U.S. Government’s Credit Rating Takes a Hit

The U.S. Government’s credit rating has taken a hit this week. Fitch Ratings downgraded the federal government’s credit rating from AAA to AA+.

In taking that action, Fitch joins Standard and Poor in lowering its evaluation of the creditworthiness of the U.S. government. Standard and Poor lowered its assessment of the U.S. government’s credit rating from AAA to AA+ in August 2011.

Then, as now, the U.S. government’s debt burden was rapidly increasing. Fitch’s commentary about its action indicates they don’t see that situation improving in the near future.

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Fitch cites that the fiscal deterioration results from years of accumulated excessive spending funded by borrowing combined with the recent rapid increase of interest rates. From 2011 through 2021, the federal government had the benefit of near-zero interest rates. Those meager rates concealed the risk associated with a large and growing national debt. They made it seem affordable because politicians could borrow so cheaply.

That risk has exploded into full view as the Federal Reserve has steadily hiked interest rates to combat inflation unleashed by President Biden’s fiscal policies. But in addition to the new borrowing the government has undertaken to support its spending, it has also been rolling over its old debt at higher interest rates. Consequently, the government’s cost of supporting the national debt has exploded.

The Cost of the National Debt Explodes

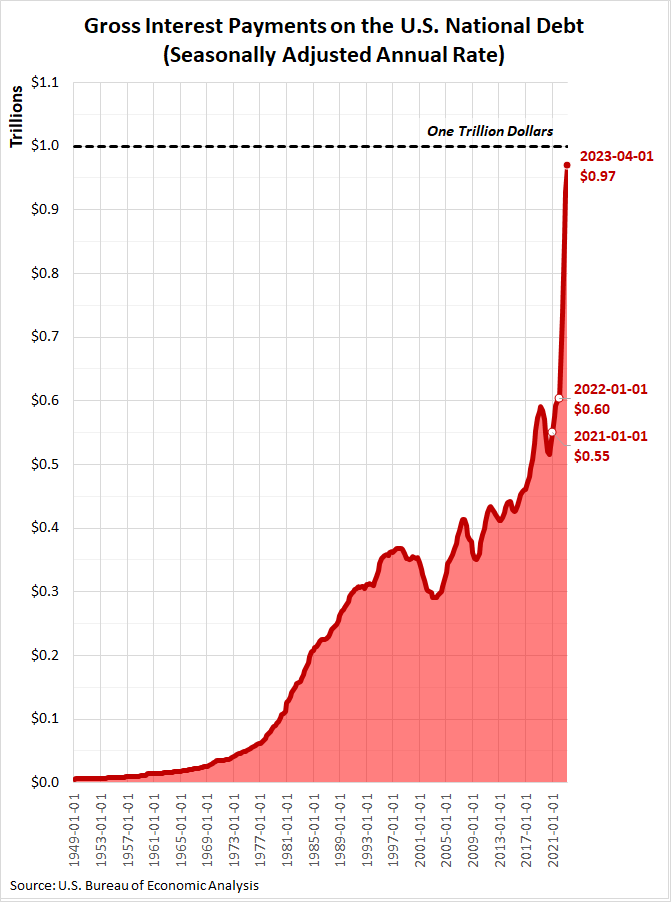

This explosion can be seen in the chart below, which shows the total interest payments the U.S. government has paid on its debts from January 1949 through April 2023.

The gross interest the U.S. government annually pays on the national debt will soon exceed $1 trillion. When it reaches $1.1 trillion, it will have doubled since January 2021.

Most of that increase has taken place since January 2022. This portion of the growth coincides with the Federal Reserve’s interest rate hikes, which started in March 2022 and have continued through July 2023.

Meanwhile, the U.S. Treasury Department announced plans to borrow over $1 trillion before the end of September 2023. That will combine new borrowing to fund new government spending and roll over older debt. All at higher interest rates.

Fitch cited the U.S. government’s excessive spending and the rising cost of paying interest on the national debt in its downgrade announcement:

We expect the general government (GG) deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022, reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.

There are three major credit rating agencies: Standard and Poor, Fitch Ratings, and Moody’s. Two of the three have downgraded the U.S. government’s credit rating. How long will it be before Moody’s joins them in stripping the U.S. government of its AAA credit rating?