Off to a Bad Start

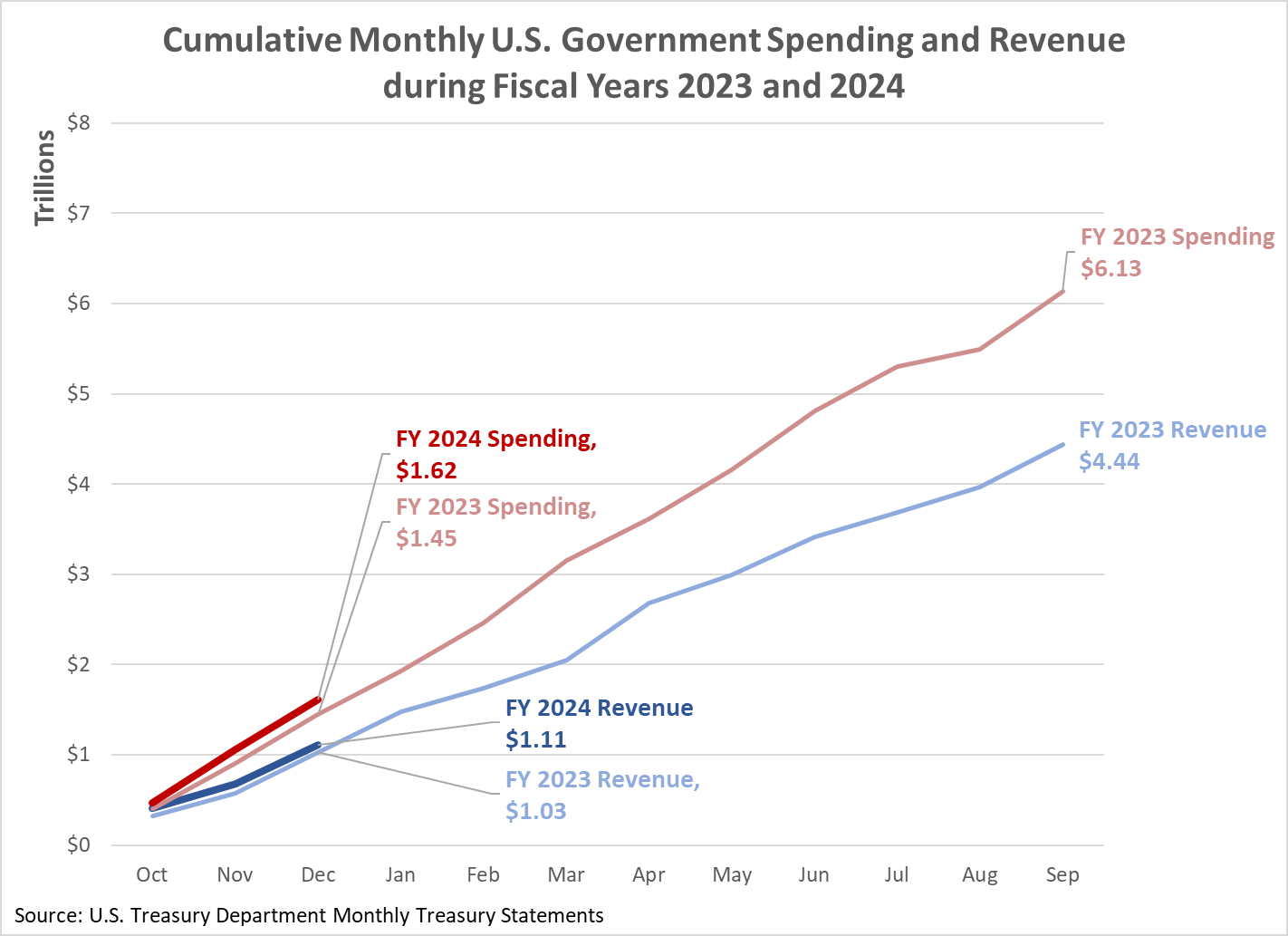

The U.S. government is off to a bad start for its 2024 fiscal year. Data published by the U.S. Treasury Department for the first three months of FY 2024 indicates the federal government’s spending is increasing considerably faster than its revenue.

Through December 2023, the government’s cumulative tax collections are up by $82 billion over what it collected through the same month in FY 2023. Unfortunately, spending rose even faster, increasing by $171 billion.

Just as unfortunately, these figures put the size of the gap between the federal government’s spending and revenue during the first three months of FY 2024 at $510 billion. That compares with a budget deficit of $421 billion during the first three months of its 2023 fiscal year. That is a 21% increase.

Tax collections have increased, but the budget deficit grew larger because government spending rose even faster.

What’s going wrong with the U.S. Government’s fiscal situation?

A month ago, analyst Michael Maharrey identified the source of the federal government’s fiscal problems:

The Biden administration blew through $588.84 billion in November, up 18% from November 2022. That pushed total spending to nearly $1.06 trillion through the first two months of fiscal 2024.

This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, the debt ceiling deal didn’t address that problem. Even with the new plan in place, spending will go up. No matter what you hear about spending cuts, the federal government constantly finds new reasons to spend more money.

This month, the editorial board of Issues and Insights has also weighed in on the cause of the U.S. government’s growing fiscal problems:

The current surge is entirely driven by out-of-control spending. Revenues are so far coming in slightly above last year’s but spending in the first quarter ballooned by $170 billion.

Spending on entitlement programs is up a relatively modest 4%. Defense spending is up 11%. Discretionary spending, however, is 23% higher so far this year than last – thanks in large part to Biden’s spending sprees.

But the real drain on the Treasury is the stunning rise in interest payments. So far in FY 2024, they are up by 50%.

How bad will it get?

When the Biden administration released its FY 2024 budget proposal, it projected its full-year deficit for FY 2024 would be over $1.8 trillion. It is on pace to exceed $2.0 trillion.

The real test will come in April as taxes for the income that Americans earned in 2023 come due. Because 2023 has been a better year for investments than 2022 was, the federal government should collect a lot more in both capital gains taxes and corporate income taxes than it did in April 2023. That boost will provide the government’s best chance to close the widening gap between its spending and revenue.

But only if its spending doesn’t grow faster in the meantime.