Reining in the Fed

The House of Representatives is currently considering a variety of bills intended to reduce the power of the Federal Reserve System. (“House Republicans Resume Efforts to Reduce Fed’s Power,” New York Times, July 11, Business Section.)

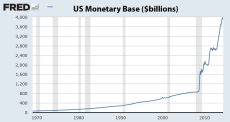

Under the pretext of fighting high unemployment, the Fed has more than quadrupled its balance sheet since summer of 2008. It has acquired $1.7 trillion worth of mortgage-backed securities, and increased its holdings of US Treasury bonds, notes and bills by $1.9 trillion. At various points during this period, it has extended hundreds of billions to companies like Bear Stearns, AIG, Fannie Mae, Freddie Mac, and the risky corporate commercial paper market, and provided a special guarantee to over $300 billion of shaky assets held by Citigroup.

A hefty $442 billion of this massive aggrandizement of the Fed’s power has been financed by actually printing new currency, a 7.8% annual rate of growth. But most of the remainder has been paid for by creating new interest-bearing excess reserve deposits.

Prior to 2008, the Fed could not pay banks interest on reserve deposits, but in the 2008 TARP bill, Congress gave the Fed power to pay interest, at its discretion, on both required and excess reserves. Without interest on excess reserves, banks would rush to make new loans with them by creating new checking account balances. Some fraction of these new deposits (historically about 40%) would drain out as currency, until excess reserves fell to virtually zero. But since October of 2008, “all” the Fed has to do to prevent this is pay banks enough interest to make idle reserves an attractive investment relative to loans.

Interest on excess reserves has enabled the Fed to expand from its traditional pre-2008 role as a central bank that mainly just prints money and buys Treasury securities, to become a massive financial intermediary in its own right: Its $1.7 trillion MBS position means that it is acting as a huge savings and loan association, funding long-term mortgages with overnight deposits. In doing so, it is taking exactly the same risks that the S&Ls took in the 1960s and 70s, that led to their demise when short-term interest rates rose to more than they were making on their fixed-rate mortgages. And the $1.5 trillion in new Treasuries it has acquired in excess of currency creation under successive “quantitative easing” programs amount to speculation that longer term bond rates will never go up – which of course they will. Fiscal prudence requires that the Treasury finance long-term borrowing with long-term debt. When the Fed second guesses the Treasury by taking the longer-term bonds it has issued off the market and replacing them with overnight reserve deposits, it merely exposes the taxpayers to unnecessary interest rate risk.

In order to rein in the Fed, the first thing Congress should do is therefore to eliminate the Fed’s 2008 power to pay interest on excess reserves. This power serves no monetary policy purpose, and merely allows the Fed to expand its scope in almost unlimited ways.

Interest on required reserves, on the other hand, is an interesting innovation that eliminates an incentive banks have had to disguise their checking accounts under categories such as “sweep accounts” that are exempt from reserve requirements. This will help the Fed monitor transactions accounts, and enable it to control their quantity if desired. Congress should therefore retain the Fed’s power to pay interest on required reserves – a power Milton Friedman long advocated, in fact. (A minor function of zero-interest required reserves is that they act as an implicit tax on checking accounts. However, banks are already taxed on the profits they make from this activity, so there is no particular reason to impose a special excise tax as well.)

And second, Congress should block the Fed from dabbling in the home loan business and from bailing out favored private firms, by restricting its asset acquisitions to the traditional categories of 1) US Treasury securities, 2) well-collateralized discount window loans to solvent FDIC-insured commercial banks, and 3) repurchase agreement to primary dealers effectively extending them credit based on the collateral of US Treasury securities. Any future bailout decisions should be made by Congress and paid for explicitly with new national debt, and not made through the back door by the Fed using its post-2008 fund-raising powers.

If the Fed had been expressly prohibited from bailing out Fannie or Freddie all along, both these undercapitalized firms would have been forced out of business early in the 2000s, long before they engendered the worst excesses of the housing finance market in 2005 and 2006.

None of the bills being discussed in the House presently incorporates either of these essential reforms. None of them has any chance of passing the Senate, but they will serve to generate useful talking points for this November’s elections, and so it is important that they be well-thought out.

One proposal is that the Fed be required to announce the monetary policy rule under which it is operating, but would be free to change the rule. But a rule that the Fed is free to set for itself as desired is no restriction on its behavior at all. The bill proposed by Bill Huizenga (R-MI) and Scott Garrett (R-NJ) would require the Fed to adopt a “Taylor Rule” that sets a Fed Funds rate target based on inflation and the “output gap.” Something along these lines is what the Fed seems to have been doing from about 1980 to 2006, but in the post-2008 environment, the Fed is also making decisions about the entire Treasury yield curve, and as the foremost mortgage intermediary must also make decisions about mortgage rates and underwriting standards. The Fed Funds rate is only a small part of its policy actions today, so that a rule governing it would not even touch a large part of its current operations.

Another proposal would eliminate “maximizing employment” from the Fed’s mandate from Congress, and merely direct it to pursue “price stability”. Most economists, at least since the work of Milton Friedman and Ned Phelps on the expectations-enhanced Phillips curve in 1968-71, agree that the Fed can’t permanently stimulate employment without perpetually accelerating inflation and thus violating its “price stability” mandate. At best, it can refrain from destabilizing employment with stop-start inflation policies. Repealing the employment mandate is therefore a long-overdue reform, but still it addresses only a small part of the Fed problem today.

In a parallel development, last Thursday the Fed’s new vice chairman Stanley Fischer urged Congress to actually expand the Fed’s mandate, by adding the requirement that it “increase financial and economic stability.” (“Fischer Urges Congress to Expand Fed’s Mandate”, New York Times, July 11, Business Section) But surely the Fed is already concerned about both financial and economic stability. Giving it “financial stability” as an explicit goal could simply be taken as a carte blanche for future bailouts of unstable financial firms.

Neither of the two reforms I have proposed above will prevent the Fed from abusing its traditional money-creating powers, but at least they will prevent it from further expanding its powers into new and dangerous territory as it has done since 2008.

Chairwoman Yellen is scheduled to speak before the House and Senate banking committees on Tuesday and Wednesday of the coming week, where she may expect to be asked questions on these issues. I have previously addressed these and other issues of monetary policy on this blog in my post, “Questions — and Answers — for Janet Yellen,” Nov. 4, 2013.

FRED® Graphs ©Federal Reserve Bank of St. Louis. 2016. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/