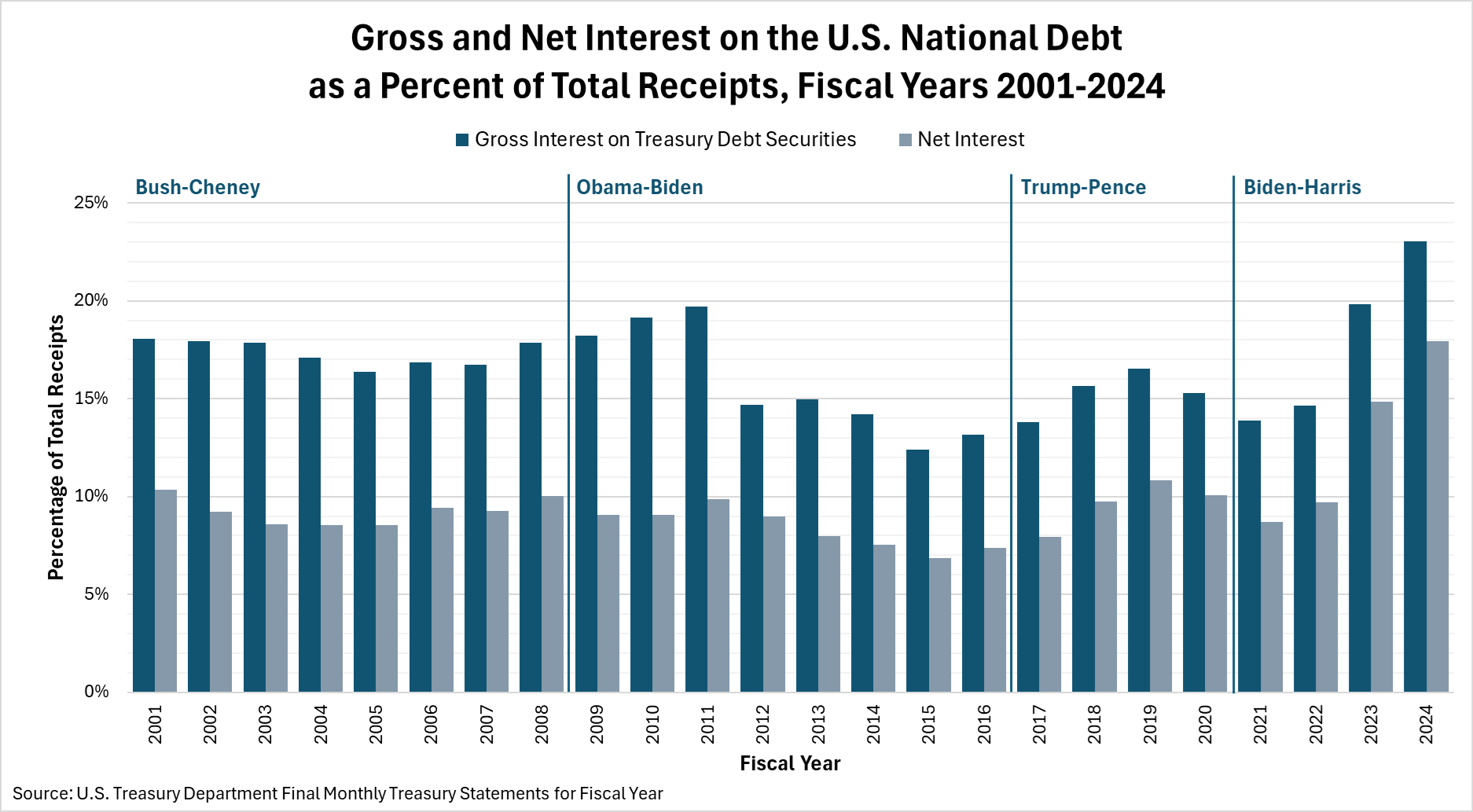

In FY 2024, 23% of the money the U.S. government collected was used to make the gross interest payments on the U.S. national debt. That is the most of any recent presidential administration going back to 2001, as you can see in the chart below:

These are both hockey stick charts. The fast inflation of the interest the U.S. government pays its creditors during the last few years represents the arrival of a fiscal crisis that national debt observers have long warned about. There will need to be a fiscal reckoning.