CBO Sends Dire Fiscal Message in 2023 Long Term Budget Outlook

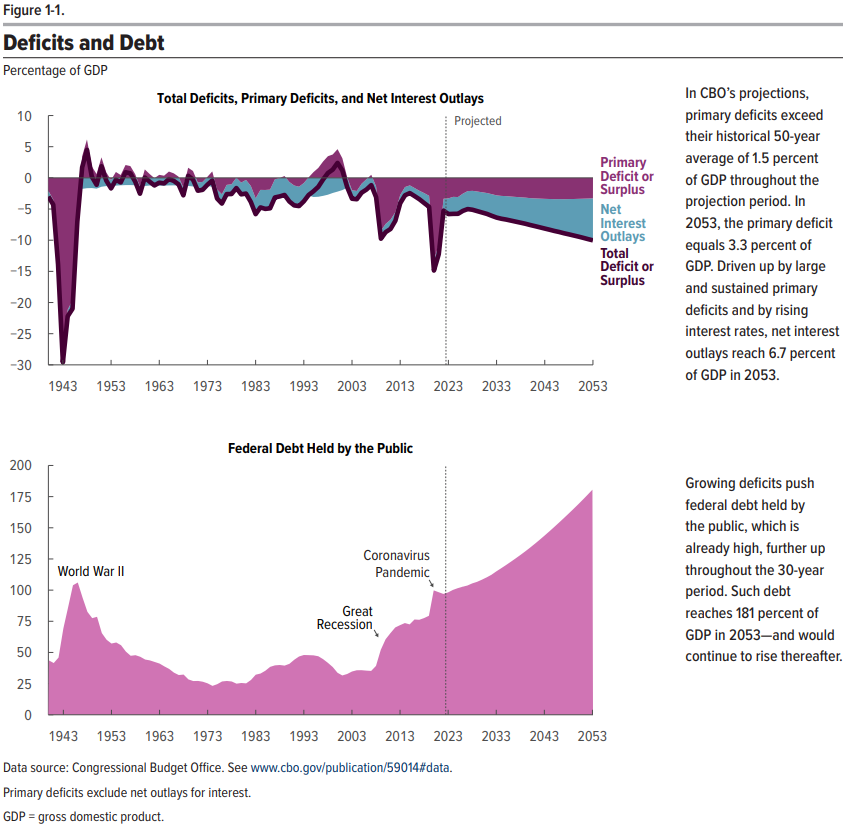

The Congressional Budget Office has released its 2023 Long-Term Budget Outlook. Within it, two charts stand out, which the CBO combined into one figure to convey its message.

Here it is:

What’s the message the CBO is sending? The U.S. government’s fiscal situation is getting worse. As the Washington Examiner’s Bruce Thompson reports, the CBO isn’t shying away from identifying the cause of the government’s fiscal problems:

What’s the message the CBO is sending? The U.S. government’s fiscal situation is getting worse. As the Washington Examiner’s Bruce Thompson reports, the CBO isn’t shying away from identifying the cause of the government’s fiscal problems:

The report clearly shows the country has a massive spending problem. The numbers reveal that the rising budget deficits are the result of record-high levels of spending and not due to lower tax revenue. The CBO states flatly that the “increase in the deficits results from faster growth in spending than in revenues.”

Spending is something that politicians have complete control over. Thompson calls the projected increase in spending “unparalleled in our history” before describing what the CBO foresees for the next thirty years:

Spending will increase from 25.2% of gross domestic product in 2022 to 29.1% in 2053, significantly higher than the average level of 21.0% over the past 30 years. Spending will average 25% over the next 10 years, an unprecedented level. The United States has exceeded 25% only during two national emergencies, World War II and the COVID-19 pandemic. Spending levels during the Vietnam War, the Great Society, the Reagan years, and the Great Recession were not even close to the spending levels projected over the coming years.

Revenue is also projected to reach historically high levels, increasing from 18.4% to 19.1% of GDP, higher than the 30-year average level of 17.2%. Over the last 80 years, revenue as a percent of GDP has exceeded 19% only eight times, and each time the high tax burden has led to an economic slowdown.

Slower economic growth is a major contributor to the deficit and debt problem. CBO projects real GDP to grow at only 1.7% a year over the next three decades, a prolonged period of slow growth we have never experienced. By comparison, real economic growth averaged twice that amount at 3.4% from 1983 to 2007.

But there is more bleak news. Take a second look at the top chart showing the CBO’s predicted growth of annual budget deficits from 2023 to 2053. It shows “Net Interest Outlays” will become the most significant contributor to the federal government’s ever-deepening deficits.

According to the CBO, “rising interest rates and mounting debt cause net outlays for interest to increase from 2.5 percent of GDP in 2023 to 6.7 percent in 2053.” That is a bigger increase than what the CBO expects major health care programs and Social Security combined will have over these years.

The U.S. government’s outsized debt is becoming a very big problem.