Tariff Truths

In a classic case of damning with faint praise, former President Donald Trump recently expressed his affection for Chinese President Xi Jinping, while threatening to engage in a trade war with China if he is reelected as President. In typical Trumpian style, he feted Xi as a smart, strong leader while also stating that while he is not specifically looking for a trade war, import duties even greater than the 60 percent he was previously reported as considering are completely on the table. An equitable fellow if ever there was one, Mr. Trump has also announced plans to ostensibly revitalize American manufacturing by levying a 10 percent tariff on imported goods across the board. This is hardly new, nor limited to Trump, as President Biden has maintained his predecessor’s duties on some $370 million worth of Chinese imports. Both national conservatives and liberal protectionists are dead wrong about tariffs and growth.

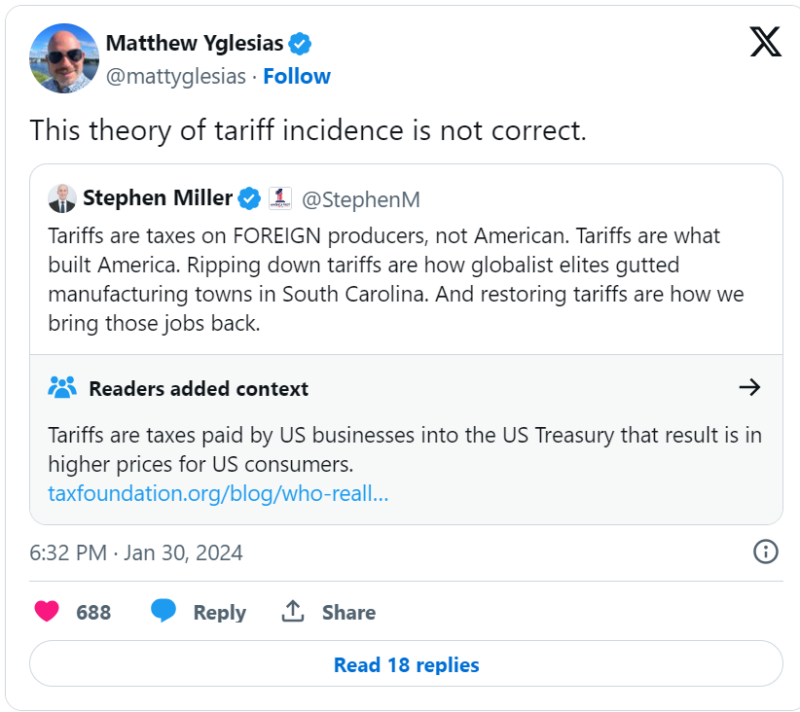

Mr. Trump’s apple-polishers have been out in full, touting tariffs as the key to recovering some mythical past of American greatness:

In addition to Mr. Miller, Oren Cass argues in favor of squeezing off exogenous competition to “vital industries” in the name of holding up positive trade balances as an end goal. Of course, trade balances really don’t matter, we’ve had them for decades and the economy continues to grow. Despite the attempt of national conservatives to reframe tariffs as the progenitor of America’s national wealth, historically, that’s inaccurate. One of the major reasons the Constitutional Convention was convened in 1787 was the inability of the national government to collect revenue under the Articles of Confederation. Congress was free to request funds from the confederation’s constituent states, but there was no mechanism for guaranteeing compliance. This severely inhibited their ability to either pay off national debt or negotiate commercial agreements with other nations. With redressing this imbalance in mind, the Convention gave Congress the “Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States.”

The solution was tariffs. Initially, thanks to James Madison, their sole purpose was to raise revenue. However, Pennsylvania Rep. Thomas Fitzsimmons attached an amendment aimed at the future use of tariffs to protect infant domestic manufacturers. This had the effect of introducing logrolling and rent-seeking into the legislature of the fledgling nation, as forward-looking congressmen began angling for specialized rates to protect favored industries in their home territories. Still, tariffs were moderate by contemporary standards, as their purpose was to provide revenue for government functions and to pay off the national debt. If tariffs were too high, Americans would be forced to buy higher-cost domestic products, but imports would decline, lowering revenue.

Even without these natural constraints, most early American statesmen favored free trade. There was some sentiment by Madison and Jefferson to use import restrictions as a means to force more equitable commercial treatment by the British. But such efforts were largely scuttled by Hamilton, who didn’t believe America to be in any position to successfully engage in any trade wars (oddly enough, the idea of protective tariffs was first broached by Hamilton, who habitually encouraged their passage to Congressmen he was friendly with, only to work behind the scenes to have them defeated in the Senate. Hamilton was…a variable man). Hamilton was correct; as William Carleton notes in Tariffs and the Rise of Sectionalism, America was still a largely agrarian society prior to 1830. America exported cash crops such as cotton, tobacco, wheat, and pork in exchange for funding imports of textiles and metals from Britain and Europe, rum and coffee from the West Indies, coffee from South America, and bullion from Mexico.

On net, America imported far more than it exported in her early years. As she was dependent on imports to supply resources and finished goods not found on the domestic markets, and import tariffs for revenue, it just really wasn’t feasible to use tariffs to artificially inflate the value of domestic industries, or as retaliatory trade measures. When Madison convinced the Jefferson Administration that the value of America’s exports to Britain far exceeded the value of British imports to America, Britain simply ignored American attempts at retaliation by sourcing their agricultural imports from less quarrelsome nations.

Despite this, America saw impressive growth prior to 1840. Here is where national conservatives lose the plot, as they often misattribute this growth to Henry Clay’s American System, a scheme of economic nationalism that had its roots in Hamilton’s Report on the Subject of Manufactures, presented to Congress in 1791. Whereas Hamilton’s report called for protective tariffs that funded industrial subsidies—concepts he would later oppose—Clay and his allies such as John Quincy Adams extended government influence to the areas of charging high prices for public lands, stabilizing currency via the Bank of the United States, and using revenue to extend a series of internal projects and improvements such as canals and roads.

That these policies coincided with massive growth is the origin of the misunderstanding, as the growth was actually fueled by a large increase in American exports between 1793 to 1807 that incentivized greater levels of domestic productivity. As Claudia Goldin and Frank Lewis observe in their excellent study, The Role of Exports in American Economic Growth during the Napoleonic Wars, favorable developments in trade shipping during the wars in Europe resulted in explosive increases in American exports. Not only did the nation’s neutrality allow them to trade among the warring factions, Britain’s diversion of her merchant fleet allowed America to fill the concurrent void in carrying goods to ports of call.

As America began to industrialize, the advantages it gained in trade during the Napoleonic Wars remained, and export revenues flourished, even during periods of import restrictions such as the War of 1812. This growth occurred in spite of American tariff policy, which changed fairly often as legislative policies shifted, not because of it. It can convincingly be argued that the American System did more to exacerbate regional tensions than it did to promote economic growth, but that is a subject worthy of its own article. Contemporary arguments of both national conservatives and liberal protectionists that tariffs promote growth are a case of the dog wagging its tail and not the other way around.

Did Trump’s tariff regime help the economy?

One of the major beliefs of Trump supporters is that his hard line on international trade strengthened the economy until the global pandemic reversed those gains. It is certainly true that there was growth during the early part of his administration, before the pandemic, but there is strong evidence that he inherited this growth as the economy corrected from many of the inefficiencies that led to the Great Recession. Before his trade war with China, Chinese exports to the global market had risen by some 12 percent per year between the 1990s and 2001, declining slightly to 11 percent after China joined the WTO. Not only did this help increase the volume of global trade by 6.5 percent per year, bilateral trade between the US and China was immensely beneficial to both nations. For instance, China’s ability to source important agricultural products from America that their own internal land and water constraints inhibited them from producing domestically provided access to large new markets for American farmers.

Farmers were not the only sector to benefit from these new markets; as China grew to become the third-largest importer of American goods behind Canada and Mexico, this flow of trade increased the average purchasing power of American households by approximately $1500 from 2000 – 2007. This relationship also helped underwrite over one million jobs in the United States. Despite these benefits, Mr. Trump addressed his concerns with what he believed to be untenable trade practices on China’s part by levying a 25 percent tariff on some 1102 Chinese products with an approximate value of $50 billion. Beijing responded by levying their own 25 percent tariff on $50 billion worth of American products, and the contest of one-upmanship was on.

Despite assurances that this would make domestic industry stronger, the evidence suggests that the opposite is true. The days held in inventory increased for many firms, raising holding costs without a subsequent rise in demand to rebalance the ledger. Supply chains were disrupted for both firms who sourced directly from China, and those with more diverse, complex chains, as other regions were also indirectly impacted by the spat, raising transaction costs. Perhaps most importantly, despite assurances to the contrary, the trade deficit between the US, and China increased. None of this even takes into account the established upward pressure that tariffs place on consumer prices. Somewhat amusingly, the increase in trade with Mexico since the imposition of those tariffs has been fueled by both multinational firms relocating facilities there, and China shipping raw materials to facilities located in Mexico.

There is, as Solomon once observed, no new thing under the sun, and economic nationalism and protectionism are as old to America as Thomas Jefferson and Henry Clay. Yet, nearly two and a half centuries of history and data determine that tariffs are neither the originators of American economic growth, nor the key to its future.

This article was originally featured on AIER.org. You can read the original here.